How I Smartened Up My Home Insurance Game — Market-Savvy Tips You Need

You know that “set it and forget it” feeling with home insurance? I had it too—until I didn’t. After overpaying for years and nearly getting burned during a claim, I dug into the market like it was a financial audit. What I found shocked me: hidden gaps, pricing traps, and smarter ways to protect my biggest asset. This isn’t just about saving bucks—it’s about staying covered when life throws curveballs. Like many homeowners, I assumed my policy was doing its job until the moment I needed it most. That’s when I realized how easily peace of mind can be compromised by outdated assumptions and overlooked details. Home insurance isn’t just a bill; it’s a cornerstone of financial security—and it deserves more attention than an annual glance at a renewal notice.

The Wake-Up Call: When “Good Enough” Insurance Almost Cost Me Big

It started with a storm—nothing historic, just strong winds and heavy rain that rolled through one autumn evening. By morning, a tree limb had crashed through the roof of my garage. The damage wasn’t catastrophic, but it was real: water intrusion, compromised shingles, and structural concerns. I called my insurer, confident I was covered. After all, I’d had the same policy for nearly a decade. I’d paid on time, never filed a claim, and assumed my agent had my back. But when the adjuster arrived, the conversation took a sharp turn. While the roof repair was covered, the estimate came back far below the actual contractor quote. The policy’s replacement cost coverage had not kept pace with inflation in local construction prices. I was underinsured by nearly 25 percent.

Then came the kicker: the garage, which housed my home office and several thousand dollars in electronics and furniture, wasn’t fully covered. Standard personal property limits applied, and my high-end laptop, backup drives, and custom-built desk weren’t itemized. The insurer offered a fraction of their value. What’s worse, the policy excluded coverage for sewer backup—a risk I didn’t even know existed until a minor clog turned into a basement cleanup costing over $8,000 out of pocket. This wasn’t a catastrophic failure of the system, but it exposed how complacency can quietly erode protection. I had trusted that “good enough” meant sufficient, but in reality, I was gambling with my largest asset. That moment changed everything. I realized home insurance isn’t a one-time decision. It’s an ongoing financial responsibility that demands attention, understanding, and proactive management. The cost of inaction wasn’t just higher premiums—it was vulnerability when I needed strength most.

What’s Really Driving Home Insurance Prices Today?

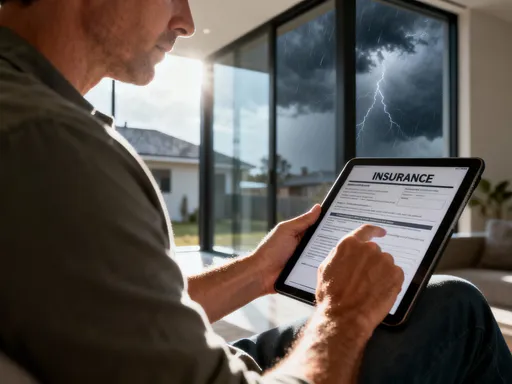

Over the past five years, home insurance premiums have risen at a pace that outstrips general inflation in many parts of the country. This isn’t random—it’s driven by a confluence of economic, environmental, and industry-specific forces that are reshaping how insurers assess risk. One of the most significant factors is the rising cost of construction. Lumber prices have fluctuated wildly, skilled labor is in short supply, and supply chain delays mean repairs take longer and cost more. Insurers factor these trends into replacement cost estimates, which directly influence premiums. A home that would have cost $300,000 to rebuild a decade ago might now cost $450,000 or more in the same location, and policies must reflect that reality.

At the same time, climate change is altering risk maps across the nation. Areas once considered low-risk for wildfires, hurricanes, or flooding are now seeing increased frequency and severity of natural events. In states like California, Florida, and Louisiana, insurers are either raising premiums dramatically or pulling back entirely from certain zip codes. This isn’t just about coastal exposure—interior regions are facing new threats from drought-induced wildfires or extreme rainfall overwhelming drainage systems. Insurers rely on sophisticated modeling to project future losses, and those projections are feeding into higher premiums for homeowners even if they’ve never filed a claim. Reinsurance costs—the insurance that insurers buy to protect themselves from large-scale disasters—have also spiked, and those costs are passed down to policyholders.

Another overlooked factor is the shift in underwriting standards. After years of low interest rates and high investment returns, insurers could absorb more losses. But with tighter monetary policy and lower yields, they’re becoming more conservative. This means stricter eligibility criteria, higher deductibles, and fewer willingness to cover certain perils unless explicitly added. Location still matters, but it’s no longer just about your street address. It’s about your regional risk profile—how close you are to a floodplain, wildfire zone, or areas with high claims frequency. All of these forces are interconnected, and they mean that what you pay for home insurance today isn’t just about your home—it’s about the broader financial and environmental landscape insurers are navigating.

The Coverage Gaps No One Talks About (But You Should Know)

Most standard home insurance policies are built on a foundation of broad protection, but they come with exclusions that can leave homeowners exposed in ways they don’t anticipate. One of the most common—and costly—gaps is the lack of coverage for sewer or drain backups. This isn’t just a concern for older homes; heavy rainfall can overwhelm municipal systems, causing wastewater to flow backward into basements. Without a separate endorsement, cleanup, structural drying, and replacement of damaged belongings fall entirely on the homeowner. I learned this the hard way when a clogged municipal line led to a backup that ruined flooring, drywall, and a home gym setup. The out-of-pocket cost was nearly $10,000, and my policy didn’t budge.

Another frequently overlooked gap involves high-value personal property. Standard policies typically impose sub-limits on categories like jewelry, art, collectibles, and electronics. If you own a wedding ring worth $15,000, a high-end camera, or a collection of vintage instruments, the default coverage may only reimburse a fraction of their value. This is where scheduled personal property endorsements come in—essentially, itemizing and insuring specific valuables at their appraised worth. While this requires extra documentation and a small additional premium, it eliminates guesswork during a claim. I now keep a digital inventory with photos, receipts, and appraisals, and I’ve scheduled several key items. It’s a small effort that could save tens of thousands down the line.

Foundation cracks and earth movement are another area of exclusion. Most policies don’t cover damage from settling, earthquakes, or sinkholes unless you’ve purchased separate coverage. In regions prone to soil instability or seismic activity, this can be a critical blind spot. Similarly, many homeowners assume their home-based business equipment is covered under personal property—but standard policies often limit or exclude business-related assets. If you run a consulting practice from home or teach music lessons with expensive instruments, you may need an endorsement or even a separate business policy. These aren’t edge cases—they’re real risks that affect thousands of households every year. The key is to review your policy’s exclusions section carefully and ask your agent to explain what’s not covered. It’s far better to spend an hour clarifying details than to discover a gap when it’s too late.

How to Compare Policies Like a Pro (Not Just by Price)

When I first decided to shop around, I did what many do: I typed my address into a comparison website and looked for the lowest number. But I quickly realized that price alone is a misleading metric. Two policies can have the same premium but vastly different levels of protection. One might offer a higher liability limit, better replacement cost coverage, or more favorable claims handling. To compare effectively, I developed a side-by-side evaluation method that goes beyond the sticker price. First, I looked at coverage details: What is the dwelling coverage based on? Is it guaranteed replacement cost, extended replacement cost, or actual cash value? Guaranteed replacement cost is the gold standard—it promises to rebuild your home even if costs exceed the policy limit, which is invaluable in a high-inflation environment.

Next, I examined liability coverage. Most standard policies start at $100,000, but I found that increasing it to $300,000 or $500,000 added only a small amount to the premium while offering much stronger protection against lawsuits. I also checked for medical payments to others coverage, which can cover minor injuries on your property and prevent small incidents from escalating. Another critical factor was the insurer’s financial strength rating. I used independent agencies like AM Best, Moody’s, and Standard & Poor’s to assess stability. A company with a strong rating is more likely to pay claims promptly, even after a major disaster. I avoided insurers with ratings below A- for this reason.

Customer service and claims satisfaction were equally important. I reviewed J.D. Power studies and National Association of Insurance Commissioners (NAIC) complaint indexes to see how companies performed in real-world scenarios. One insurer offered a low rate but had a high complaint ratio—red flag. I also tested responsiveness by calling customer service lines and asking detailed questions. How quickly were they able to answer? Did the agent explain terms clearly? These soft factors matter when you’re stressed after a loss. Finally, I compared deductible structures. A higher deductible lowers your premium, but I made sure I could afford the out-of-pocket cost if disaster struck. By evaluating policies on these dimensions—coverage breadth, financial strength, service quality, and claims history—I moved from being a price shopper to a value-driven buyer. The cheapest policy isn’t always the best deal; the best value is the one that pays when you need it most.

Timing the Market: When to Switch, When to Stay

For years, I stayed with the same insurer out of loyalty. I thought long-term customers were rewarded with stability and better service. But when I analyzed my renewal notices, I discovered the opposite: my premium had increased steadily, while new customers in my area were getting lower rates for the same coverage. Insurers often use acquisition pricing—offering discounts to attract new business—while existing customers absorb rate hikes. This is a well-documented pattern in the industry. I realized that loyalty, in this case, was costing me money. The optimal time to shop around isn’t at renewal—it’s 30 to 60 days before. That gives you time to compare, request quotes, and make a switch without risking a lapse in coverage.

I also learned that timing within the year matters. Late winter and early spring—January through March—are often the best months to find competitive rates. Insurers are coming off annual earnings reports and may be more aggressive in acquiring customers. In contrast, renewal periods in hurricane or wildfire season often come with higher premiums due to heightened risk perception. I now treat home insurance like a financial review—scheduled annually, not just when a bill arrives. I also discovered that switching insurers doesn’t necessarily hurt your credit. Unlike credit card applications, insurance inquiries are considered soft pulls and don’t impact your score. However, I made sure to avoid gaps in coverage. Even a one-day lapse can lead to higher rates or denial of future policies. I coordinated new policies to start the day after the old one ended and confirmed cancellation in writing.

That said, switching isn’t always the answer. If you’ve had multiple claims, moving to a new insurer might be difficult or expensive. In such cases, it may be better to stay and work with your current provider to improve your risk profile—like installing security systems or updating plumbing. The key is to be strategic: shop annually, but decide based on value, not just price. I now set a calendar reminder every January to review my policy, check for changes in my home or local risk factors, and request updated quotes. This habit has saved me over $1,200 in the past three years and given me confidence that I’m not overpaying or underprotected.

Bundling, Discounts, and the Fine Print Traps

Bundling home and auto insurance is one of the most common ways to save, and for good reason—it often comes with a multi-policy discount of 10 to 25 percent. I took advantage of this and initially saw a drop in my total insurance costs. But over time, I began to question whether I was truly getting the best deal. Was my auto insurance rate competitive on its own? Was I over-insuring my home just to maintain the bundle? I decided to test it. I got standalone quotes for both policies from different providers and compared the combined cost to my bundled rate. In one case, unbundling and switching providers saved me more than the bundle discount. The lesson: bundling can be smart, but it shouldn’t be automatic. Always verify that each component of the bundle is priced fairly.

Insurers offer a range of other discounts—some legitimate, others less so. I found that discounts for safety upgrades like security systems, smoke detectors, and deadbolt locks were consistently valuable and easy to qualify for. Installing a monitored alarm system earned me a 15 percent reduction. Similarly, being claims-free for five or more years often comes with a loyalty discount, though it’s not always automatic—sometimes you have to ask. New homebuyers may qualify for a discount if the house is newer or has modern electrical, plumbing, and roofing systems. But I also encountered marketing-driven discounts that sounded good but offered minimal savings. For example, “paperless billing” or “autopay” discounts were often just 1 to 3 percent—nice, but not transformative.

One of the most effective ways to reduce premiums without sacrificing coverage is to raise your deductible. I increased mine from $500 to $1,000 and saw an immediate 10 to 15 percent drop in my premium. I made sure I had an emergency fund to cover the higher out-of-pocket cost, so the trade-off made sense. I also reviewed my policy’s risk score—a proprietary calculation insurers use based on credit history, claims history, and other factors. While I couldn’t change my past, I could improve my present by paying bills on time and reducing credit utilization, which over time helped lower my risk profile. The key is to look beyond the headline discount and ask: does this actually save me meaningful money? If not, it’s just noise.

Building a Smarter, Future-Proof Home Insurance Strategy

Today, my approach to home insurance is no longer reactive—it’s strategic and ongoing. I’ve rebuilt my policy with a clearer understanding of what’s covered, what’s not, and how market forces affect my costs. I maintain a detailed home inventory, updated annually, with photos, serial numbers, and estimated values. I store it in a secure cloud folder, accessible from any device. I’ve added endorsements for sewer backup, scheduled high-value items, and increased my liability coverage to $500,000. I’ve also raised my deductible to a level that balances savings with affordability. These changes didn’t happen overnight, but they’ve given me a level of confidence I didn’t have before.

More importantly, I’ve made policy review a habit. Every January, I conduct a home insurance audit: I check for home improvements, reassess replacement costs, and request new quotes. I stay informed about local risk changes—like new flood maps or wildfire zones—and adjust coverage accordingly. I also maintain open communication with my agent, asking questions and clarifying terms before signing anything. This isn’t about suspicion—it’s about responsibility. Homeownership is one of the most significant financial commitments a person can make, and insurance is its protective layer. Treating it as a static expense is a mistake. Markets change, homes change, and risks evolve. A policy that made sense five years ago may not be right today.

What I’ve learned is that being smart about home insurance isn’t about finding the cheapest rate—it’s about building resilience. It’s about knowing you’re covered, not just assuming it. It’s about making informed decisions that align with your financial goals and lifestyle. By taking control of my policy, I’ve saved money, reduced stress, and gained peace of mind. And that, more than any discount, is the real return on investment. Protecting your home isn’t a one-time task. It’s a continuous practice of vigilance, review, and adaptation. Because when life throws a curveball, the best defense isn’t luck—it’s preparation.