How I Built a Legacy Portfolio Through Cultural Inheritance

What if your family’s traditions could shape a smarter investment strategy? For me, cultural inheritance wasn’t just about values or heirlooms—it became the foundation of a resilient portfolio. I learned that blending heritage with financial planning isn’t old-fashioned; it’s forward-thinking. This is how I aligned long-term wealth building with what matters most, balancing emotion and logic in a way textbooks never taught me. The result was not only financial stability but a deeper sense of purpose in every decision. It began with a simple realization: wealth is more than numbers on a statement. It’s the story behind them, the values that shaped them, and the future they are meant to support.

The Moment I Realized Inheritance Was More Than Money

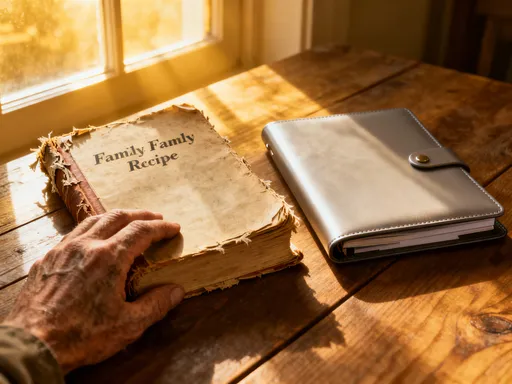

When my grandmother passed away, she left behind more than photographs and keepsakes. In a small wooden chest, I found bundles of handwritten recipes, notes on seasonal planting, and stories about our ancestors who farmed the same land for generations. At first, I saw these as sentimental treasures—beautiful, but not valuable in a financial sense. Yet over time, something shifted. I began to recognize that these items carried a different kind of worth—one rooted in continuity, knowledge, and identity. Unlike stocks that fluctuate daily or bonds that mature in fixed terms, these cultural assets offered a kind of stability that money alone could not provide.

This understanding came during a period of personal financial reflection. I was reviewing my modest portfolio, trying to decide whether to shift into higher-risk assets for greater returns. But as I held my grandmother’s notes, I asked myself: what if the goal wasn’t just to grow wealth, but to preserve meaning? That question changed everything. I started to see inheritance not as a one-time transfer of assets, but as an ongoing process—one that connects past, present, and future. The recipes weren’t just instructions; they were a record of resilience, adaptation, and resourcefulness. The land wasn’t just property; it was a living archive of stewardship. These realizations led me to rethink how I approached investing—not just for profit, but for continuity.

From that point on, I began to view financial planning as an extension of cultural responsibility. Instead of treating inherited land as a potential sale for immediate gain, I considered how it could be managed sustainably. Instead of dismissing family stories as nostalgia, I saw them as guides for long-term thinking. This shift didn’t reject modern finance; it enhanced it. By integrating emotional and historical context into my strategy, I developed a more disciplined, patient, and values-driven approach. The result was a portfolio that didn’t just grow—it endured.

Defining Cultural Inheritance in Financial Terms

For many, the word “inheritance” immediately brings to mind bank accounts, real estate, or insurance payouts. But cultural inheritance—while less tangible—is equally significant in shaping financial behavior. It includes family businesses built on traditional crafts, land tied to ancestral practices, oral histories, artisanal skills, and even communal relationships that support economic resilience. These assets are rarely listed on a balance sheet, yet they influence how individuals perceive risk, make decisions, and define success. Recognizing them as part of a broader financial ecosystem allows for a more holistic and sustainable investment strategy.

Consider a family-owned vineyard passed down through four generations. On paper, it may be valued as agricultural real estate. But its true worth extends beyond market price. It carries knowledge of soil health, seasonal cycles, and sustainable farming methods that can’t be bought. It also represents a commitment to quality and tradition that builds brand loyalty and customer trust—intangible assets that contribute to long-term profitability. When investors fail to account for these elements, they risk making decisions based solely on short-term financial metrics, potentially undermining the very legacy they aim to preserve.

Understanding cultural inheritance in financial terms means acknowledging that not all value is liquid. A handwoven textile business, for example, may generate modest income, but it sustains cultural identity, provides employment in a rural community, and preserves artisanal techniques at risk of disappearing. These benefits contribute to social capital, which in turn supports economic stability. By valuing such enterprises not just for their revenue, but for their role in intergenerational continuity, investors can make choices that balance profitability with purpose. This perspective opens the door to impact investing—where financial returns are intentionally aligned with cultural preservation, environmental sustainability, and community development.

Moreover, recognizing cultural assets helps shape risk tolerance. Someone who views their inherited farm as both a livelihood and a legacy is likely to adopt a long-term horizon, avoiding reactive decisions during market downturns. They may accept lower short-term yields in exchange for preserving land integrity or maintaining traditional practices. This doesn’t mean ignoring financial discipline—it means redefining it. The goal becomes not just maximizing returns, but ensuring that wealth serves a broader mission. In this way, cultural inheritance becomes a strategic framework, guiding asset allocation, risk management, and succession planning with greater clarity and intention.

Building a Portfolio That Honors Heritage Without Sacrificing Growth

The next step in my journey was practical: how to build a portfolio that respected my heritage while still achieving financial growth. I began by conducting an inventory of what I had inherited—not just physical assets, but skills, knowledge, and responsibilities. This included a small plot of ancestral land, my grandmother’s recipe collection, and informal expectations to maintain certain family traditions. I categorized these into three types: passive, active, and symbolic assets.

Passive assets were those that could generate income with minimal intervention. The inherited land, for example, was suitable for long-term leasing to local farmers. This provided steady rental income without requiring daily management. Active assets required more engagement but offered greater potential for growth. My grandmother’s recipes, for instance, inspired the launch of a small preserves business. While it started as a side project, it gradually evolved into a source of modest but reliable revenue. Symbolic assets—such as family documents, photographs, and oral histories—did not produce income, but they played a crucial role in shaping investment values. They guided decisions about which industries to support, which companies to avoid, and how to define ethical success.

With this framework in place, I turned to diversification. I allocated a portion of my portfolio to low-cost index funds, ensuring exposure to broad market growth without excessive risk. Another portion went into real estate investment trusts (REITs), providing liquidity and professional management. I also invested in socially responsible ETFs that aligned with environmental, social, and governance (ESG) principles—many of which resonated with the values embedded in my cultural inheritance. The key was balance: no single asset class dominated, and emotional attachments did not override financial prudence.

Importantly, I set clear boundaries. While I wanted to honor my heritage, I did not romanticize it. I evaluated each inherited asset objectively: Did it generate income? Could it be sustained? Was it appreciating or depreciating in value? If an asset failed to meet basic financial criteria, I considered alternatives—such as leasing, partnering, or reinventing its use—rather than holding onto it out of sentiment. This approach allowed me to preserve cultural meaning without sacrificing financial health. The portfolio grew not because I chased high returns, but because I built it on a foundation of stability, purpose, and disciplined diversification.

Risk Control: When Emotion Meets Investment Discipline

One of the greatest challenges in integrating cultural inheritance into financial planning is managing emotional attachment. It’s natural to want to preserve what was passed down, especially when it carries deep personal meaning. But emotion, when unchecked, can lead to poor financial decisions. I learned this the hard way with a family orchard that had been in decline for years. Despite clear signs—falling yields, rising maintenance costs, and dwindling market demand—I hesitated to make changes. I told myself it was about honoring tradition, but in truth, I was avoiding the discomfort of letting go.

The turning point came when I calculated the true cost of keeping the orchard. After accounting for labor, irrigation, equipment, and lost opportunity, I realized it was draining resources that could be better used elsewhere. This was a painful realization, but also a necessary one. I decided to lease the land to a local cooperative that specialized in sustainable agriculture. They reintroduced native crops and used regenerative practices, preserving the land’s ecological and cultural value while making it financially viable. The arrangement provided steady income and allowed me to step back from day-to-day management. More importantly, it taught me a critical lesson: stewardship does not require ownership, and preservation does not mean stagnation.

To prevent similar missteps, I established objective benchmarks for all legacy assets. For example, any inherited property must generate at least a minimum return on investment or be reassessed. I also set thresholds for maintenance costs—if upkeep exceeds a certain percentage of income, the asset is reviewed for restructuring or divestment. These rules are not rigid, but they provide a framework for making decisions based on data, not emotion. Additionally, I brought in an independent financial advisor who had no personal ties to my family or history. Their role was to provide objective analysis and challenge assumptions, ensuring that sentiment did not override financial reality.

Diversification remained central to risk control. I made it a rule that no single holding—whether emotional or financial—could exceed 15% of the total portfolio. This prevented overconcentration and reduced vulnerability to market shifts. It also allowed me to maintain cultural assets without jeopardizing overall stability. By combining emotional awareness with disciplined risk management, I created a system where heritage and financial health could coexist. The result was not just a stronger portfolio, but greater peace of mind.

Practical Strategies I Tested and Trusted

Over time, I developed and refined a set of practical strategies that allowed me to integrate cultural inheritance into my financial life without compromising growth or stability. One of the most effective was the creation of a “heritage reserve”—a fixed percentage of the portfolio, capped at 20%, dedicated exclusively to culturally significant assets. This included the leased orchard, the preserves business, and a small fund supporting local cultural education programs. The cap ensured that emotional investments remained within manageable limits, protecting the broader portfolio from disproportionate risk.

Another key strategy was the use of trusts structured to support cultural preservation. I established a family trust with clear guidelines: a portion of annual returns would fund language workshops, traditional craft apprenticeships, and community storytelling events. These initiatives not only honored our heritage but also strengthened intergenerational ties. From a financial perspective, the trust offered tax efficiency and asset protection, while aligning with long-term values. It transformed philanthropy from an afterthought into an integrated part of wealth management.

I also explored collaborative models, such as partnering with local cooperatives to sustain traditional farming methods. By pooling resources with other families who shared similar values, we were able to access better equipment, distribution channels, and expertise. These partnerships generated modest but stable returns, while preserving agricultural practices that might otherwise have disappeared. Each venture was carefully documented, with performance reviewed quarterly. Adjustments were made based on both financial outcomes and cultural impact, ensuring accountability and sustainability.

What made these strategies work was consistency, not complexity. I avoided chasing trends or speculative opportunities. Instead, I focused on steady, measurable progress. I tracked both financial returns and non-financial outcomes—such as community engagement, skill transmission, and environmental health. This dual metric system provided a more complete picture of success. Over time, the approach proved resilient, even during market fluctuations. The lessons were clear: patience, clear boundaries, and alignment between identity and investment choices create a foundation that lasts.

Why This Approach Works Across Generations

One of the most rewarding outcomes of this strategy has been its impact on younger family members. When wealth is presented as a series of numbers and transactions, it can feel abstract and impersonal. But when it’s tied to stories, values, and shared responsibilities, it becomes meaningful. I began involving my nieces and nephews in family financial discussions, not to burden them, but to help them understand the “why” behind our choices. We visited the leased orchard, baked using my grandmother’s recipes, and attended cultural events funded by the trust. These experiences created emotional connections to the portfolio, fostering a sense of ownership and responsibility.

We also established regular family meetings focused on both financial performance and cultural values. These weren’t formal board meetings, but structured conversations where everyone could ask questions, share perspectives, and contribute ideas. We reviewed investment returns, discussed upcoming decisions, and reflected on how our choices aligned with family principles. This transparency reduced the potential for future conflict and ensured that everyone felt heard. More importantly, it turned inheritance planning from a legal formality into a living, evolving practice.

The younger generation has begun to contribute their own ideas—suggesting digital archiving of family stories, exploring e-commerce for the preserves line, and proposing new ways to measure cultural impact. Their engagement shows that legacy is not about rigidly preserving the past, but about adapting it for the future. By involving them early, we are building a shared understanding of wealth as both a resource and a responsibility. This intergenerational dialogue ensures continuity without rigidity, allowing the portfolio to evolve while staying true to its roots.

Final Thoughts: Wealth That Lasts Beyond Numbers

Looking back, I realize that my journey wasn’t just about building a portfolio—it was about redefining what wealth means. True financial success is not measured solely by account balances or annual returns. It’s reflected in resilience, in continuity, and in the ability to support future generations without losing sight of the past. My portfolio now carries the imprint of my grandmother’s wisdom, the lessons of the land, and the values passed down through stories. But it also embraces modern tools, disciplined risk management, and market realities. The two are not in conflict—they are in conversation.

Cultural inheritance, when integrated wisely, becomes a compass—not an anchor. It doesn’t dictate every decision, but it guides them. It encourages patience over impulsivity, stewardship over consumption, and purpose over profit alone. The discipline it demands—balancing emotion with objectivity, tradition with innovation—leads to smarter, more sustainable choices. It builds not just financial strength, but moral clarity.

For anyone navigating estate inheritance, I offer this insight: your story is not separate from your strategy. It can be its greatest strength. By honoring what you’ve been given, while applying sound financial principles, you create something that lasts—not just in dollars, but in meaning. That is the essence of a legacy portfolio. And that, ultimately, is the kind of wealth worth building.