How I Renovated Without Breaking the Bank — My Risk-Smart Method

Home renovation sounds exciting—until you face budget overruns, contractor surprises, or hidden structural issues. I learned this the hard way when my dream kitchen remodel started draining my savings. But instead of panicking, I shifted gears and built a smarter approach. What if you could renovate with confidence, knowing you’ve protected your finances from common pitfalls? This is how I turned a risky project into a controlled, rewarding journey—using practical strategies anyone can follow. My experience taught me that the difference between a successful renovation and a financial nightmare often comes down to preparation, not luck. With careful planning and disciplined execution, even modest budgets can yield beautiful, lasting results.

The Hidden Dangers Lurking in Your Renovation Plan

Many homeowners begin renovation projects with enthusiasm, picturing sleek countertops and open-concept living spaces. Yet beneath the surface of these dreams lie financial risks that can quickly turn inspiration into stress. The most common mistake is assuming everything will go according to plan. In reality, unexpected issues such as outdated plumbing, load-bearing wall complications, or mold behind drywall are not rare—they are routine. These hidden structural problems can add thousands of dollars to a project and extend timelines significantly. What starts as a $20,000 bathroom upgrade can balloon into a $35,000 effort once unforeseen repairs are factored in. The key is not to avoid renovations but to anticipate disruption before it strikes.

Permit delays are another often-overlooked risk. Local building departments may require multiple inspections or revisions to submitted plans, which can stall construction for weeks. Contractors might charge daily idle fees, or subcontractors may need to reschedule, increasing overall labor costs. Similarly, supply chain disruptions—such as those seen during recent global events—can delay the arrival of essential materials like tiles, windows, or appliances. These delays not only slow progress but may force homeowners to accept higher prices from alternative suppliers. Without a buffer, these setbacks become financial emergencies rather than manageable hiccups.

Contractor reliability also poses a significant threat. Some professionals may overpromise and underdeliver, disappear midway through a job, or subcontract work without proper oversight. Others may lack the necessary licenses or insurance, leaving the homeowner liable for accidents on the property. These risks are especially pronounced in hot housing markets where demand for skilled labor outpaces supply. Homeowners may feel pressured to hire the first available contractor without thorough vetting, only to face poor craftsmanship or billing disputes later. Recognizing that renovation involves more than aesthetics—it is a complex logistical and financial undertaking—shifts the mindset from impulsive action to strategic planning.

Understanding these dangers is not meant to discourage renovation but to promote smarter decision-making. Every successful project begins with an honest assessment of what could go wrong. This awareness allows for proactive measures: setting aside contingency funds, choosing verified professionals, and building flexible timelines. When you acknowledge risk instead of ignoring it, you gain control. You stop reacting to crises and start preventing them. That shift in perspective is the foundation of a financially sound renovation—one that enhances your home without endangering your future.

Building Your Financial Safety Net Before Hammer Meets Wall

Before any demolition begins, the most important step in a renovation is financial preparation. This means creating a dedicated safety net specifically for the project—one that operates independently of general household savings or emergency funds. Many homeowners make the error of dipping into retirement accounts, college savings, or credit lines without a clear repayment plan. While these options may seem convenient, they expose long-term financial goals to short-term risks. A better strategy is to build a renovation-specific reserve that accounts for both planned expenses and unexpected costs. This buffer acts as insurance against the unpredictable nature of construction work.

Financial experts commonly recommend allocating 10% to 20% of the total estimated budget as a contingency fund. For example, on a $30,000 kitchen remodel, setting aside $3,000 to $6,000 for surprises is a prudent move. This range reflects historical data showing that most renovations exceed initial estimates by at least this margin. The fund should be kept in a liquid account—such as a high-yield savings account—so it can be accessed quickly when needed. Keeping this money separate from everyday finances helps prevent emotional spending and ensures it remains available only for renovation-related emergencies.

Equally important is evaluating your current financial health before committing to any major project. This includes reviewing monthly cash flow, outstanding debts, and other upcoming expenses. If you are already carrying high-interest credit card balances or facing a major life event like a child’s tuition payment, delaying the renovation may be the wiser choice. Prioritizing financial stability over immediate home improvements protects your credit score and reduces stress. It also ensures that if an issue arises during construction, you won’t be forced to take on additional debt or sell assets under pressure.

Liquidity is another critical factor. Unlike investments in stocks or real estate, renovation funds must be readily available. Tying up money in illiquid assets increases vulnerability to delays and disputes. For instance, if a contractor requests a milestone payment and you must wait days to liquidate an investment, the project stalls, potentially leading to penalties or strained relationships. By maintaining accessible funds, you retain control over the timeline and maintain leverage in negotiations. Ultimately, the goal is not just to complete the renovation but to do so without compromising your broader financial well-being. A well-funded, disciplined approach transforms renovation from a gamble into a calculated investment in your home and future.

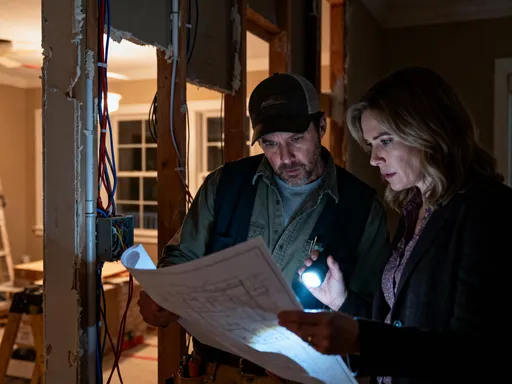

Choosing Contractors with Caution—and Cutting Hidden Costs

Selecting the right contractor is one of the most impactful decisions in any renovation. A skilled, reliable professional can deliver quality work on time and within budget, while a poor choice can lead to shoddy results, cost overruns, and legal complications. Yet many homeowners rely solely on online reviews or word-of-mouth recommendations without deeper due diligence. While positive testimonials are helpful, they don’t guarantee performance. A more thorough vetting process includes checking licenses, verifying insurance coverage, and contacting past clients directly. These steps may take extra time, but they significantly reduce the risk of hiring someone unqualified or uninsured.

Licensing requirements vary by state and locality, but a valid license indicates that the contractor has met minimum standards for knowledge and experience. It also means they are subject to regulatory oversight, which provides recourse if problems arise. Similarly, liability and workers’ compensation insurance protect the homeowner in case of injury or property damage during the project. If a contractor lacks insurance and an accident occurs, the homeowner could be held financially responsible. Always request proof of both licenses and insurance before signing any agreement, and verify them through official channels when possible.

The contract itself is another crucial safeguard. Vague or incomplete agreements often lead to disputes over scope, materials, and pricing. A detailed contract should include a full description of the work, itemized costs, a clear timeline, and provisions for change orders. It should also outline how disputes will be resolved and specify the consequences of delays. Without these elements, contractors may charge extra for tasks assumed to be included or extend deadlines without penalty. A well-drafted contract protects both parties and serves as a reference point throughout the project.

Beyond traditional full-service contractors, alternative models can help manage costs. A hybrid DIY approach, where homeowners handle non-structural tasks like painting, demolition, or fixture installation, can reduce labor expenses without sacrificing safety. Another option is managing the project independently while hiring licensed subcontractors for specialized work like electrical or plumbing. This requires more coordination but allows for greater cost control. Additionally, obtaining multiple bids encourages competitive pricing and reveals discrepancies in scope or quality. By combining careful selection with strategic cost-saving methods, homeowners can achieve professional results without overspending.

Smart Material Sourcing: Quality Without the Price Shock

Materials typically represent the largest portion of a renovation budget, often exceeding 50% of total costs. However, prices for similar items can vary dramatically depending on where and when they are purchased. The difference between a successful renovation and a budget-busting ordeal often lies in sourcing strategy. The goal is not to buy the cheapest materials but to find those that offer the best value—durable, functional, and aesthetically appropriate without unnecessary markups. Understanding this distinction between *cheap* and *cost-effective* is essential for making wise purchasing decisions.

Timing plays a major role in material costs. Retailers and suppliers often offer seasonal promotions, such as end-of-year clearance sales or holiday discounts on flooring, cabinets, and appliances. Planning purchases around these events can yield savings of 20% or more. For example, buying windows in late winter may coincide with manufacturer incentives, while ordering countertops in early spring can avoid peak demand surcharges. Staying informed about industry cycles allows homeowners to time their purchases strategically, reducing costs without compromising quality.

Overstock and salvage outlets are another valuable resource. These stores sell excess inventory, discontinued models, or slightly imperfect items at steep discounts. A cabinet with a minor scratch or a tile batch with slight color variation might be sold at 40% to 60% off retail price. For renovation projects where uniform perfection is not critical, these options offer significant savings. Some nonprofit organizations also operate home improvement stores that sell donated materials at reduced rates, supporting community programs while helping homeowners save money.

Negotiation is often overlooked but can lead to meaningful savings. Many suppliers are willing to discount prices for bulk orders or cash payments. Building a relationship with a local supplier may result in better deals on future purchases or access to upcoming sales. Additionally, asking for floor models or display units can reduce appliance costs by 25% or more. However, it’s important to know where not to cut corners. Materials related to safety and structural integrity—such as electrical wiring, insulation, and foundation components—should never be compromised. Spending slightly more on these elements prevents costly repairs and hazards down the line. By focusing savings on finishes and fixtures, homeowners can achieve a high-end look without the high-end price tag.

Managing Cash Flow: Staging Payments to Protect Your Budget

One of the most common financial missteps in renovation is paying too much too soon. Some contractors request large down payments—sometimes as high as 50%—before work begins. While this may seem standard, it places the homeowner at significant risk. If the contractor fails to deliver, goes out of business, or performs subpar work, recovering those funds can be difficult. A better approach is to use staged payments tied to specific project milestones. This method ensures that money changes hands only as progress is made, aligning financial outflow with tangible results.

A typical staged payment schedule might include an initial deposit of 10% to 15% to secure the contractor’s services and cover material ordering costs. Subsequent payments are released upon completion of key phases: demolition, framing, plumbing and electrical rough-ins, drywall installation, and final finishes. Each payment should be contingent on homeowner approval and, when possible, third-party inspection. This structure incentivizes the contractor to meet deadlines and maintain quality, while giving the homeowner leverage throughout the process.

Financing choices also affect cash flow management. Home equity lines of credit (HELOCs) are popular for renovations because they offer flexible access to funds. However, they often come with variable interest rates that can rise over time, increasing repayment costs. Using a HELOC impulsively—without a clear drawdown plan—can lead to overspending and long-term debt. A fixed-rate home equity loan may be a safer alternative, providing predictable monthly payments and a defined repayment term. Alternatively, personal loans or savings-based funding eliminate interest costs altogether and reduce financial exposure.

Treating the renovation like a managed investment rather than a spending spree changes the mindset around money. Each disbursement becomes a decision point, not an automatic transfer. This discipline reduces both financial and emotional stress, as the homeowner maintains control over the budget. By aligning payments with progress and avoiding large upfront commitments, it’s possible to complete a high-quality renovation without jeopardizing financial stability.

Insurance and Permits: The Boring Paperwork That Saves Thousands

While permits and insurance may seem like bureaucratic hurdles, they are essential components of a financially responsible renovation. Skipping permits to save time or money can result in fines, forced demolition of unapproved work, or complications when selling the home. Most jurisdictions require permits for structural changes, electrical upgrades, and plumbing modifications. These approvals ensure that work meets local building codes and safety standards. An inspector’s sign-off provides documentation that the renovation was completed legally, which increases buyer confidence and protects resale value.

Homeowner’s insurance is another area where assumptions can lead to costly mistakes. Standard policies typically do not cover damage that occurs during active construction. For example, if a fire breaks out while contractors are working, or if water damage results from a plumbing test, the homeowner may be left paying out of pocket. To close this gap, temporary builder’s risk insurance can be purchased. This coverage protects the property during the renovation period, covering theft, fire, weather damage, and other common risks. Premiums are usually modest relative to the potential losses, making it a wise investment.

Permits also play a role in contractor accountability. Licensed professionals are more likely to follow code requirements when they know inspections are scheduled. This reduces the likelihood of hidden shortcuts that could compromise safety or require expensive corrections later. Additionally, having a paper trail of approved plans and inspections strengthens your position in case of disputes over work quality or compliance. While the process may add a few weeks to the timeline, the long-term benefits far outweigh the inconvenience.

Viewing permits and insurance not as obstacles but as protective tools shifts the perspective from avoidance to empowerment. These measures form a legal and financial shield that safeguards your investment. They ensure that your renovation enhances both the physical and monetary value of your home while minimizing exposure to risk. In the world of home improvement, the most boring paperwork often delivers the greatest peace of mind.

Measuring Success Beyond the Final Look

When the last coat of paint dries and the final fixture is installed, it’s natural to focus on the visual transformation. A bright new kitchen, a spa-like bathroom, or an expanded living area can bring immense satisfaction. But true renovation success extends beyond aesthetics. The most meaningful measure is financial: Did the project stay within a reasonable range of the original budget? Did it avoid creating new debt or depleting emergency savings? Most importantly, did it strengthen your overall financial position rather than weaken it? Answering these questions provides a more complete picture of achievement.

Another key metric is return on investment (ROI). While not every renovation pays for itself at resale, certain upgrades consistently add value. Kitchen and bathroom remodels, energy-efficient windows, and minor exterior improvements often yield strong returns. However, overly personalized or luxury features—such as a built-in home theater or imported marble countertops—may not appeal to future buyers and could limit marketability. Evaluating choices through an ROI lens encourages decisions that balance personal enjoyment with long-term financial benefit.

Intangible returns also matter. A well-executed renovation can improve daily comfort, support aging in place, or accommodate growing family needs. These benefits contribute to quality of life in ways that aren’t reflected on a balance sheet. However, they should not come at the expense of financial security. The ideal outcome is a home that feels better to live in and is stronger as an asset. By assessing both tangible and intangible results, homeowners gain a balanced view of success—one that honors both emotion and economics.

Ultimately, a successful renovation is not defined by how much was spent or how glamorous the result, but by how wisely the process was managed. It’s about making informed choices, preparing for the unexpected, and maintaining control over finances. When these principles guide the journey, the outcome is more than a beautiful space—it’s a testament to thoughtful stewardship of one’s resources.

Renovate with Vision, Not Just Tools

A home renovation is more than a construction project—it is a financial decision with lasting consequences. Every choice, from contractor selection to material sourcing, impacts not only the appearance of the home but also the homeowner’s financial health. By planning for risks, protecting cash flow, and making informed decisions, what could have been a risky venture becomes a controlled, value-building journey. The real reward is not just a refreshed living space, but the peace of mind that comes from knowing the transformation was achieved wisely and sustainably. With preparation and discipline, any homeowner can renovate with confidence, creating beauty without sacrificing security.