How I Turned My Hobby Into a Smart Money Move

What if the thing you do for fun could also grow your wealth? I used to see my hobby as just an escape—until I realized it was quietly draining my wallet. After a few costly mistakes, I started treating it like a side project with real financial potential. This shift didn’t just save me money; it opened up unexpected income streams and smarter spending habits. Here’s how blending passion with practical wealth management changed everything.

The Hidden Cost of Passion

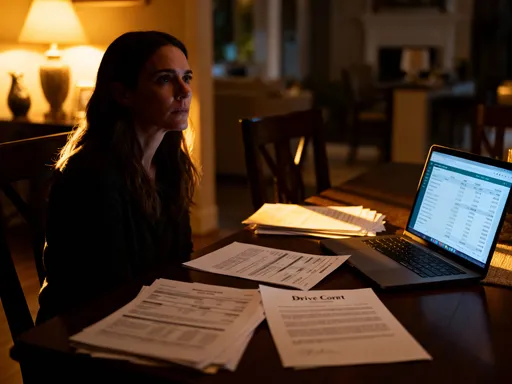

Hobbies are often celebrated as essential outlets for creativity, relaxation, and personal expression. Yet beneath the surface of enjoyment lies a financial reality many overlook: hobbies can be surprisingly expensive. While they may begin with modest investments—a beginner’s paint set, a simple gardening tool, or a library membership—the costs tend to escalate over time. What starts as a small indulgence can evolve into a consistent drain on household finances, especially when spending is driven by emotion rather than intention. For many, particularly women managing family budgets, these incremental expenses can subtly undermine long-term financial goals without immediate notice.

Consider the common scenario of a photography enthusiast who begins with a basic camera but soon feels drawn to upgrade lenses, lighting equipment, editing software, and even travel expenses for the perfect shot. Each purchase feels justified in the moment—after all, improving skills seems worthwhile. However, when tracked over a year, such expenses can total thousands of dollars, rivaling the cost of a family vacation or a car repair. Similarly, someone who enjoys crafting may subscribe to multiple online classes, buy premium materials, and join exclusive communities, only to find that unused supplies pile up in storage. These patterns are not isolated; they reflect a broader trend where emotional satisfaction is exchanged for financial strain, often without conscious awareness.

The danger lies in how society frames these costs. Phrases like “treat yourself” or “investing in happiness” make it easy to justify ongoing spending, even when it exceeds reasonable limits. But true financial well-being requires distinguishing between meaningful investment and unchecked consumption. When hobby-related spending is not monitored, it can erode emergency savings, delay retirement planning, or limit the ability to handle unexpected expenses. The first step toward change is awareness. By tracking every expense tied to a hobby—no matter how small—individuals gain clarity on where their money truly goes. This transparency allows for informed decisions, such as pausing subscriptions, selling unused gear, or setting spending limits that align with overall financial priorities.

A practical approach is to create a separate category in a household budget specifically for hobby expenses. This makes it easier to see trends over time and avoid blending recreational costs with essential spending. It also encourages mindfulness. For example, before purchasing a new knitting machine, one might ask: Will this significantly enhance my enjoyment or productivity? Or is it a fleeting desire influenced by social media trends? By introducing this level of scrutiny, hobbyists can preserve the joy of their pastime while protecting their financial stability. The goal is not to eliminate spending but to make it intentional, ensuring that passion enriches life without compromising security.

From Spending to Investing: A Mindset Shift

Financial wisdom often begins not with complex strategies, but with a shift in perspective. For years, I viewed my hobby as a necessary expense—a way to unwind after long days of caregiving and household management. But when I reframed it as a potential asset rather than a liability, everything changed. This mental shift from passive spending to active investment unlocked a new way of thinking about money. Instead of seeing each purchase as a loss, I began evaluating whether it could generate long-term value. This approach is not about turning every hobby into a business, but about making smarter choices that align passion with financial health.

Not all spending is equal. Economists often distinguish between consumption and investment. Consumption provides immediate satisfaction but depreciates quickly—like buying concert tickets or dining out. Investment, on the other hand, builds value over time, whether through skill development, income generation, or asset appreciation. Applying this lens to hobbies transforms decision-making. For instance, spending $300 on a high-quality sewing machine may seem steep, but if it enables the creation of custom garments that can be sold or passed down through generations, it becomes an investment. In contrast, repeatedly buying low-cost fabric that frays after one use represents pure consumption. The key question becomes: Does this purchase enhance my ability to create, earn, or save in the future?

This mindset encourages prioritizing durability, utility, and learning. A gardener might choose to invest in a soil testing kit and native plant seeds rather than decorative pots that need frequent replacement. A writer might allocate funds toward a reputable online course instead of trendy notebooks that gather dust. These choices may require more upfront planning, but they yield lasting benefits. Over time, such investments can reduce recurring costs, improve outcomes, and even open doors to new opportunities. For example, mastering a skill through deliberate practice could lead to teaching others, writing guides, or consulting—pathways that were not visible when the hobby was seen only as leisure.

Moreover, this shift fosters a sense of ownership and empowerment. When women view themselves as stewards of both their time and money, they gain confidence in their financial decisions. They begin to see their hobbies not as guilty pleasures, but as spaces where personal growth and economic resilience intersect. This does not mean every activity must generate income. The value may be intangible—reduced stress, improved mental clarity, or stronger family bonds through shared projects. Yet by applying investment principles, even non-monetized hobbies can contribute to overall well-being in measurable ways. The core idea is intentionality: spending with purpose, not impulse, and recognizing that how we use our resources today shapes the quality of life tomorrow.

Monetizing Skills Without Selling Out

One of the most empowering realizations is that passion and profit can coexist without conflict. Many women hesitate to monetize their hobbies, fearing that doing so will turn something joyful into a chore. There’s a valid concern that external pressures—deadlines, customer demands, or performance expectations—might erode the very freedom that makes a hobby special. However, smart monetization is not about scaling up or chasing profits at all costs. It’s about creating small, sustainable ways to earn that enhance, rather than diminish, the experience.

Consider the baker who begins by making birthday cakes for family and friends. Instead of launching a full bakery, she starts by accepting a few custom orders each month, setting clear boundaries on time and capacity. Each sale offsets the cost of ingredients and equipment, making her hobby self-funding. Over time, she builds a reputation within her community, allowing her to charge slightly more while maintaining flexibility. This approach keeps the work enjoyable because it remains within her control. She chooses when to accept orders, how many to take, and what designs to create. The income is modest, but meaningful—it might cover a portion of groceries, a child’s extracurricular activity, or a personal savings goal.

Similar opportunities exist across a wide range of interests. A gardener with a green thumb might propagate rare herbs or heirloom seedlings and sell them at a local farmers’ market. A knitter could offer personalized baby blankets for newborns in her neighborhood. A photographer might license her images for small businesses or create digital prints for online sale. These ventures require minimal startup costs and can be managed around existing responsibilities. The key is to start small, test interest, and scale only if it feels right. This low-risk experimentation allows individuals to assess demand without overcommitting.

Another effective strategy is knowledge sharing. Many women possess skills they underestimate—how to organize a pantry, preserve seasonal produce, or create natural cleaning products. Teaching these through workshops, online videos, or downloadable guides can generate income while reinforcing expertise. Platforms like community centers, libraries, or neighborhood groups often welcome such offerings. Even occasional earnings—say, $100 from a weekend class—can make a difference when consistently applied to debt reduction or savings. The focus should not be on replacing a full-time income, but on building financial resilience through diversified streams.

Importantly, monetization works best when it aligns with personal values. This means setting boundaries to protect time, energy, and emotional well-being. For example, limiting client work to weekends, capping the number of orders per month, or declining projects that feel misaligned. These rules prevent burnout and preserve the integrity of the hobby. When approached this way, earning from passion becomes less about financial gain and more about balance—using skills to support life goals without sacrificing joy. Over time, this model fosters a healthier relationship with money, where creativity and practicality support one another.

Building a Hobby Budget That Works

A well-structured budget is one of the most powerful tools for financial control, yet it is often overlooked in the context of hobbies. Many people assume budgeting is only for essentials like rent, groceries, or utilities. But discretionary spending—especially on activities that bring joy—deserves equal attention. Without a clear plan, it’s easy to overspend on a beloved pastime, especially when purchases are framed as self-care or personal development. A dedicated hobby budget changes this dynamic by introducing structure without restriction. It allows for enjoyment while preventing financial drift.

The foundation of an effective hobby budget is clarity. Begin by reviewing past spending related to the activity. Gather receipts, bank statements, or digital payment records to calculate how much was spent over the last six to twelve months. This number often surprises people. Seeing the total cost of supplies, classes, tools, and event fees in one place provides a reality check. From there, determine how much can realistically be allocated moving forward based on overall household income and financial goals. This amount should be specific, written down, and treated as non-negotiable—just like any other budget category.

Next, categorize expenses into needs and wants. Needs are essential items required to continue the hobby safely and effectively—such as replacement parts, safety gear, or basic materials. Wants are upgrades, luxuries, or experimental purchases that enhance experience but aren’t necessary. Prioritizing needs ensures sustainability, while limiting wants prevents impulse spending. For example, a quilter might need high-quality thread and a functional sewing machine but may want an expensive embroidery attachment. The budget should cover the former first, with the latter considered only if funds remain.

Another valuable technique is the sinking fund. This involves setting aside a small amount each month for larger, irregular expenses—like annual workshop fees, equipment maintenance, or travel to a special event. By spreading the cost over time, these expenses become manageable rather than overwhelming. For instance, if a gardening conference costs $600, saving $50 per month for a year makes it affordable without disrupting other financial plans. This method reduces stress and eliminates the need for last-minute borrowing or credit card use.

Flexibility is also important. Life changes, and so do interests. A hobby budget should be reviewed quarterly to reflect shifts in time, energy, or financial capacity. If a project becomes less enjoyable or too costly, it’s okay to scale back or reallocate funds. The goal is not perfection, but progress—maintaining a balance between enjoyment and responsibility. When managed this way, a hobby budget becomes a tool for empowerment, allowing individuals to engage fully in their passions without guilt or financial regret.

Protecting Yourself: Risk and Reality Checks

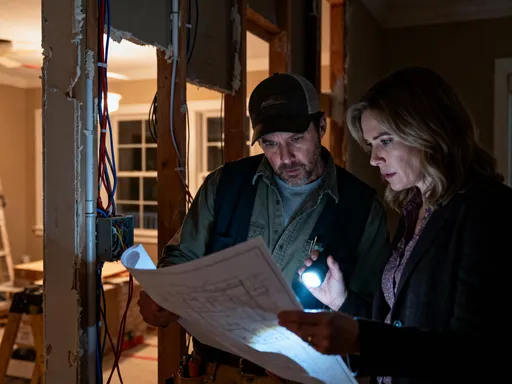

Every financial decision carries some level of risk, and hobbies are no exception—especially when income generation becomes part of the equation. One of the most common pitfalls is overestimating earning potential. It’s easy to imagine turning a craft into a full-time business based on a few successful sales, but sustainable income takes time, consistency, and market demand. Many women enter monetization with high hopes, only to find that customer interest is limited or inconsistent. Without proper planning, this can lead to financial disappointment or even loss if significant money has been reinvested into inventory or marketing.

To mitigate this risk, it’s essential to treat any hobby-based income as uncertain and supplemental. This means avoiding major financial commitments based on projected earnings. For example, do not purchase expensive equipment on credit expecting future profits to cover payments. Instead, operate within existing means and reinvest only what can be comfortably spared. Setting a cap on reinvestment—such as no more than 20% of earnings—helps maintain control and prevents overextension. This disciplined approach ensures that even if income fluctuates, the core budget remains stable.

Time is another often-overlooked cost. Many underestimate how much effort goes into fulfilling orders, managing communications, or maintaining quality standards. What begins as a few hours a week can quickly expand, especially during peak seasons. This can lead to burnout, particularly for women balancing caregiving, household duties, and personal well-being. To protect against this, establish clear boundaries. Define specific work hours, set limits on the number of clients or projects, and learn to say no when necessary. These boundaries preserve the joy of the hobby and prevent it from becoming a source of stress.

Additionally, basic risk protection should not be ignored. Valuable equipment—such as cameras, musical instruments, or specialized tools—should be insured, either through homeowner’s policies or standalone coverage. This safeguards against loss due to theft, damage, or accidents. Similarly, any income earned, even occasionally, may have tax implications. Keeping simple records of sales and expenses ensures compliance and reduces year-end stress. Consulting a tax professional or using basic accounting software can help navigate these requirements without complexity.

The goal is not to eliminate risk, but to manage it wisely. Awareness, preparation, and moderation are key. By approaching hobby-based earning with caution and clarity, individuals can enjoy the benefits of supplemental income without compromising their financial or emotional well-being.

Tools and Habits for Long-Term Success

Sustainable financial management depends less on grand gestures and more on consistent, repeatable habits. The most effective tools are often the simplest—those that integrate seamlessly into daily life without adding burden. For women managing multiple responsibilities, the key is minimizing decision fatigue while maximizing awareness. Automation, reminders, and routine check-ins can transform financial discipline from a chore into a natural part of everyday life.

One powerful habit is the monthly expense review. Set a recurring calendar alert to examine all hobby-related transactions from the past month. Compare actual spending to the budgeted amount and note any deviations. This practice builds accountability and helps identify patterns—such as recurring subscriptions that are no longer used or impulse purchases made during stressful periods. Over time, this review becomes a reflective tool, offering insights into both behavior and emotional triggers.

Another useful method is the goal jar. Designate a physical or digital container where a portion of hobby-related earnings is automatically saved. Whether it’s $10 from each sale or a fixed percentage, this fund grows quietly over time. The money can be used for future upgrades, emergency repairs, or even a personal reward. Seeing progress visually—through a savings tracker or a growing balance—provides motivation and reinforces positive behavior.

Expense tracking apps also play a valuable role. Many offer features like category tagging, spending limits, and monthly reports. By labeling all hobby purchases clearly, users gain real-time visibility into their financial flow. Some apps even send alerts when nearing a budget cap, helping prevent overspending before it happens. These tools work best when used consistently, even during months with no activity. Maintaining the habit ensures readiness when spending resumes.

Finally, pairing each hobby session with a brief financial check-in can deepen the connection between passion and responsibility. After an hour of painting, gardening, or writing, take two minutes to log any expenses or income related to the activity. This small act reinforces mindfulness and turns financial management into a natural extension of the hobby itself. Over months and years, these micro-habits accumulate into significant results—greater control, reduced stress, and a stronger sense of financial confidence.

The Bigger Picture: Wealth Beyond Money

True wealth extends far beyond bank statements and investment portfolios. For many women, financial security is deeply tied to peace of mind, family stability, and personal fulfillment. When a hobby is managed with intention, it becomes more than a pastime—it becomes a practice in mindful living. The skills developed through budgeting, tracking, and thoughtful spending apply to all areas of life, fostering a sense of control and resilience. This holistic approach to money reveals that financial well-being is not about deprivation, but about alignment—spending in ways that reflect values, goals, and priorities.

Disciplined engagement with a hobby builds confidence. Each decision—to save for a tool, decline an overwhelming order, or celebrate a small earning milestone—reinforces self-trust. Over time, this confidence spills over into other financial choices, from negotiating household expenses to planning for retirement. Women who manage their passions wisely often find they are better equipped to handle larger financial challenges, not because they have more money, but because they have developed stronger habits and clearer thinking.

Moreover, a balanced approach to hobbies can strengthen family life. Children observe how parents manage time and resources, learning by example. A mother who budgets for her knitting supplies teaches her daughter the value of planning and patience. A father who sells handmade furniture on weekends models entrepreneurship and perseverance. These lessons are passed down not through lectures, but through lived experience. When passion and responsibility coexist, they create a legacy of financial literacy and emotional intelligence.

In the end, the goal is not to turn every hobby into a profit center, but to cultivate a relationship with money that supports a full, meaningful life. Smart choices today—like tracking expenses, setting limits, and starting small—lay the foundation for a future where joy and security are not in conflict. By treating passion with care and intention, individuals discover that wealth is not just something they accumulate, but something they become. It is built in quiet moments of creation, in thoughtful decisions, and in the balance between giving and growing. When passion and prosperity grow together, the result is not just financial success, but lasting well-being.