How I Built My Emergency Fund Without Sacrificating My Lifestyle

Building an emergency fund used to feel impossible—like trying to fill a bucket with a hole in it. I was stuck in the cycle of living paycheck to paycheck, until I realized the real issue wasn’t my income, but my spending leaks. What changed everything was shifting my focus from cutting big expenses to mastering small, consistent cost reductions. This isn’t about extreme frugality; it’s about smart trade-offs that add up. I discovered that financial stability doesn’t come from sudden windfalls or drastic lifestyle changes, but from daily awareness and intentionality. By rethinking how I managed small expenses, I was able to build a cushion that gave me control, confidence, and freedom. This is the story of how I created an emergency fund that worked with my life—not against it—and how you can do the same without giving up the things you enjoy.

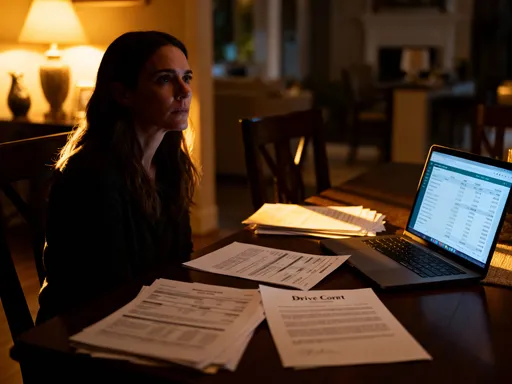

The Hidden Cost of Financial Stress

Financial stress is more than just a mental burden—it’s a silent drain on decision-making, energy, and long-term outcomes. For years, I operated under constant low-level anxiety about money, not because I was in crisis, but because I had no buffer. A flat tire, a medical co-pay, or even a surprise home repair could throw off my entire month. This lack of security led to reactive choices: using credit cards for small emergencies, delaying necessary purchases, or borrowing from friends. Each time, I told myself it was just a one-time fix, but over time, these small compromises snowballed into persistent debt and deeper financial strain.

What I didn’t realize at the time was that this cycle wasn’t caused by low income alone. Many people believe that saving is only possible when you earn more, but in my case, the real obstacle was a lack of awareness. I was tracking my income and major expenses, but I wasn’t paying attention to the small, recurring outflows that quietly eroded my budget. Subscription services I no longer used, overlapping memberships, auto-renewals I forgot to cancel—these were the invisible leaks that kept my emergency fund from forming. It wasn’t until I committed to a full financial audit that I saw the full picture.

Tracking every dollar for one month was eye-opening. I used a simple spreadsheet to log all transactions, categorizing them into essentials, discretionary spending, and true waste. What emerged was a pattern: I was spending nearly $200 a month on services and habits I barely noticed. That amount, if redirected, would have built a $2,400 emergency cushion in a single year—without any change to my income. Recognizing this gap between intention and behavior was the turning point. It shifted my mindset from feeling powerless to seeing opportunity. The real cost of financial stress wasn’t just emotional—it was measurable in missed savings, compounding interest, and lost peace of mind.

Why Your Emergency Fund Starts with Spending Awareness

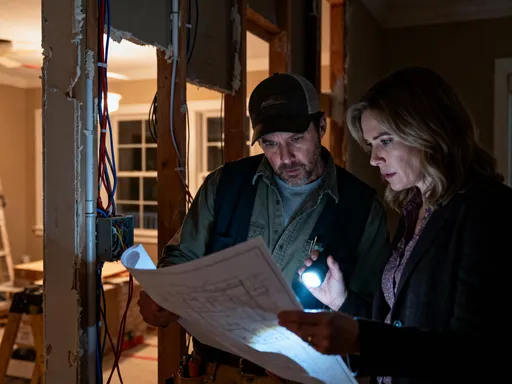

Before you can save, you must first see. An emergency fund isn’t built by willpower alone—it’s built on insight. Many people jump straight into saving strategies without understanding where their money actually goes, which sets them up for frustration and failure. I learned this the hard way when I tried budgeting apps that simply told me to “save more” without explaining why I never had anything left at the end of the month. The missing piece was clarity. Once I began categorizing my spending into fixed, flexible, and discretionary buckets, I gained control over my financial narrative.

Fixed expenses—rent, utilities, insurance—were largely unavoidable, but they made up less of my budget than I thought. The real flexibility was in the middle and lower tiers: groceries, transportation, entertainment, and personal care. These were areas where small changes could create lasting space in my monthly cash flow. For example, I discovered I was paying for both a premium internet plan and a separate streaming bundle, even though my household rarely used either to full capacity. By switching to a more competitive provider and bundling services, I reduced my monthly bill by over 30%—a saving I didn’t feel because my internet speed didn’t change and my viewing habits stayed the same.

This experience taught me a crucial lesson: awareness leads to agency. When you know exactly where your money is going, you stop making blind trade-offs. Instead of cutting joy, you eliminate waste. I didn’t stop enjoying meals out or canceling all subscriptions—I simply stopped paying for what I didn’t use. This approach wasn’t about deprivation; it was about alignment. Every dollar saved became a deliberate choice, not a sacrifice. That shift in perspective made the process sustainable. Over time, these small wins built confidence and momentum, proving that financial improvement doesn’t require dramatic lifestyle changes—just consistent, informed decisions.

The Power of Micro-Cost Reductions

When most people think of saving money, they imagine big, visible changes: selling a car, moving to a cheaper home, or quitting a habit like dining out. But these kinds of cuts are hard to maintain and often lead to burnout. My breakthrough came when I stopped chasing large savings and started focusing on micro-reductions—tiny adjustments that required little effort but added up significantly over time. These weren’t grand gestures; they were subtle shifts that fit naturally into my routine, making them easy to sustain.

One of the first changes I made was switching from name-brand to generic products at the grocery store. I started with non-perishables like rice, pasta, and canned goods, and found that the quality difference was negligible. This single switch saved me an average of $15 per shopping trip. Applied over a year, that’s nearly $800—enough to cover a major car maintenance or several months of unexpected bills. I also began batching errands to reduce fuel use. Instead of making separate trips for groceries, dry cleaning, and pharmacy pickups, I grouped them into one weekly outing. The time saved was minimal, but the fuel savings added up, especially as gas prices fluctuated.

Another powerful micro-reduction was pausing subscriptions I wasn’t actively using. I had signed up for several services during free trials and forgotten to cancel. Some were fitness apps I tried once, others were music platforms I no longer listened to. By reviewing my bank statements and canceling five inactive subscriptions, I reclaimed over $40 a month. These small actions didn’t disrupt my lifestyle, but they created a steady stream of freed-up cash. I began to think of these savings not as cuts, but as income—money I was now able to redirect toward my emergency fund. Over six months, these micro-savings alone contributed more than $1,000 to my safety net. The real power wasn’t in any single change, but in their collective impact.

Automating Safety Without Feeling the Pinch

Willpower is unreliable. No matter how motivated I felt at the beginning of the month, there were always moments when unexpected expenses or emotional spending threatened my progress. The real game-changer was automation. Once I identified areas where I could reduce spending, I set up automatic transfers to move that money directly into a high-yield savings account. The key was making the process invisible. Because the funds never entered my primary checking account, I didn’t have the chance to spend them. It was like paying myself before I even saw the money.

I treated my emergency fund like a fixed expense—similar to rent or a utility bill. Every payday, a set amount was transferred automatically. At first, I started small: just $50 per paycheck. As I found more micro-savings, I increased the amount. The beauty of this system was that it removed emotion from saving. I wasn’t constantly deciding whether to save or spend; the decision had already been made. This consistency built momentum. Even in months when I had minor setbacks, the automation kept me on track.

I also chose a savings account that was accessible but not too convenient. It wasn’t linked to a debit card or payment app, so I couldn’t impulsively withdraw funds. Yet it was easy enough to access in a true emergency. This balance between accessibility and friction helped protect the fund from casual use. Over time, the account grew steadily, and I began to see it not just as a stash of cash, but as a symbol of progress. Automation turned saving from a chore into a quiet, reliable habit—one that required no daily effort but delivered long-term results. By the end of the first year, I had built a $5,000 emergency fund without ever feeling deprived.

Smart Trade-Offs That Don’t Feel Like Sacrifice

Sustainability beats intensity every time. I’ve seen people launch into extreme budgeting—cutting out all dining, entertainment, and personal spending—only to abandon the effort within weeks. I knew I didn’t want that cycle. Instead, I focused on smart trade-offs: choices that preserved enjoyment while improving value. The goal wasn’t to live with less, but to get more from what I already had.

Take dining out, for example. I love good food, and I wasn’t willing to give up restaurant meals entirely. Instead, I limited takeout to one night a week and spent the rest of the time cooking at home. But I didn’t settle for bland or repetitive meals. I learned to make versions of my favorite restaurant dishes—homemade pizza, stir-fries, tacos—using affordable ingredients. The result? I saved over $200 a month while still enjoying delicious, varied meals. The act of cooking even became a relaxing ritual, not a chore.

Another trade-off was in entertainment. I canceled premium streaming tiers with 4K and multiple profiles, opting instead for a standard plan. I also shared one legal subscription with a family member, splitting the cost evenly. This wasn’t about losing access—it was about using resources more efficiently. I still watched everything I wanted, just without paying for features I rarely used. Similarly, I switched from bottled water to a reusable filter pitcher, saving both money and plastic. These weren’t restrictions; they were upgrades in value. By focusing on satisfaction per dollar, I maintained my quality of life while freeing up cash for security. The fund grew not because I suffered, but because I became more intentional.

Avoiding the Emergency Fund Traps

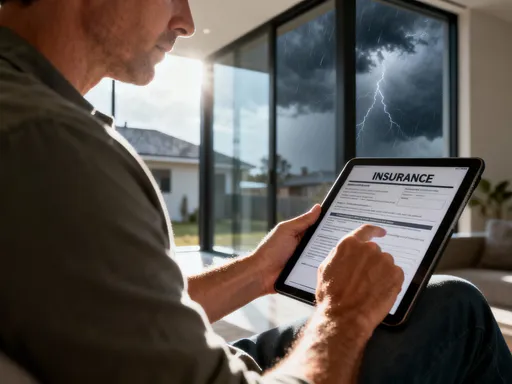

Even with the best intentions, it’s easy to derail progress. One of the biggest traps is treating the emergency fund like a backup credit line for non-essentials. I almost made this mistake when I considered using part of my savings for a vacation deal. It felt justified—I’d worked hard, I deserved it, and I could always rebuild later. But I stopped myself by defining clear rules: the fund was only for true emergencies—unexpected medical costs, car repairs, job loss, or urgent home maintenance. Leisure, even if tempting, didn’t qualify.

Another close call came when my car needed a $600 repair. For a moment, I panicked—this was exactly the kind of expense I had been saving for, but seeing the balance drop was emotionally difficult. I reminded myself that this was the purpose of the fund: to absorb shocks without triggering debt. Using it responsibly wasn’t a failure—it was a success. I paid for the repair, then adjusted my budget to refill the amount over the next three months. This approach kept me from dipping into credit and maintained the fund’s integrity.

I also avoided low-yield savings accounts that failed to keep up with inflation. Placing the fund in a traditional bank with near-zero interest would have meant losing purchasing power over time. Instead, I chose a high-yield savings account offered by a reputable financial institution, which provided a competitive annual percentage yield while keeping funds liquid and safe. This ensured my money was working for me, even as it sat in reserve. By protecting the fund from misuse and inflation, I preserved both its value and its purpose.

From Survival to Confidence: The Real ROI of Security

The most significant benefit of my emergency fund wasn’t measured in dollars—it was measured in peace of mind. For the first time in years, I stopped dreading the phone ringing late at night. I knew that if something went wrong, I had a plan. This sense of control transformed how I approached work, spending, and long-term goals. I no longer feared small setbacks, and I became more willing to take calculated risks—like negotiating a better salary or investing in a certification that could advance my career.

Financial confidence also improved my relationships. I stopped avoiding money conversations with family, and I could make decisions without guilt or anxiety. When a relative needed temporary help, I was able to offer support without jeopardizing my own stability. The fund didn’t make me rich, but it gave me freedom—the freedom to choose, to breathe, to plan beyond the next paycheck. That shift from survival to stability was profound.

Looking back, building the emergency fund wasn’t the end goal. It was the foundation. It taught me discipline, awareness, and the power of small, consistent actions. Today, I continue to grow my savings, not out of fear, but from strength. The habits I formed have become second nature, and my financial life is more resilient than ever. If you’re starting from scratch, know this: you don’t need a perfect budget or a huge income. You need clarity, consistency, and the belief that small steps lead to real change. Your emergency fund isn’t just a number in an account—it’s the first step toward lasting financial freedom.