How I Manage Risk While Earning Online – A Remote Worker’s Real Talk

Working from home changed my life, but it also shook up my finances in ways I didn’t expect. One month I’d earn big, the next—crickets. I started losing sleep over instability. That’s when I realized: remote income isn’t just about making money, it’s about keeping it safe. This is how I built a smarter financial system that handles the ups and downs—without the panic. It didn’t happen overnight, and it wasn’t about earning more. It was about changing how I thought about money when the paycheck never looks the same twice. For anyone navigating the unpredictable world of online income, this is a practical look at how to stay grounded, prepared, and in control—even when clients disappear or invoices get delayed.

The Hidden Financial Trap of Remote Work

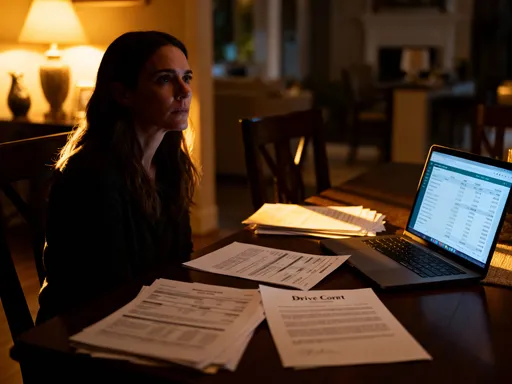

Remote work is often sold as the ultimate lifestyle upgrade—flexible hours, no commute, and the freedom to work from anywhere. But behind the glossy social media posts lies a financial reality few talk about: income volatility. Unlike traditional employees who receive a predictable paycheck every two weeks, remote workers—freelancers, consultants, digital creators, and independent contractors—face fluctuating monthly earnings. One month might bring in $6,000 from three major projects; the next could total just $1,200 with no clear reason why. This inconsistency isn’t just inconvenient—it creates real financial stress that can erode confidence and long-term planning.

The trap begins when remote workers assume that high earning months mean financial stability. They spend more, upgrade subscriptions, or make larger purchases, only to face anxiety when the next month’s income drops unexpectedly. Without a steady cash flow, even basic budgeting becomes a guessing game. Fixed expenses like rent, insurance, and groceries don’t change, but income does. This mismatch leads to cash flow gaps—periods where outgoing payments exceed incoming funds. Over time, these gaps can force workers to rely on credit cards or personal loans, digging a hole that’s hard to climb out of. The emotional toll is just as real: constant worry about where the next paycheck will come from, guilt over spending, and a sense of financial shame when comparing oneself to peers with stable jobs.

Another overlooked risk is the absence of employer-provided benefits. Traditional employees often receive health insurance, retirement contributions, paid time off, and disability coverage as part of their compensation. Remote workers must secure these on their own, which adds both complexity and cost. For example, a family health insurance plan can cost several hundred dollars per month, and retirement planning requires proactive effort without an employer match. There’s also the issue of self-employment taxes, which many new remote workers underestimate. While a W-2 employee splits payroll taxes with their employer, independent contractors pay both the employer and employee portions—adding nearly 15.3% to their tax burden on net earnings. Failing to plan for this can result in a massive tax bill at year-end, wiping out what felt like a profitable year.

Perhaps the most dangerous risk is over-reliance on a single income source. Many remote workers start with one client or platform and gradually build their reputation. But when 70% or more of income comes from one source, any disruption—contract non-renewal, platform algorithm changes, or client budget cuts—can be devastating. This lack of diversification leaves workers vulnerable, with little time to react when income suddenly dries up. The combination of irregular pay, no safety net, and high personal responsibility creates a financial environment that demands a different approach than traditional personal finance advice offers. The solution isn’t to work more—it’s to build systems that protect against these hidden risks before they take hold.

Building Your Financial Safety Net (Without Waiting for “Stable” Income)

When income fluctuates, the idea of saving money can feel impossible. Many remote workers tell themselves they’ll start building a safety net “once things stabilize” or “after the next big project.” But the truth is, stability in remote work isn’t something that arrives—it’s something you create. The foundation of that stability is a well-structured financial safety net, designed specifically for irregular earnings. This isn’t about saving a fixed amount each month; it’s about adapting your savings strategy to the rhythm of your income, ensuring you’re protected during lean periods without sacrificing long-term goals.

The first step is redefining the emergency fund. Traditional advice suggests saving three to six months of living expenses in a single account. For remote workers, this model often fails because it assumes steady income and predictable expenses. A more effective approach is a tiered emergency fund with multiple layers. The first layer is a liquidity buffer—enough cash to cover one month of essential expenses, kept in a high-yield savings account for immediate access. This acts as a shock absorber for unexpected bills or short-term income dips. The second layer is a three-month stability fund, also in a liquid account but used only for true emergencies like medical costs or major repairs. The third and final layer is a long-term resilience fund, which can be invested slightly more aggressively and used for larger life changes, such as switching careers or taking a sabbatical.

To fund these layers, remote workers should adopt a percentage-based savings strategy rather than a fixed dollar amount. For example, saving 25% of every payment received—regardless of size—ensures that savings grow in proportion to income. This method automatically adjusts during high-earning months (when saving more is easier) and low-earning months (when saving less is necessary). Automated transfers are key: setting up rules to move a portion of each deposit into the appropriate savings account removes the temptation to spend the money first. Some financial institutions even allow for “round-up” features or income-splitting tools that make this process seamless.

Equally important is the use of a buffer account to smooth monthly expenses. Instead of paying bills directly from the main income account, remote workers can transfer a fixed “monthly budget” into a separate account at the start of each month. This amount should be based on average monthly expenses, not peak income. Any income beyond that goes into savings or debt repayment. If a month’s earnings fall short, the buffer account still allows bills to be paid on time, preventing late fees and credit damage. This system creates predictability in spending, even when income is unpredictable. Over time, it reduces financial anxiety and builds confidence, allowing remote workers to focus on their craft rather than constantly worrying about money.

Diversifying Income Streams Like a Pro

Relying on a single source of income is one of the biggest financial risks remote workers face. Whether it’s one major client, a single platform, or a niche service, putting all your earnings into one basket leaves you exposed to sudden changes beyond your control. Diversification isn’t just for stock portfolios—it’s a critical strategy for personal income resilience. By building multiple revenue streams, remote workers can reduce dependency on any one source, create more predictable total income, and protect themselves against market shifts, client turnover, or industry disruptions.

The most effective approach to diversification starts with assessing existing skills and available time. Most remote workers already have a core service—writing, design, programming, consulting, or coaching. The key is to identify complementary opportunities that leverage the same expertise but generate income in different ways. For example, a freelance writer might start by creating digital products like e-books, templates, or courses based on their most requested topics. These require an upfront time investment but can generate passive income for months or even years. A graphic designer could offer print-on-demand products, stock illustrations, or monthly design subscriptions. The goal isn’t to launch five new businesses at once, but to add one or two small, sustainable streams that align with existing strengths.

Another powerful method is combining freelance work with part-time remote roles. Many companies now offer hybrid arrangements—contract positions with set hours and predictable pay, without the commitment of full-time employment. These roles provide a steady income base, reducing the pressure to constantly chase new clients. Even earning $1,000–$2,000 per month from a consistent source can dramatically improve financial stability. Platforms that connect professionals with short-term or ongoing remote roles can be valuable resources for finding these opportunities without sacrificing flexibility.

Testing new income streams should be done incrementally, without abandoning the primary source of earnings. A practical approach is the “10% rule”: dedicating 10% of work time each week to developing a side project. This could mean writing one article for a personal blog, recording a short video tutorial, or building a simple digital product. Over time, these small efforts compound. Many successful online creators started this way—posting consistently, refining their offer, and gradually attracting an audience. The focus should be on consistency, not immediate profit. As secondary streams gain traction, they can be scaled up while the main income source remains intact. This gradual, low-risk approach allows remote workers to build resilience without overextending themselves.

Managing Taxes and Benefits on Your Own

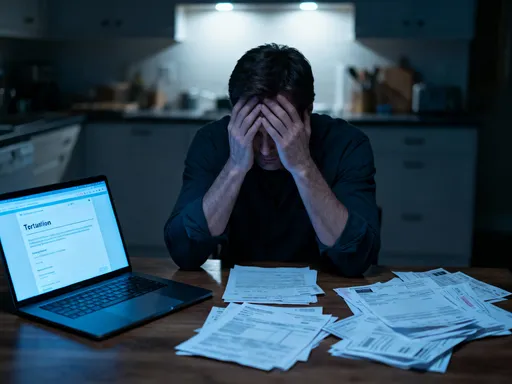

One of the most daunting aspects of remote work is handling taxes and benefits independently. Without an employer withholding income and payroll taxes, the responsibility falls entirely on the worker. Many make the mistake of spending their full income, only to face a shocking tax bill at the end of the year. To avoid this, remote workers must adopt a proactive tax strategy that includes quarterly estimated payments, diligent expense tracking, and strategic retirement planning.

The first step is setting up a tax reserve account. This is a separate savings account where a percentage of every payment—typically 25% to 30%, depending on income level and location—is automatically deposited. This money is strictly for taxes and should never be used for regular expenses. By setting it aside immediately, remote workers avoid the stress of scrambling to pay taxes later. They can also use tax software or work with an accountant to estimate quarterly payments accurately, ensuring they don’t underpay (and face penalties) or overpay (and lose access to their own money).

Another critical advantage of self-employment is the ability to claim business deductions. Remote workers can deduct a portion of home office expenses, internet and phone bills, software subscriptions, professional development courses, and even certain travel costs. Keeping detailed records—through apps or simple spreadsheets—is essential to maximize these write-offs and stay compliant. These deductions can significantly reduce taxable income, lowering the overall tax burden. However, it’s important to follow IRS guidelines and avoid claiming personal expenses as business costs.

Retirement planning is another area where remote workers must take initiative. Without a 401(k) match, they need to choose the right retirement account—such as a SEP IRA, SIMPLE IRA, or solo 401(k)—based on income and business structure. These accounts allow for higher contribution limits than traditional IRAs and offer tax advantages. For example, a solo 401(k) lets self-employed individuals contribute both as employer and employee, potentially saving tens of thousands per year. Starting early, even with small contributions, allows compound growth to work over time. The key is consistency: treating retirement savings as a non-negotiable expense, just like rent or insurance.

Protecting Yourself with the Right Insurance

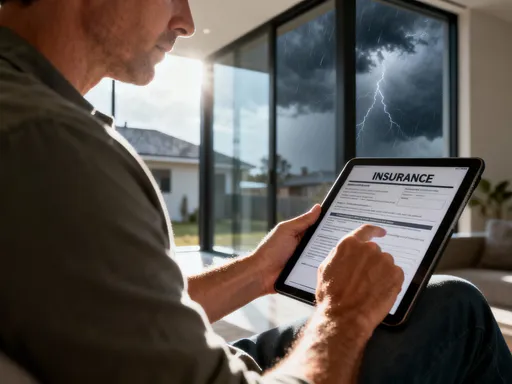

Health, disability, and liability insurance are no longer employer-provided perks—they are personal financial responsibilities for remote workers. Skipping coverage to save money may seem appealing in the short term, but a single medical emergency or work-related claim can wipe out years of earnings. The right insurance acts as a financial safeguard, protecting both income and assets.

Health insurance is the most urgent need. Depending on the country, remote workers may access government marketplaces, professional associations, or private plans. Comparing options based on premiums, deductibles, and network coverage is essential. Some choose high-deductible plans paired with Health Savings Accounts (HSAs), which offer triple tax advantages and can be used for future medical costs. For families, coverage must extend to dependents, making cost comparison even more critical.

Disability insurance is often overlooked but equally important. If an illness or injury prevents work for several months, disability insurance replaces a portion of income. Given that remote work relies heavily on cognitive and physical ability, this protection is vital. Short-term and long-term disability policies vary in cost and coverage, so choosing one that fits both budget and risk profile is key.

For those offering professional services, liability insurance—such as errors and omissions (E&O) coverage—can protect against client lawsuits. A client claiming financial loss due to a missed deadline or incorrect advice could lead to costly legal fees. Professional liability insurance covers these scenarios, offering peace of mind. While not every remote worker needs it, those in consulting, finance, or legal-adjacent fields should strongly consider it. The cost is often minimal compared to the risk.

Tools and Habits That Keep Finances on Track

Staying financially organized is not about perfection—it’s about consistency. Remote workers benefit greatly from simple, repeatable habits and reliable tools that reduce mental load. Budgeting apps like YNAB (You Need A Budget) or Monarch Money help track irregular income and align spending with cash flow. Income trackers, whether digital spreadsheets or dedicated software, allow workers to visualize earning patterns over time, identifying seasonal trends or client dependencies.

Monthly financial check-ins are a powerful habit. Setting a recurring calendar event to review income, expenses, savings progress, and upcoming bills ensures nothing slips through the cracks. During these reviews, workers can adjust spending in lean months, accelerate debt repayment in high-earning months, and reallocate funds as needed. Automating as much as possible—bill payments, savings transfers, tax contributions—reduces the need for constant decision-making.

Daily habits matter too. Logging expenses immediately, categorizing income by source, and noting client payment timelines build awareness over time. These small actions create a clear financial picture, making it easier to plan ahead and avoid surprises. The goal is not to become a financial expert, but to develop a system that works with the reality of remote work—irregular income, multiple responsibilities, and long-term goals.

Long-Term Wealth: Thinking Beyond Survival

Managing risk isn’t about playing it safe—it’s about creating the freedom to thrive. Remote workers who master cash flow, diversify income, plan for taxes, and protect themselves with insurance lay the foundation for long-term wealth. The shift from survival to growth begins when financial systems are in place, allowing energy to focus on opportunities rather than emergencies. Investing becomes possible, not just as a dream, but as a disciplined practice. Asset allocation, low-cost index funds, and real estate crowdfunding are accessible options that build wealth over time.

Mindset is equally important. Moving from scarcity—“I might not earn next month”—to abundance—“I have systems that protect me”—changes how decisions are made. Instead of reacting to income swings, remote workers can plan for sabbaticals, career shifts, or early financial independence. The goal isn’t endless hustle, but sustainable success. By treating financial management as a core skill—just like writing, coding, or designing—remote workers gain true control over their lives. This is the real promise of remote work: not just location freedom, but financial resilience and lasting peace of mind.