How I Mastered My Money Goals Without Losing Sleep

What if chasing financial goals didn’t mean stress, risky bets, or endless budgeting? I used to lie awake worrying about money—until I shifted my mindset and built real financial skills that actually work. This isn’t about get-rich-quick tricks. It’s about practical, tested strategies that focus on earning smarter, protecting what you have, and avoiding common pitfalls. Let me walk you through how I gained control—without the hype or heartburn. It started not with a spreadsheet, but with a simple question: What do I really want from my money? That one shift changed everything.

The Real Starting Point: Defining What “Financial Success” Actually Means to You

Many people begin their financial journey by setting goals like “save more” or “get out of debt,” but these statements lack direction and emotional weight. Without a clear vision, motivation fades when challenges arise. I learned this after years of half-hearted budgeting that never stuck. The turning point came when I paused and asked myself: What does financial success look like in my life? For me, it wasn’t a specific dollar amount. It was the ability to handle surprises without panic, to make choices without being trapped by bills, and to spend time with my family without guilt about lost income.

Defining success on personal terms is the foundation of any lasting financial plan. When goals are tied to values—such as security, independence, or generosity—they become more than numbers. They become reasons to act consistently, even when progress feels slow. For example, saving for a home isn’t just about accumulating a down payment. It’s about creating stability for your children, having a space that reflects your effort, and building equity you can rely on later. That deeper meaning fuels discipline in a way that abstract targets never can.

To clarify your own definition, try this exercise: Write down three financial decisions you’ve made in the past year. Now, ask why you made each one. Keep asking “why” until you reach a core value. You might start with “I opened a savings account” and end with “because I want to feel safe when unexpected expenses come.” That insight becomes the anchor for all future decisions. Once you know your “why,” setting specific, measurable goals becomes much easier. Instead of “save more,” you might say, “I will save $10,000 over the next three years to cover emergency repairs on my home.” This version is clear, time-bound, and emotionally grounded.

It’s also important to recognize that financial success evolves. What matters at 35 may not matter at 50. Regular reflection helps ensure your goals stay aligned with your life stage. Some people prioritize retirement early, while others focus on paying off student loans or funding their children’s education. There’s no universal path. The key is intentionality. When your financial plan reflects who you are and what you care about, it stops feeling like a chore and starts feeling like progress.

Building Your Financial Foundation: The Skill Most People Skip

Most financial advice jumps straight to investing or aggressive debt payoff, but without a solid base, those strategies can backfire. I learned this the hard way after a sudden car breakdown wiped out my emergency fund—and then some. I had been tracking my spending and even contributing to a retirement account, but I hadn’t built enough cushion to handle real-life shocks. That moment forced me to step back and rebuild from the ground up. The first, and most critical, step was creating a true financial foundation: emergency savings, debt clarity, and consistent cash flow awareness.

An emergency fund isn’t just a nice idea—it’s a financial shock absorber. Experts often recommend three to six months of living expenses, but the right amount depends on your situation. If your job is stable and you have multiple income sources, three months may suffice. If your income fluctuates or you’re the sole provider, aim higher. I started small, saving $50 per month, and gradually increased it as my budget allowed. The goal wasn’t perfection but progress. Over time, that fund grew into a reliable safety net that reduced my anxiety about the unknown.

Equally important is understanding your debt. Not all debt is bad—mortgages and student loans can be tools for building long-term value—but high-interest debt, especially from credit cards, erodes wealth. I began by listing every debt, including balances, interest rates, and minimum payments. Seeing it all in one place was uncomfortable, but it gave me clarity. From there, I chose a repayment strategy that worked for me: the debt snowball method, where I paid off the smallest balances first to build momentum. Others prefer the avalanche method, which saves more on interest by targeting high-rate debt first. The best approach is the one you’ll stick with consistently.

Cash flow tracking completed the foundation. For three months, I recorded every dollar that came in and went out. I used a simple spreadsheet, though apps can automate this. The goal wasn’t to restrict spending but to understand patterns. I discovered I was spending far more on subscriptions and convenience foods than I realized. That awareness led to small, sustainable changes—canceling unused services, meal planning, and setting spending limits. These habits didn’t feel punishing; they felt empowering. By mastering the basics first, I created a stable platform for everything else.

Earning with Purpose: Growing Income Beyond the 9-to-5

For years, I believed financial improvement meant spending less. I cut coupons, comparison-shopped, and avoided dining out. While frugality has its place, I hit a ceiling. No matter how careful I was, my progress stalled because my income wasn’t growing. The real breakthrough came when I shifted focus from cutting back to earning more. Increasing income, especially in ways that align with your skills and schedule, can have a far greater impact than penny-pinching alone.

I started by assessing my strengths and available time. As someone with writing and organizational skills, I explored freelance work in content creation and virtual assistance. I began with small projects on reputable platforms, building confidence and a portfolio. The key was starting small—just five to ten hours a week—so it didn’t overwhelm my family responsibilities. Over time, as clients returned and referrals came in, my side income grew. It wasn’t passive, but it was flexible and scalable.

Not every side hustle works for everyone. The most sustainable opportunities share common traits: they leverage existing skills, offer fair pay for time invested, and fit into your lifestyle. Teaching, consulting, crafting, or even renting out unused space can be viable paths. The goal isn’t to burn out with multiple jobs but to find one or two meaningful ways to increase cash flow. I also explored passive income, such as investing in dividend-paying funds or creating digital products. These required upfront effort but generated returns over time with minimal ongoing work.

Upskilling played a major role too. I took online courses in financial literacy and digital marketing, which not only improved my side work but also increased my value at my full-time job. Within two years, I earned two promotions, significantly boosting my primary income. That experience taught me that investing in yourself is one of the highest-return financial decisions you can make. When you earn more, saving and investing become easier, and financial goals feel more achievable.

Investing Without Anxiety: A Calm Approach to Growing Wealth

I used to avoid investing entirely. The stock market felt like a casino—risky, confusing, and full of jargon. But I realized that avoiding it was also a risk: inflation was quietly eroding the value of my savings. The turning point came when I committed to learning the basics. I discovered that successful investing isn’t about picking winners or timing the market. It’s about consistency, diversification, and patience. Once I understood the principles, my fear faded, replaced by confidence in a long-term strategy.

Asset allocation—the way you divide your investments among stocks, bonds, and other assets—is the cornerstone of smart investing. Your mix should reflect your goals, time horizon, and risk tolerance. When I was younger and saving for retirement decades away, I could afford to take more risk with a higher stock allocation. Now, as I approach midlife, I’ve gradually added more bonds for stability. The key is not to chase high returns but to build a portfolio that can weather market swings without forcing you to sell at a loss.

Diversification reduces risk by spreading investments across different sectors, industries, and geographic regions. I use low-cost index funds and exchange-traded funds (ETFs), which provide instant diversification and keep fees low. These funds track broad market indexes, such as the S&P 500, and have historically delivered strong long-term returns. I contribute regularly through automatic transfers, a strategy known as dollar-cost averaging, which helps smooth out market volatility over time.

Emotions are the biggest threat to investment success. Fear leads to selling low; greed leads to buying high. I’ve learned to tune out short-term noise and focus on my plan. I review my portfolio quarterly, not daily, and only make adjustments when my goals or life circumstances change. If I’m unsure, I consult a fee-only financial advisor—one who doesn’t earn commissions from selling products. Their guidance has been invaluable in staying on track without overreacting to market fluctuations.

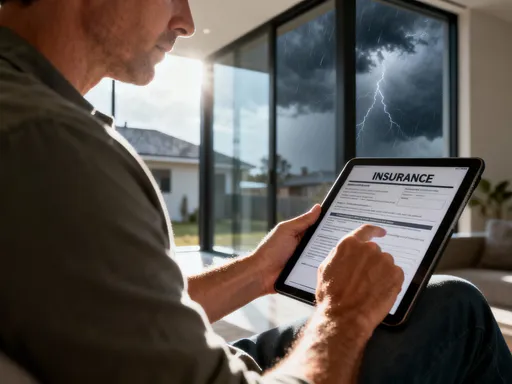

Risk Control: Protecting Your Progress from Hidden Threats

Building wealth is important, but protecting it is just as critical. I once thought insurance was just another expense, but I’ve come to see it as a core part of financial security. After a close friend faced a serious health issue that drained their savings, I reevaluated my own coverage. Health, life, disability, and property insurance aren’t luxuries—they’re safeguards that prevent one event from undoing years of progress.

Health insurance is essential, especially in countries without universal coverage. I make sure my plan covers preventive care, hospitalization, and prescription drugs. I also maintain a health savings account (HSA), which offers triple tax advantages: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. This account has become a powerful tool for both current and future medical costs.

Life and disability insurance are often overlooked, particularly by those without dependents. But even if you’re not supporting a family, disability insurance protects your income if you’re unable to work due to illness or injury. I chose a policy that replaces a portion of my income and kicks in after a short waiting period. It’s a small monthly cost for significant peace of mind. Similarly, I reviewed my will and set up a simple estate plan to ensure my assets are distributed according to my wishes, avoiding legal complications for my loved ones.

Behavioral risks matter too. Overconfidence can lead to risky bets, while procrastination delays important decisions. I combat these by setting clear rules for myself—like not making investment changes during market downturns—and by scheduling regular financial check-ins. These habits keep my emotions in check and my plan on track.

The Hidden Costs: Where Financial Plans Usually Fail

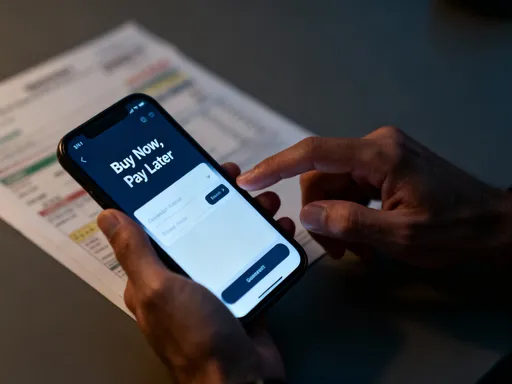

Even well-designed financial plans can fail because of hidden costs. I once reviewed my accounts and was shocked to find I was paying hundreds of dollars a year in fees—on mutual funds, bank accounts, and retirement plans. These small charges compound over time, silently reducing returns. I also underestimated the impact of taxes. Without proper planning, I was giving away more than necessary, especially on investment gains and retirement withdrawals.

Fees are one of the few factors within your control. I switched to low-cost index funds and moved my accounts to institutions with no maintenance fees. I also consolidated retirement accounts to simplify management and reduce administrative costs. These changes didn’t require drastic lifestyle shifts but added up to thousands in savings over time.

Tax efficiency is another area where small changes yield big results. I max out my retirement contributions each year, taking full advantage of tax-deferred or tax-free growth. I also hold investments longer than a year to qualify for lower long-term capital gains rates. In taxable accounts, I place tax-efficient investments like index funds, while keeping higher-turnover funds in retirement accounts. These strategies don’t eliminate taxes, but they minimize the drag on my portfolio.

Emotional spending is a hidden cost too. I used to shop when stressed, telling myself I deserved a treat. Over time, those small indulgences added up. I now use a 24-hour rule for nonessential purchases and track my spending weekly. This awareness has helped me align my habits with my goals. Convenience often comes at a high price—whether it’s delivery fees, premium subscriptions, or impulse buys. By being intentional, I’ve reduced waste and redirected those funds toward what truly matters.

Putting It All Together: A Living Financial Plan That Adapts

Your financial life is not static, and your plan shouldn’t be either. I used to treat my budget like a rigid contract, feeling guilty when I deviated. Now, I see it as a flexible roadmap—one that evolves with my life. Every quarter, I schedule a financial review: I check my progress toward goals, update my budget, and assess any changes in income, expenses, or priorities. These check-ins keep me aligned without requiring constant effort.

I also celebrate milestones, no matter how small. Paying off a credit card, hitting a savings target, or sticking to my budget for three months straight—all are wins worth acknowledging. Positive reinforcement builds confidence and motivation. At the same time, I avoid comparing myself to others. Social media often shows curated success stories, but everyone’s journey is different. My progress is mine, and that’s enough.

Discipline and flexibility aren’t opposites—they’re partners. I stick to my core principles, like saving consistently and avoiding high-interest debt, but I allow room for life’s surprises. If an unexpected expense comes up, I adjust my budget instead of abandoning it. If a new opportunity arises, I evaluate it based on my goals, not impulse. This balanced approach has helped me stay consistent without feeling restricted.

Over time, these practices have become habits. I no longer lie awake worrying about money. I still face challenges, but I have the skills and systems to handle them. My plan isn’t perfect, but it’s working. That’s what matters.

Conclusion

True financial mastery isn’t about perfection. It’s about progress, awareness, and resilience. The skills I’ve built didn’t transform my life overnight—but they gave me something better: control. You don’t need extreme measures or risky bets to move forward. By focusing on clear objectives, practical strategies, and consistent habits, you can build a financial life that supports your goals and reduces stress. The journey isn’t about reaching a number—it’s about becoming someone who knows how to navigate money, no matter what comes next.