How I Tamed My Spending with Smarter Installment Habits

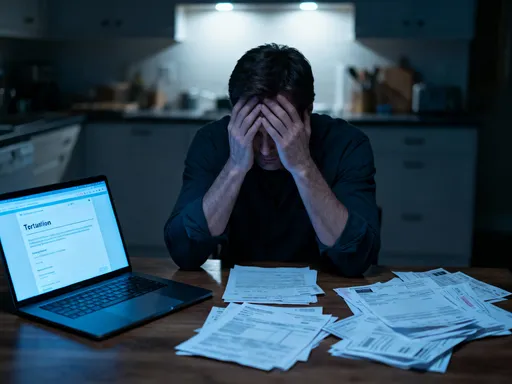

I used to think installment payments were a lifesaver—until I got buried under overlapping bills and hidden fees. Like many beginners, I didn’t see the risks until they hit hard. This is the real talk I wish I had before diving in: how to use installments without falling into financial traps. It’s not about cutting out convenience—it’s about staying in control. Let me walk you through what actually works. What started as a way to manage big-ticket items quietly became a web of obligations I could barely track. The freedom I thought I gained turned into stress, late notices, and a credit score that took a nosedive. But with time, discipline, and clearer boundaries, I learned how to use installment plans responsibly—without losing sleep over my balance. This is not a story of perfection, but of progress. And if you’re navigating the same waters, you’re not alone.

The Allure and the Trap: Why Installments Feel Easy (But Aren’t Always Safe)

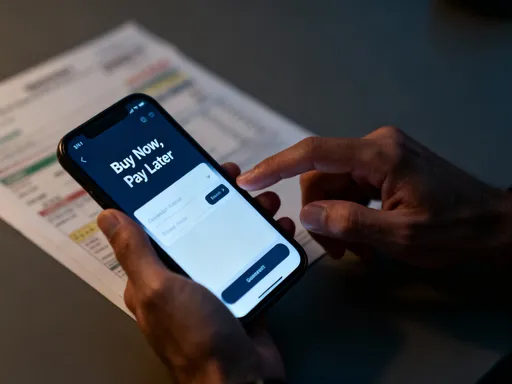

Installment plans are everywhere now—offered at checkout counters, embedded in online shopping carts, and promoted through flashy ads promising “no payments for 6 months” or “split into 4 easy payments.” These offers are designed to feel empowering, even liberating. For someone managing a household budget, the ability to spread out the cost of a new refrigerator, a family vacation, or a seasonal wardrobe update can seem like a practical solution. The appeal is understandable. Big expenses become digestible, and immediate cash flow pressure is reduced. But beneath this surface-level convenience lies a more complex financial reality.

The trap often starts subtly. A single installment plan might appear harmless. But when multiple purchases are broken into monthly chunks across different retailers and lenders, the cumulative effect can strain even a well-structured budget. What feels like manageable $50 or $100 payments suddenly turns into $400 or more in recurring obligations. Many people underestimate how quickly these commitments add up, especially when they’re not tracked in one place. Unlike a mortgage or car loan, which are typically centralized and monitored, retail installment plans are often siloed—each with its own due date, terms, and communication channel. This fragmentation makes it easy to lose sight of the full picture.

Moreover, the psychological design of installment plans plays on our natural preference for immediate gratification. The “buy now, pay later” model taps into the desire to enjoy benefits today while delaying the financial pain. Behavioral economists refer to this as temporal discounting—the tendency to value present rewards more highly than future costs. When the cost is spread over time, the emotional weight of spending diminishes. A $600 purchase split into four $150 payments doesn’t feel as significant as handing over the full amount at once. This mental accounting trick can lead to overspending, particularly on nonessential items that wouldn’t have been purchased with cash.

Another hidden risk is the erosion of financial discipline. When installment plans become a default option, the habit of saving up for larger purchases fades. Instead of setting aside money over time, consumers grow accustomed to financing everything. This shift can weaken long-term financial resilience. Emergency funds dwindle, and the ability to make large purchases without debt diminishes. Over time, the convenience of installments can morph into dependency—a crutch that masks deeper budgeting challenges. Recognizing this pattern is the first step toward regaining control.

Risk Control Starts with Awareness: Mapping Your Real Payment Capacity

Before agreeing to any installment plan, the most important step is assessing your true financial capacity. This means moving beyond optimistic estimates and confronting the actual numbers in your monthly cash flow. Too many people sign up for payment plans based on how they *hope* their finances will look, rather than how they *actually* are. The difference between these two perspectives can mean the difference between staying on track and falling into a debt spiral.

To build an accurate picture of your payment capacity, start by listing all fixed monthly expenses—rent or mortgage, utilities, insurance, transportation, and minimum debt payments. Subtract these from your net income to determine your baseline financial obligations. Next, track your variable spending over at least one to three months. This includes groceries, household supplies, personal care, and discretionary spending like dining out or entertainment. Use bank statements, budgeting apps, or a simple spreadsheet to capture these outflows. Only after accounting for both fixed and variable costs can you identify how much disposable income remains for new financial commitments.

Once you have a clear view of your available funds, simulate how an installment payment will fit into your cash flow. Ask: Does the due date align with your pay cycle? Will the payment land during a month with other large bills? What happens if an unexpected expense arises—can you still afford the installment without cutting essentials? This kind of scenario planning helps prevent overcommitment. It’s not enough to say, “I can afford $75 a month.” You must ask whether that $75 is truly sustainable across different financial conditions.

Another critical practice is treating installment payments like non-negotiable bills. Many people prioritize rent, utilities, and loan payments because the consequences of missing them are immediate and severe. Installment plans, especially those from retailers, often don’t carry the same urgency—until they do. Late fees, credit reporting, and service interruptions can follow missed payments. By mentally upgrading installment obligations to the same tier as essential bills, you reinforce their importance and reduce the risk of default. Awareness isn’t just about numbers—it’s about mindset. When you see each payment as a firm commitment, not a flexible suggestion, you’re far more likely to honor it.

Hidden Risks in Plain Sight: Fees, Credit Checks, and Behavioral Traps

One of the most misleading aspects of installment plans is the marketing language used to promote them. Phrases like “no interest,” “zero down,” and “easy approval” dominate the messaging, creating the impression of a risk-free transaction. But these claims often come with fine print that can undermine their benefits. Late fees, for example, are common and can be substantial—sometimes as high as $39 per missed payment. While one late fee might seem minor, repeated delays can add up quickly, turning an affordable plan into a costly burden.

Default penalties are another concern. Some lenders impose fees not just for late payments, but for failed autopay attempts, insufficient funds, or even early payoff in certain cases. In extreme scenarios, defaulting on an installment loan can lead to debt collection actions or legal claims, especially if the amount is significant. These consequences are rarely highlighted during the sign-up process, leaving consumers unprepared when problems arise.

Credit checks are another area of hidden impact. While most installment providers perform soft inquiries— which do not affect credit scores—some may conduct hard pulls, particularly for larger amounts or repeated use. Even soft inquiries, when accumulated across multiple applications, can signal financial stress to future lenders. If you’re planning to apply for a mortgage or auto loan in the near future, a pattern of frequent installment applications might raise red flags during underwriting.

Beyond financial costs, behavioral risks are equally significant. The ease of approval for installment plans can erode spending discipline. When credit is extended with minimal friction, the psychological barrier to purchasing decreases. This can lead to impulse buying—acquiring items you don’t truly need just because the payment feels manageable. Over time, this behavior can distort your relationship with money, making it harder to distinguish between wants and needs. The convenience of financing becomes a justification for overspending, and the cycle repeats with each new purchase.

Additionally, some installment programs automatically enroll users in premium services or credit-linked accounts, often with recurring fees. These add-ons may not be clearly disclosed during checkout, and customers only discover them later on their statements. By then, canceling may require time-consuming customer service interactions. The lesson is clear: read all terms carefully, ask questions before signing, and assume that if a deal seems too good to be true, there’s likely a cost hidden somewhere in the details.

Building Your Safety Net: Rules That Keep Installments Under Control

Discipline is the cornerstone of responsible installment use. Without self-imposed boundaries, even the most well-intentioned plans can go off track. The key is to establish personal rules that act as guardrails—simple, enforceable guidelines that prevent overextension and promote long-term stability. These rules are not restrictions; they are tools that create financial freedom by reducing risk and decision fatigue.

One effective rule is to cap the number of active installment plans at any given time. For example, limiting yourself to two or three concurrent plans ensures that your obligations remain visible and manageable. This prevents the scattered, out-of-sight problem that comes with juggling too many payments. Another helpful practice is implementing a 48-hour cooling-off period before finalizing any installment purchase. This pause allows you to step back, reassess the necessity of the item, and confirm that the payment fits within your budget. It’s a simple delay that can prevent many impulsive decisions.

Aligning due dates with your income cycle is another powerful strategy. If you’re paid biweekly or monthly, schedule installment payments to occur just after your paycheck arrives. This timing ensures that funds are available and reduces the risk of overdrafts or missed payments. This practice, known as payment stacking, enhances cash flow efficiency and provides peace of mind. When your income and outflows are synchronized, budgeting becomes more predictable and less stressful.

Automation is another essential tool. Set up automatic payments or calendar reminders to avoid missing due dates. Even one late payment can trigger fees and damage your credit. By automating the process, you remove the need for constant vigilance. Additionally, consider building an emergency buffer—setting aside a small amount each month to cover unexpected shortfalls. This fund acts as insurance against temporary income disruptions, such as a delayed paycheck or an urgent home repair, ensuring that your installment commitments remain intact.

Credit Health vs. Short-Term Relief: The Long-Term Trade-Offs

While installment plans offer immediate relief, their impact on long-term credit health must not be overlooked. Responsible use—making payments on time, every time—can contribute positively to your credit history. On-time payments are a key factor in credit scoring models, demonstrating reliability to lenders. Over time, consistent behavior can improve your creditworthiness, making it easier to qualify for favorable rates on mortgages, auto loans, or personal lines of credit.

However, the opposite is also true. Missed or late payments are typically reported to credit bureaus and can remain on your report for up to seven years. Even a single delinquency can cause a significant drop in your score, affecting your ability to secure financing in the future. Some installment lenders report to all three major credit bureaus, meaning a default can have wide-reaching consequences. The damage isn’t just numerical—lenders may view a history of late payments as a sign of financial instability, leading to higher interest rates or outright denials.

Another subtle but important factor is credit utilization. If your installment plan is linked to a revolving credit line—such as a store card or digital wallet—it may count toward your overall credit usage. High utilization, even without maxing out a card, can negatively affect your score. Lenders prefer to see utilization below 30%, and installment debt can push that ratio higher if not managed carefully.

The trade-off, then, is between short-term convenience and long-term opportunity. Using installments to cover essential, planned expenses can be wise. But relying on them for discretionary spending can compromise future goals like homeownership, education funding, or business investment. Every financial decision today shapes the options available tomorrow. By prioritizing credit health, you preserve access to better financial products and lower borrowing costs down the road.

Smart Alternatives: When to Say No to Installments and What to Do Instead

Not every purchase warrants an installment plan. Learning to say no is one of the most powerful financial skills you can develop. Before agreeing to finance, ask: Is this item necessary? Could I save for it instead? Is there a more affordable alternative? These questions help shift the focus from immediate access to long-term value.

One effective alternative is targeted saving. Open a dedicated savings account for specific goals—like a new appliance, home improvement, or holiday expenses. Set up automatic transfers each payday, even if the amount is small. Over time, these contributions accumulate, allowing you to make purchases with cash. This method builds financial patience and eliminates interest and fees. It also reinforces a sense of accomplishment—owning something you fully paid for brings a different kind of satisfaction than financing it.

Another strategy is leveraging cash-back rewards or loyalty programs. If you already use a credit card responsibly, redirecting earned rewards toward large purchases can reduce the out-of-pocket cost. Just be sure to pay off the balance in full each month to avoid interest. Similarly, some retailers offer lump-sum discounts for customers who pay in cash or with debit. It’s worth asking—many people don’t realize these options exist.

Finally, consider timing your purchases around sales or promotional periods. Waiting a few weeks or months can result in significant savings, especially on electronics, furniture, or seasonal items. Delaying gratification isn’t deprivation—it’s strategic patience. The money saved can be redirected toward emergency funds, retirement accounts, or other financial goals. By choosing alternatives to installments, you reclaim control and build a stronger foundation for lasting financial health.

Mastering the Balance: Using Installments as a Tool, Not a Crutch

The goal is not to eliminate installment plans, but to use them wisely. When approached with awareness, discipline, and clear boundaries, they can be a valuable tool in financial management. They allow for strategic purchasing, smooth cash flow, and even credit building—when used responsibly. The danger lies in overuse, lack of tracking, and treating them as a default rather than a deliberate choice.

True financial control comes from regular review. Schedule quarterly check-ins to audit all active installment plans. Are they still aligned with your budget? Have your income or expenses changed? Can any be paid off early to reduce interest or fees? This ongoing evaluation keeps your financial plan dynamic and responsive. It also reinforces accountability, ensuring that each payment serves a purpose rather than just being an automatic deduction.

Each installment payment is more than a transaction—it’s a reflection of your financial habits. When you make a payment on time, you’re not just fulfilling an obligation; you’re strengthening discipline, building trust with lenders, and moving closer to long-term goals. Over time, these small, consistent actions compound into significant progress. Financial freedom isn’t achieved through one big decision, but through thousands of thoughtful choices.

In the end, managing installment plans isn’t just about money—it’s about mindset. It’s about recognizing that convenience should never come at the cost of control. By setting rules, staying informed, and prioritizing long-term health over short-term ease, you can use installments as a tool that supports your financial journey, not one that derails it. The power is in your hands. With awareness and intention, you can spend smarter, save more, and build a future that’s truly within your control.