Why Accidents Don’t Have to Break You — A Pro’s Take on Financial Resilience

I used to think emergency funds were overrated—until a car crash left me with unexpected bills. That’s when I realized: real financial strength isn’t about returns, it’s about resilience. Accidents happen fast, but smart planning doesn’t. I spent months recovering, both physically and financially, and during that time, I learned more about money than I ever did in business school. It wasn’t high-yield stocks or real estate deals that saved me—it was structure, foresight, and a layered defense against the unexpected. This is not a story about getting rich. It’s about staying solvent when life throws a curveball. And if you’ve ever assumed ‘it won’t happen to me,’ this is why you need to reconsider.

The Wake-Up Call: When Life Interrupts Your Finances

A rainy Tuesday changed everything. I was driving home from a routine workday when another driver ran a red light. The impact was sudden, violent, and disorienting. Fortunately, no one died. But I spent the next six weeks on medical leave, three months in physical therapy, and over $18,000 in out-of-pocket expenses despite having health insurance. My income dropped to zero overnight. My savings, while decent, began shrinking faster than I anticipated. What shocked me most wasn’t the pain or the recovery timeline—it was how quickly financial stability can dissolve when you’re not prepared.

This experience revealed a dangerous illusion many professionals live with: the belief that a stable job and a growing bank account equal security. The truth is, income is fragile. One accident, one injury, one unplanned event can disrupt cash flow, trigger debt, and delay long-term goals like homeownership or retirement. According to the Federal Reserve, 37% of Americans wouldn’t be able to cover a $400 emergency without borrowing or selling something. That statistic isn’t just a number—it represents millions of households one setback away from financial crisis.

The emotional toll was just as heavy as the financial strain. Stress about bills, uncertainty about recovery, and guilt over depending on family created a mental burden that slowed my healing. I began to see financial resilience not as a dry topic for spreadsheets, but as a form of self-care. When money is stable, healing becomes possible. When finances collapse, recovery gets harder. This realization shifted my entire approach to personal finance. It’s not enough to save for retirement or invest for growth. You must also plan for interruption—because life doesn’t wait for your financial timeline.

Financial Planning Beyond the Emergency Fund

Most financial advice stops at “Build an emergency fund.” And yes, having three to six months of living expenses in a liquid account is essential. But in my case, that fund covered only half of my recovery costs. Medical deductibles, lost wages, transportation to therapy, and home modifications added up quickly. I realized that relying solely on cash savings is like building a house with only one wall—it gives a sense of safety, but it won’t withstand a storm.

True financial resilience requires a layered defense. Think of it as a pyramid: the base is your emergency fund, but above it are other protective layers—insurance, accessible credit, income protection, and flexible assets. Each layer serves a different purpose and activates under different circumstances. For example, while cash reserves handle short-term disruptions, disability insurance replaces income during long recoveries, and a home equity line of credit can cover unexpected medical equipment costs.

One common mistake is treating the emergency fund as a catch-all solution. In reality, it should be reserved for true emergencies—not routine expenses or minor setbacks. When larger crises hit, you need more robust tools. A professional-grade financial plan doesn’t depend on one strategy; it integrates multiple safeguards that work together. This approach reduces the pressure on any single resource and prevents total depletion during prolonged challenges.

Moreover, inflation and rising healthcare costs mean that the value of cash erodes over time. Keeping too much in a low-interest savings account can actually reduce your real purchasing power. That’s why diversifying your safety net across different asset types and risk-mitigation tools is critical. The goal isn’t to maximize returns in your emergency portfolio—it’s to preserve access, maintain stability, and ensure continuity when income stops.

Risk Control: Protecting Income Like Your Wealth Depends On It

Most people focus on growing wealth, but few prioritize protecting income. Yet, for most households, income is the engine that drives all financial progress. Without it, savings shrink, investments stall, and debt accumulates. When I lost my ability to work, I learned the hard way that no investment return can replace a steady paycheck. That’s why income protection should be the cornerstone of any accident preparedness plan.

Disability insurance is one of the most effective tools for this, yet it remains underutilized. According to the Council for Disability Awareness, nearly 25% of today’s 20-year-olds will experience a disability before retirement. Despite this, fewer than 40% of workers have individual disability coverage. Employer-provided plans exist, but they often cover only 50-60% of salary and may not be portable if you change jobs. Gaps like these can leave you exposed when you need protection most.

When evaluating disability insurance, consider the benefit amount, elimination period (the waiting time before payments begin), and the definition of disability. Some policies pay only if you can’t work in any job, while others cover you if you can’t perform your specific occupation—a crucial difference for professionals like doctors, engineers, or executives. A policy that aligns with your career and lifestyle increases the likelihood of receiving benefits when you need them.

Beyond insurance, consider contingency income sources. These might include passive income streams, freelance work you can do from home, or a side business with low physical demands. During my recovery, I started consulting part-time via video calls, which helped offset some lost income. It wasn’t full pay, but it reduced the strain on savings. Building flexible income options before a crisis gives you more control when life disrupts your routine.

Smart Asset Allocation for Stability, Not Just Growth

Traditional investment advice often emphasizes growth: “Maximize returns,” “Stay invested for the long term,” “Don’t time the market.” While these principles have merit, they don’t account for periods when you can’t afford volatility. When recovering from an accident, a 20% drop in your portfolio isn’t just a paper loss—it’s a real threat to your ability to pay bills. That’s why asset allocation must include a strong emphasis on stability, not just growth.

A balanced approach divides your portfolio into segments based on function. One portion is for long-term growth (stocks, real estate), another for income (dividend-paying assets, bonds), and a third for stability and access (cash, short-term bonds, money market funds). The stability segment acts as a shock absorber, providing liquidity without forcing you to sell depreciated assets during a market downturn.

For example, short-term Treasury bonds or certificate of deposit (CD) ladders offer modest returns with minimal risk. They’re not exciting, but they preserve capital and generate predictable income. Cash-value life insurance, while complex, can also serve as a low-volatility reserve that grows tax-deferred and can be borrowed against in emergencies. These tools aren’t meant to replace growth investments, but to complement them by reducing overall portfolio risk.

The exact allocation depends on your age, risk tolerance, and financial obligations. A common model for mid-career professionals might be 50% growth assets, 30% income-generating assets, and 20% stability assets. As you approach major life events—like a child’s college years or a planned career break—you might temporarily increase the stability portion. The key is intentionality: your portfolio should reflect not just your goals, but your vulnerabilities.

Practical Steps to Build Your Financial Safety Net

Building financial resilience isn’t about making one big move—it’s about taking consistent, thoughtful steps. Start by assessing your personal risk exposure. Ask: What would happen if I couldn’t work for three months? Six months? What are my largest financial obligations? How much would medical costs, therapy, or home modifications cost in a worst-case scenario? Being honest about these questions helps you size your safety net accurately.

Next, calculate your recovery timeline. This isn’t just about healing physically—it’s about how long it would take to regain financial footing. Include lost income, ongoing expenses, and potential one-time costs like legal fees or vehicle repairs. Use this number to determine how much you need in accessible funds and insurance coverage. For instance, if you estimate $30,000 in total costs over six months, your emergency fund should cover at least half, with insurance and other tools filling the rest.

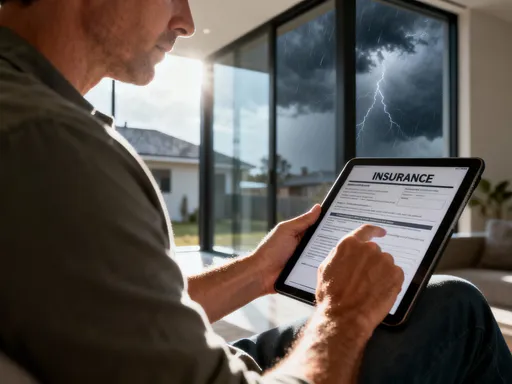

Then, review your insurance coverage. Do you have health insurance with a manageable deductible? Is your disability coverage sufficient? Does your auto policy include personal injury protection? Don’t assume your current plans are enough—read the fine print. Consider consulting a fee-only financial advisor to identify gaps. You might also explore umbrella liability insurance, which protects your assets if you’re sued after an accident, even if you’re not at fault.

Finally, structure your accessible funds. Keep three to six months of expenses in a high-yield savings account. Consider adding a second tier of liquidity through a money market fund or a short-term bond fund. If you own a home, a home equity line of credit (HELOC) can serve as a backup, though it should be used cautiously. The goal is to have multiple access points so you don’t have to liquidate long-term investments in a crisis.

Avoiding the Common Traps After an Accident

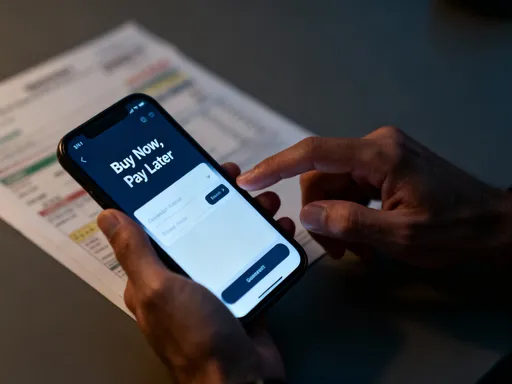

In the aftermath of an accident, emotions run high, and decision-making suffers. Many people make financial choices in the moment that have long-term consequences. One of the most common mistakes is tapping into retirement accounts like a 401(k) or IRA. While the IRS allows penalty-free withdrawals for certain medical expenses, doing so reduces your future savings, triggers taxes, and eliminates years of compound growth. Withdrawing $10,000 today could cost you over $50,000 in lost returns by retirement.

Another trap is ignoring insurance claims or failing to appeal denials. Insurance companies often delay or underpay claims, assuming policyholders won’t fight back. But every dollar matters when you’re not earning. Keep detailed records, submit all required documentation, and don’t hesitate to escalate disputes. Many hospitals and insurers have financial assistance programs you may qualify for—but you have to ask.

Underestimating recovery time is another frequent error. People often return to work too soon, worsening their condition and extending the financial strain. A realistic timeline prevents this. Work with your doctor to create a recovery plan that includes financial milestones, not just medical ones. And don’t overlook non-medical costs: childcare during appointments, transportation to therapy, or modifications like a wheelchair ramp can add up quickly.

Finally, avoid high-interest debt. Credit cards and payday loans may seem like quick fixes, but they can trap you in a cycle of repayment. If you must borrow, explore low-interest personal loans, payment plans with providers, or assistance from family with clear terms. The goal is to minimize long-term damage while maintaining dignity and control.

Long-Term Resilience: Planning That Grows With You

Financial resilience isn’t a one-time project—it’s an ongoing practice. Life changes: you get married, have children, switch careers, buy a home. Each of these events alters your risk profile and financial needs. That’s why your safety net must evolve. Set a calendar reminder to review your financial plan at least once a year. Update your emergency fund target, reassess insurance coverage, and adjust asset allocation as needed.

Major life events should trigger immediate reviews. Having a baby? You may need more life insurance and a larger emergency fund. Starting a business? Income volatility increases, so you’ll need stronger cash reserves. Approaching retirement? Protecting assets becomes more important than chasing growth. These transitions are not just milestones—they’re opportunities to strengthen your defenses.

Integrate accident preparedness into your broader wealth strategy. It shouldn’t be a separate checklist item, but a core principle. Just as you budget for groceries or plan for vacations, build resilience into your routine. Teach your family about the plan so they know what to do if something happens. Share login details, keep important documents organized, and discuss financial priorities openly.

In the end, true financial security isn’t measured by how much you earn or how big your portfolio is. It’s measured by how well you can withstand disruption. Accidents don’t have to break you—not if you’ve built a system that holds when life gets shaky. Resilience isn’t about avoiding risk; it’s about managing it wisely. And with the right plan, you can face the unexpected not with fear, but with confidence.