Why I Stopped Putting All My Eggs in One Basket — A Real Talk on Smarter Risk Management

Have you ever felt your stomach drop when the market swings wild? I did—more than once. Early in my investing journey, I learned the hard way that putting everything into one asset is like walking a financial tightrope. After nearly losing ground during a sudden downturn, I shifted my focus to protecting what I’ve built. That’s when asset diversification stopped being a buzzword and became my safety net. Here’s how I restructured my strategy to manage risk without sacrificing growth.

The Wake-Up Call: When Risk Hit Home

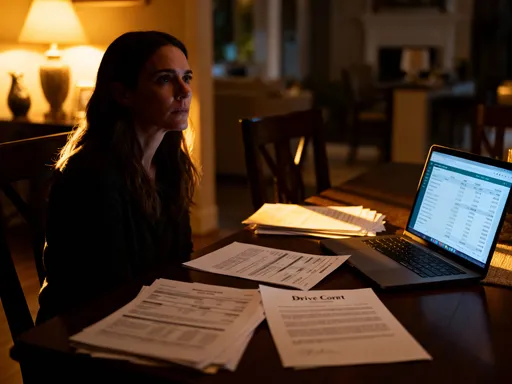

It was early spring when the news broke—unexpected regulatory changes in a key sector sent shockwaves through the market. I remember sitting at my kitchen table, coffee cooling in my mug, eyes locked on my phone as the value of my portfolio began to slip. Within days, nearly 30% of my investment in a single tech stock had vanished. That stock wasn’t just a portion of my holdings—it was the centerpiece. I had poured savings into it over months, convinced by its rapid growth and glowing headlines. I told myself I was being bold, forward-thinking. But in reality, I was being reckless.

This moment wasn’t just a financial setback; it was a personal reckoning. I had mistaken confidence for strategy. I had ignored warnings about concentration risk because the returns felt too good to question. What I didn’t realize then was that a single investment, no matter how promising, can never represent a complete plan. When that stock faltered, I wasn’t just watching numbers fall—I was watching years of careful saving teeter on the edge of a cliff.

That experience reshaped my entire approach to money. Before, I treated risk management as something distant, abstract—an idea for economists or financial advisors, not for someone like me, a regular person building wealth slowly over time. But now I see it differently. Risk isn’t an outlier; it’s the central force shaping long-term outcomes. Ignoring it doesn’t make you brave—it makes you vulnerable. The real turning point wasn’t the loss itself, but the realization that I needed a system, not just hope, to protect what I had worked so hard to accumulate.

From that moment on, I committed to learning not just how to grow money, but how to safeguard it. I began studying how professional investors structure their portfolios, not to mimic them exactly, but to understand the principles behind their resilience. What I discovered was both simple and profound: sustainable wealth isn’t built on big bets, but on consistent protection against big losses. That shift—from chasing gains to managing exposure—became the foundation of everything that followed.

What Asset Diversification Really Means (And What It Doesn’t)

When I first heard the term “asset diversification,” I assumed it meant owning several different stocks. I thought if I held shares in a tech company, a retailer, and a utility provider, I was diversified. But I was wrong. True diversification goes far beyond picking a few different tickers. It’s about constructing a portfolio that balances exposure across asset classes, industries, geographic regions, and risk profiles so that no single event can derail your financial trajectory.

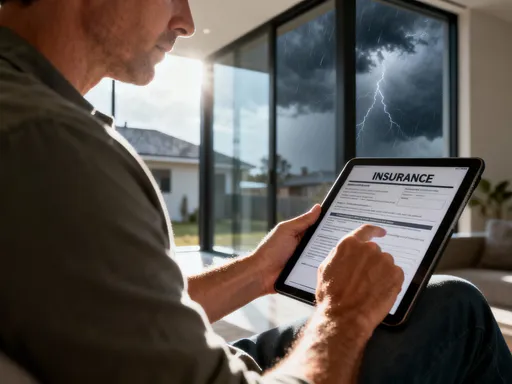

At its core, diversification is the practice of not relying on any one source of return. This means spreading investments across stocks, bonds, real estate, cash equivalents, and sometimes alternative assets like commodities or private equity. Each of these behaves differently under various economic conditions. For example, when stock markets decline, bonds often hold their value or even rise, helping to offset losses. Real estate may provide steady income through rent, even when public markets are volatile. By combining assets with low correlation—meaning they don’t move in lockstep—you reduce the overall volatility of your portfolio.

But it’s equally important to understand what diversification does not do. It does not eliminate risk entirely. No strategy can promise that. It also does not guarantee profits or shield you from all losses. Some people believe that if they own enough different investments, they’ll always come out ahead. That’s a dangerous misconception. Markets can fall broadly, and during economic downturns, even diversified portfolios may experience declines. The goal isn’t to avoid every dip, but to prevent catastrophic failure.

Another myth is that more is always better. Owning 50 stocks across the same sector isn’t true diversification. If all those companies are in the technology industry, a regulatory change or innovation disruption could still wipe out a large portion of your holdings. Real diversification requires thoughtful allocation, not just quantity. It means considering not just what you own, but why you own it, how it fits into your broader financial picture, and how it responds to different market environments. It’s a deliberate, ongoing process—not a one-time checklist.

Why Risk Protection Beats Chasing Returns

We live in a culture that celebrates winners—the investor who made 200% on a startup, the trader who timed the market perfectly. The financial media amplifies these stories, making high returns seem not just possible, but expected. But what rarely gets headlines is the quiet power of preservation. I’ve come to believe that protecting capital is more important than chasing explosive growth, especially over the long term.

Consider two investors. One focuses on maximizing returns, concentrating their money in high-growth stocks. They boast impressive gains in bull markets—15%, 20%, even 30% in a single year. But when a downturn hits, their portfolio drops by 40%. To recover, they don’t need a 40% gain—they need nearly 70%, because they’re climbing back from a much lower base. That kind of recovery can take years, even if the market eventually rebounds.

The second investor takes a different path. They accept slightly lower average returns—say, 8% per year—by maintaining a balanced, diversified portfolio. When the market falls, their losses are milder, perhaps limited to 15% or 20%. As a result, they recover faster and stay invested, continuing to earn returns while the first investor is still trying to regain lost ground. Over time, the second investor often ends up with more wealth, not because they took bigger risks, but because they avoided devastating setbacks.

This isn’t about fear or playing it too safe. It’s about math, psychology, and time. Large losses don’t just reduce your account balance—they erode confidence. Many people panic and sell at the worst possible moment, locking in losses and missing the recovery. A well-diversified portfolio helps you stay the course. It gives you the emotional stability to keep investing regularly, even when headlines are grim. That consistency is what builds lasting wealth, not the occasional home run.

Protecting your money also preserves your options. When your finances are stable, you can afford to wait for better opportunities, support your family through unexpected expenses, or retire on your own terms. Growth matters, but only if it’s sustainable. Risk management isn’t the enemy of returns—it’s their foundation.

Building a Resilient Portfolio: My Step-by-Step Approach

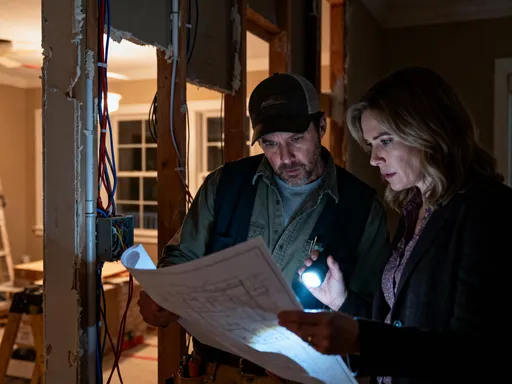

After my wake-up call, I knew I needed a new plan. I didn’t want to abandon growth, but I wanted to pursue it more wisely. I began by assessing my financial goals, time horizon, and risk tolerance. I asked myself: When do I need this money? What kind of volatility can I handle without panicking? How much risk am I willing to take to reach my objectives? These questions helped me define a strategy that wasn’t based on emotion, but on reality.

I started with asset allocation—the backbone of any strong portfolio. I divided my investments across four main categories: equities, fixed income, real estate, and cash reserves. Within equities, I spread holdings across domestic and international markets, large and small companies, and multiple sectors. I used low-cost index funds to gain broad exposure without overpaying in fees. For fixed income, I included government and investment-grade corporate bonds, which provide income and stability. I allocated a portion to real estate investment trusts (REITs) to access property markets without buying physical buildings. And I maintained an emergency fund in high-yield savings accounts to avoid selling investments during downturns.

A key principle in my approach is correlation. I look for assets that don’t move in sync. For example, when U.S. stocks struggle, international markets might perform better. When interest rates rise, bonds may decline, but certain types of stocks—like those in energy or financials—can benefit. By combining assets with different drivers, I reduce the overall swings in my portfolio’s value. This doesn’t mean eliminating risk, but smoothing it out so that no single event causes a crisis.

Another critical habit is rebalancing. Over time, some investments grow faster than others, shifting the original balance. If stocks outperform, they may become 70% of a portfolio originally set at 60%. That increases risk exposure. I review my portfolio every six months and adjust back to target allocations by selling overperforming assets and buying underrepresented ones. This forces me to “buy low and sell high” in a disciplined way, rather than chasing trends. Rebalancing isn’t exciting, but it’s one of the most effective tools for long-term risk control.

Common Traps People Fall Into (And How to Avoid Them)

Even with good intentions, investors often undermine their own diversification. One of the most common mistakes is over-diversification. Some people buy so many funds and stocks that their portfolio becomes diluted and hard to manage. Owning 30 mutual funds doesn’t necessarily mean better protection—it can lead to redundancy and higher fees. The goal isn’t to own everything, but to own the right mix. I’ve learned to focus on quality over quantity, choosing funds with clear objectives and low expense ratios.

Another trap is trend chasing. When a particular asset class performs well—like cryptocurrency or AI stocks—there’s a strong temptation to pile in. I’ve felt it myself. But adding large positions based on hype disrupts balance and increases risk. I now follow a rule: no single investment can exceed 5% of my total portfolio without a strong, long-term rationale. This keeps me from overcommitting to any one idea, no matter how promising it seems.

Many investors also overlook currency and geopolitical risks, especially in global holdings. If you own foreign stocks or bonds, changes in exchange rates can affect returns. Political instability in a country can impact markets overnight. I address this by limiting international exposure to a manageable level—around 20% of my equity allocation—and choosing diversified funds rather than individual foreign stocks. This provides global access without excessive concentration.

Finally, emotional discipline is often the hardest part. It’s easy to feel confident in a rising market and fearful in a falling one. But reacting to emotions leads to poor decisions—selling low, buying high, abandoning strategy. I’ve built safeguards: I write down my investment plan and review it regularly. I avoid checking my portfolio daily. And I remind myself that volatility is normal, not a signal to act. These small habits help me stay aligned with my long-term goals, even when the market feels chaotic.

Tools and Habits That Keep Me on Track

I don’t rely on intuition or memory to manage my investments. Instead, I use simple but effective tools that bring clarity and consistency. One of the most helpful is a portfolio tracker—a digital spreadsheet that logs all my holdings, their current values, and performance over time. It updates automatically through linked accounts, giving me a real-time snapshot of my asset allocation. This makes it easy to spot imbalances before they become problems.

I also use a risk assessment checklist. Every quarter, I go through a short list of questions: Has my financial goal changed? Have I taken on new debt or income? Is my emergency fund still sufficient? Am I comfortable with my current level of risk? This routine helps me stay proactive, not reactive. It’s not about making big changes every time, but about ensuring my strategy still fits my life.

Another habit is scheduling regular review meetings—with myself. I set a calendar reminder every six months to evaluate my portfolio. I look at performance, check for rebalancing needs, and assess whether my funds are still aligned with my goals. I also review fees and expense ratios to ensure I’m not overpaying. These sessions take less than an hour, but they prevent complacency and keep me accountable.

I’ve also learned the value of simplicity. I don’t use complex algorithms or high-frequency trading tools. My strategy relies on low-cost index funds, automatic contributions, and disciplined rebalancing. I automate as much as possible—monthly deposits into retirement and brokerage accounts—so I’m consistently investing, regardless of market noise. These small, repeatable actions compound over time, building stability without requiring constant attention.

Long-Term Gains Start with Smart Risk Control

Looking back, I realize that my biggest financial breakthrough wasn’t a winning stock pick or a lucky timing call. It was the decision to prioritize protection over performance. By embracing diversification, I didn’t just reduce risk—I gained peace of mind. I can sleep through market turbulence because I know my portfolio is built to endure. I don’t need to react to every headline or panic when prices drop. That emotional stability has been worth more than any short-term gain.

Building wealth is not a sprint; it’s a marathon. The winners aren’t always the fastest or the most aggressive. They’re the ones who stay in the race. Diversification isn’t about avoiding risk altogether—that’s impossible. It’s about managing it wisely, so that one bad outcome doesn’t undo years of progress. It’s about creating a financial foundation that can withstand uncertainty, adapt to change, and support your life for decades to come.

I no longer measure success by how high my portfolio climbs in a bull market. I measure it by how well it holds up in a storm. And by that standard, I’ve never been in better shape. I’ve learned that true financial freedom isn’t just having enough money—it’s having the confidence that you won’t lose it. That confidence comes not from luck, but from a strategy rooted in discipline, balance, and long-term thinking. If you’re still putting all your eggs in one basket, I urge you to reconsider. Start small. Rebalance one account. Add a new asset class. Over time, those steps add up to something powerful: a portfolio that doesn’t just grow, but endures.