How I Built a Resilient Portfolio to Tackle Nursing Costs in Retirement

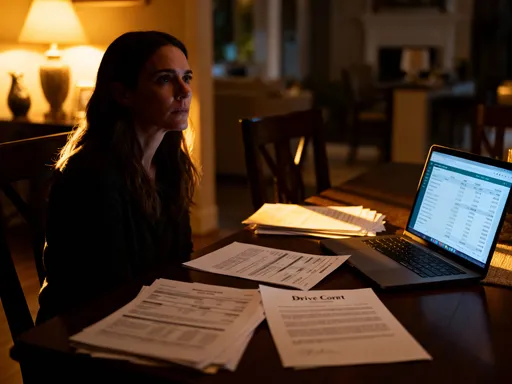

What if the biggest threat to your retirement isn’t outliving your savings, but the rising cost of care? I faced this reality when planning for long-term nursing needs. Instead of panicking, I redesigned my investment portfolio with resilience at its core. This isn’t about chasing returns—it’s about creating stability, managing risk, and preparing for what’s ahead. Here’s how a professional approach made all the difference. The journey began not with a market crash or a sudden job loss, but with a quiet realization: the dream of a peaceful, independent retirement could be disrupted not by poor investments, but by the growing likelihood of needing extended medical support. As someone committed to securing a stable future for myself and my family, I knew I had to address this not as an afterthought, but as a central pillar of financial planning.

The Hidden Threat Lurking in Retirement Plans

When most people envision retirement, they picture leisurely mornings, travel plans, and time with grandchildren. Rarely does the conversation turn to long-term nursing care—yet statistically, it should. According to widely accepted health and aging studies, approximately 70% of adults over the age of 65 will require some form of long-term care during their lifetime. This includes home health aides, assisted living facilities, or skilled nursing units. The cost of such care varies by region, but even conservative estimates place the average annual expense for a private room in a nursing facility well above $100,000 in many areas. These figures are not outliers; they reflect a steady upward trend driven by rising healthcare labor costs, facility maintenance, and regulatory compliance.

What makes this expense particularly dangerous is its slow and predictable nature. Unlike a stock market correction, which appears suddenly and commands immediate attention, the threat of nursing costs builds over years. Families often assume they’ll rely on savings, Social Security, or even family support. But when care becomes necessary, the financial pressure can be overwhelming. A portfolio that was designed to withdraw 4% annually may suddenly need to support 8% or more, drastically shortening its lifespan. In many cases, retirees are forced to sell assets at inopportune times—often during market downturns—locking in losses and accelerating depletion.

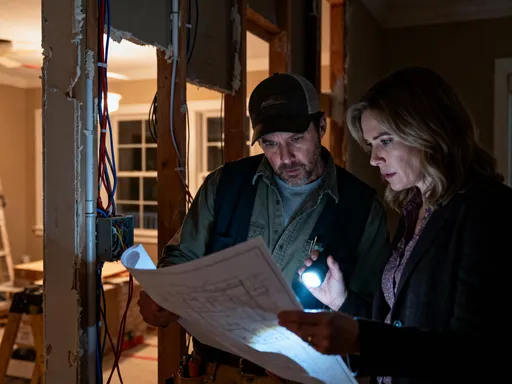

Consider the case of a retired couple with a $750,000 portfolio, structured traditionally with a 60/40 stock-to-bond allocation. They planned for a modest lifestyle, withdrawing $30,000 per year. For a decade, the plan worked smoothly. Then, one spouse suffered a stroke and required full-time nursing care. The new monthly bill exceeded $8,000—nearly $100,000 per year. To meet this, their withdrawal rate jumped to over 13%. Even with partial insurance coverage, the gap was covered by liquidating holdings. Within five years, the portfolio was exhausted. This wasn’t due to poor market performance or reckless spending on luxuries. It was the result of an unprepared structure facing a predictable, yet unaccounted-for, financial shock.

This example underscores a critical shift in thinking: nursing costs are not merely a health issue. They are a core financial risk, as significant as inflation, market volatility, or longevity. Treating them as an optional or minor concern leaves retirees vulnerable. The most resilient retirement plans do not ignore this reality—they integrate it from the beginning. By recognizing long-term care as a near-certainty for many, investors can move from fear-based reactions to strategic preparation. This means re-evaluating asset allocation, withdrawal strategies, and liquidity planning not just for growth, but for endurance.

Why Traditional Portfolios Fall Short

Most retirement portfolios are built on a foundation of growth and income. The classic model—a mix of equities for appreciation and bonds for stability—has served generations well under normal conditions. Financial advisors often recommend a 4% withdrawal rule, assuming a balanced market environment and moderate inflation. However, this model begins to falter when long-term care expenses enter the equation. The reason lies in the mismatch between portfolio design and real-world financial demands. Traditional allocations assume a relatively steady withdrawal pattern, but nursing costs introduce sudden, large, and prolonged cash flow needs that can destabilize even well-diversified accounts.

One of the primary weaknesses of conventional portfolios is their lack of liquidity readiness. Many retirees hold a significant portion of their wealth in appreciating assets like stocks, real estate, or retirement accounts with penalties for early access. While these can generate strong long-term returns, they are not easily converted into cash when needed immediately. Imagine a scenario where a retiree must pay $7,000 per month for a care facility, but 70% of their portfolio is invested in equities. Selling shares during a market downturn—say, a 20% correction—means realizing losses just to cover basic living expenses. This not only reduces principal but also diminishes future compounding potential, creating a downward spiral.

Another issue is sequence-of-returns risk, which becomes especially dangerous in the early years of retirement. If a retiree experiences poor market performance shortly after beginning withdrawals—particularly large ones driven by care costs—the impact on portfolio longevity is magnified. For example, a 10% portfolio loss in the first two years of retirement, combined with high withdrawals, can reduce the expected lifespan of savings by decades. Traditional models often fail to account for this compounding vulnerability because they rely on average annual returns, which smooth out volatility. In reality, timing matters immensely. A series of bad years at the wrong time can derail even the most carefully planned retirement.

Additionally, emotional decision-making under financial stress further undermines traditional strategies. When faced with mounting care bills, retirees may panic and make impulsive choices—such as abandoning equities entirely, locking in losses, or taking on high-interest debt. These reactions are understandable but detrimental. A portfolio designed only for theoretical performance lacks the psychological resilience to support disciplined behavior during crises. It doesn’t provide clear guidance on which assets to sell, when, or how much to withdraw without causing long-term damage. Without predefined rules and structured liquidity, retirees are left navigating uncertainty with limited tools.

The gap between conventional planning and real-life challenges reveals a need for a new approach. Portfolios must be stress-tested not just against market cycles, but against life’s most disruptive events. This means moving beyond static allocations and embracing dynamic, adaptive frameworks that prioritize stability without sacrificing growth. The goal is not to eliminate risk—this is impossible—but to manage it in a way that preserves both financial security and peace of mind.

Designing a Resilient Investment Framework

Resilience in investing is not simply about avoiding losses; it’s about designing a structure that can absorb shocks while staying aligned with long-term goals. For retirees facing the possibility of nursing costs, this means shifting focus from pure return optimization to holistic portfolio durability. A resilient framework rests on three foundational pillars: liquidity readiness, risk-layered asset allocation, and downside protection. Each plays a distinct role in ensuring that financial setbacks do not become personal crises.

Liquidity readiness ensures that cash is available when needed without forcing the sale of long-term assets at inopportune times. This begins with establishing tiered cash reserves—often referred to as a cash bucket strategy. The idea is simple: set aside enough liquid funds to cover one to three years of anticipated expenses, including potential care costs. These funds can be held in high-yield savings accounts, short-term certificates of deposit, or money market funds. By isolating this portion from market fluctuations, retirees gain breathing room during downturns. If nursing care begins, they can draw from this buffer instead of selling stocks at a loss. This small structural change can dramatically improve portfolio longevity.

Risk-layered asset allocation takes diversification a step further by organizing investments according to their function and risk profile. Instead of a single stock-bond mix, assets are grouped into layers: growth, stability, and protection. The growth layer—typically 40% to 50% of the portfolio—holds equities in broad-market index funds or dividend-producing companies, designed to outpace inflation over time. The stability layer includes intermediate and defined-duration bonds, which provide predictable income and lower volatility. The protection layer may include assets with low correlation to traditional markets, such as Treasury Inflation-Protected Securities (TIPS) or certain real estate investment trusts (REITs), which can perform well during periods of economic stress.

Downside protection involves strategies that limit losses during market declines. This does not mean avoiding equities altogether, but rather using tools that reduce exposure to severe drawdowns. One approach is tactical rebalancing—systematically selling high-performing assets and buying underperforming ones to maintain target allocations. Another is using options-based strategies, such as protective puts, which act as insurance against steep market drops. While these require a higher level of sophistication, they can be implemented through managed accounts or professionally advised portfolios. The goal is not to eliminate volatility, but to cap the damage when it occurs.

Together, these pillars create a portfolio that is not only diversified but structurally sound. It allows retirees to meet unexpected demands without derailing their financial trajectory. For example, if nursing care begins, funds can be drawn from the liquidity bucket while the growth and stability layers continue compounding. Rebalancing ensures that no single asset class becomes overconcentrated. Downside protection helps preserve capital during downturns, reducing the need for emergency sales. This framework transforms the portfolio from a passive collection of investments into an active financial safety net.

Balancing Growth and Safety Without Sacrificing Returns

A common fear among retirees is that preparing for long-term care means abandoning growth and settling for low-yield, ultra-safe investments. This trade-off is often seen as inevitable: security on one side, returns on the other. However, this binary view is misleading. With careful planning, it is possible to maintain meaningful equity exposure while significantly reducing risk. The key lies in smart asset selection, strategic rebalancing, and proper asset location across different account types.

Equities remain essential for long-term wealth preservation because they historically outperform inflation and fixed-income investments over time. Completely eliminating them increases the risk of outliving one’s savings, especially as life expectancy continues to rise. Instead of removing stocks, the focus should be on quality and stability. Dividend-producing companies, particularly those with a history of consistent payouts and strong balance sheets, offer both income and growth potential. These firms tend to be less volatile than high-growth tech stocks and can provide steady cash flow during market turbulence.

Low-volatility exchange-traded funds (ETFs) are another effective tool. These funds track indexes composed of stocks with lower historical price swings, such as large-cap value stocks or multi-factor strategies that emphasize quality, momentum, and low volatility. While they may not surge during bull markets, they also tend to fall less during corrections. Over a full market cycle, this reduced volatility can lead to better long-term compounded returns, even if annual gains appear modest. For retirees, this smoother ride translates into greater confidence and fewer emotional decisions.

Asset location—deciding where to hold different types of investments—also plays a crucial role. Tax-advantaged accounts like IRAs and 401(k)s are ideal for holding bonds and other income-generating assets, as their earnings are taxed at ordinary income rates. Taxable brokerage accounts, on the other hand, are better suited for equities, especially those that produce qualified dividends or long-term capital gains, which are taxed at lower rates. This strategic placement enhances after-tax returns without increasing risk.

Tactical rebalancing further supports this balance. By periodically adjusting the portfolio back to its target allocation—say, selling some equities after a strong run and buying bonds—investors lock in gains and maintain discipline. This process naturally enforces a “buy low, sell high” approach, reducing emotional interference. When combined with a resilient framework, these strategies allow retirees to stay invested in growth assets while minimizing exposure to sequence-of-returns risk and market timing errors.

Tactical Liquidity: Preparing for Cash Flow Surprises

When nursing care begins, the timing of cash needs often matters more than the total size of the portfolio. A retiree with $1 million in assets but no accessible cash may face the same hardship as someone with far less. Tactical liquidity planning addresses this by ensuring that funds are available when needed, without compromising long-term growth. This goes beyond having an emergency fund; it involves structuring withdrawals in a way that aligns with both market conditions and personal circumstances.

One effective method is the use of a withdrawal ladder—staggering access to funds across different time horizons. For example, a retiree might keep one year of expenses in a high-yield savings account, the next two years in short-term bonds, and years four to five in intermediate-term bonds. As each rung matures, it replenishes the cash buffer. This creates a predictable income stream that insulates the portfolio from market timing. If a care facility bill arrives, the funds are already liquid and ready to use.

Another option is the strategic use of Health Savings Accounts (HSAs), if available. While typically associated with high-deductible health plans, HSAs offer triple tax advantages: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. For those planning ahead, HSAs can serve as powerful tools for covering future nursing costs. Even if care is decades away, allowing the account to grow tax-free and investing the funds in low-cost index funds can result in a substantial pool of dedicated medical capital.

Hybrid financial instruments, such as certain types of life insurance policies with long-term care riders, also offer liquidity without direct market exposure. These products allow policyholders to access death benefits to pay for care, either through accelerated benefits or reimbursement structures. While not suitable for everyone, they can provide peace of mind for those concerned about depleting their investment portfolio. The key is to evaluate these options as part of an integrated plan, not as standalone solutions.

Tactical liquidity is not about hoarding cash—it’s about smart sequencing. It recognizes that financial resilience depends not just on how much you have, but on how and when you can access it. By aligning liquidity with anticipated needs, retirees gain control over their financial narrative, reducing stress and preserving long-term wealth.

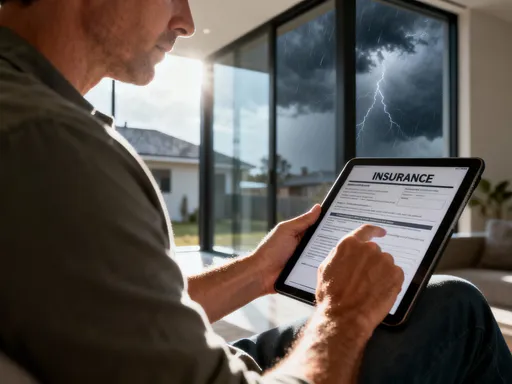

Risk Management Beyond the Portfolio

True financial resilience extends beyond investment accounts. While a well-structured portfolio is essential, it is only one piece of a broader strategy. Complementary planning tools—such as advance healthcare directives, family coordination, and estate planning—play a vital role in managing the risks associated with long-term care. These are not merely legal formalities; they are practical mechanisms that reduce uncertainty, prevent conflict, and protect financial resources.

Advance directives, including living wills and durable powers of attorney for healthcare, ensure that medical decisions align with personal values, even if cognitive ability declines. They also prevent costly legal disputes among family members, which can drain time, energy, and money. Similarly, financial powers of attorney allow trusted individuals to manage accounts and pay bills if the retiree becomes incapacitated, avoiding court-appointed guardianship and its associated fees.

Family coordination is another often-overlooked element. Open conversations about care preferences, financial responsibilities, and housing options can prevent misunderstandings later. Some families choose to pool resources, while others rely on professional caregivers. The goal is not to assign blame or create burdens, but to establish clarity. When everyone understands the plan, transitions are smoother and less emotionally taxing.

Estate planning, including wills, trusts, and beneficiary designations, ensures that assets are distributed according to intent. For those concerned about Medicaid eligibility, certain irrevocable trusts can help protect assets while still qualifying for assistance. These strategies require professional guidance, but they can significantly reduce the financial strain on both the individual and their heirs.

By integrating these non-investment tools with a resilient portfolio, retirees create a comprehensive defense against the financial impact of long-term care. It’s not just about money—it’s about control, dignity, and preparedness.

Putting It All Together: A Sustainable Path Forward

The journey to financial resilience in retirement is not about finding a single solution, but about building a cohesive system. Consider the case of a 68-year-old retiree who, after a health scare, restructured her $900,000 portfolio using the principles outlined here. She established a three-year liquidity bucket in high-yield accounts, allocated 50% to a mix of dividend stocks and low-volatility ETFs, 30% to defined-duration bonds, and 10% to inflation-protected securities. She also funded her HSA strategically and updated her advance directives.

Two years later, when she required assisted living, she was able to cover the costs without selling equities during a market dip. Her withdrawal ladder provided steady cash flow, and her family understood the plan, reducing stress. Her portfolio continued to grow, and she retained independence and peace of mind.

This outcome was not the result of luck or extraordinary wealth. It was the product of disciplined, professional-grade planning—accessible to anyone willing to think ahead. Building a resilient portfolio is not about predicting the future; it’s about preparing for it. By prioritizing stability, liquidity, and adaptability, retirees can face the uncertainties of aging with confidence. The goal is not just to survive, but to thrive—with dignity, security, and control over one’s financial destiny.