How I Tamed My Spending Without Feeling Deprived

Ever feel like your money disappears by the 15th of the month? I did too—until I stopped fighting my habits and started working with them. This isn’t about extreme budgeting or cutting out coffee. It’s about smarter cost control that actually sticks. I tested small changes, learned from slip-ups, and found what really works. If you’re new to managing expenses, this is your no-judgment zone. Let’s make saving feel less like sacrifice and more like progress.

The Moment I Realized I Was Losing Control

It wasn’t a bank overdraft or a missed bill that woke me up. It was the quiet, constant hum of anxiety every time I opened my bank app. I had a steady job, health insurance, and no major debt, yet I felt like I was always one unexpected expense away from panic. My salary wasn’t small, but my savings were smaller. I’d look at my balance on the 12th or 13th of the month and wonder, Where did it all go? There was no big purchase to blame—no vacation, no car repair—just a slow, steady leak of dollars that left me feeling powerless.

What surprised me most was the emotional toll. I wasn’t reckless. I didn’t shop for therapy or eat out every night. But still, I couldn’t seem to keep up. I began to notice how often I’d justify small expenses: “It’s only $4,” “I’ll make up for it next month,” “I deserve this.” These phrases became a script, repeated silently every time I tapped my card. The truth was, I wasn’t living beyond my means—I was living just inside them, with nothing left over. That realization hit hard. It wasn’t about earning more. It was about understanding where my money was going and why.

This wasn’t a crisis moment, but it was a turning point. I decided to stop blaming myself and start observing. Instead of jumping into a strict budget or cutting out all treats, I chose to look at my spending with curiosity, not judgment. I wanted to understand the patterns, not punish them. And that small shift in mindset—seeing my habits as data, not failures—was the first real step toward control.

What Cost Control Really Means (It’s Not Just Budgeting)

When most people hear “cost control,” they think of spreadsheets, strict categories, and saying no to everything fun. But real cost control isn’t about restriction—it’s about awareness. It’s the quiet understanding of where your money goes and making choices that reflect your actual priorities. Budgeting is a tool, but cost control is a mindset. One tracks numbers; the other shapes behavior.

For years, I tried budgeting. I’d set limits for groceries, dining, and entertainment, only to blow past them by week two. Why? Because the budget didn’t match my real life. It was built on ideals, not habits. I’d forget recurring charges, underestimate small purchases, or feel guilty for spending on things that mattered to me. The system failed because it didn’t account for human nature. True cost control starts not with rules, but with observation. It’s about asking, What am I already doing? before deciding What should I change?

One of the biggest leaks in personal finance isn’t big-ticket spending—it’s the slow drip of unnoticed expenses. A $12 monthly subscription for an app I used once. A $3.50 coffee three times a week. An online order because it was raining and cooking felt hard. These aren’t reckless choices, but they add up. Over a year, that coffee habit costs over $500. The forgotten subscription? Another $144. Alone, they seem harmless. Together, they form a pattern of spending that quietly erodes financial peace.

Emotional spending plays a role too. It’s easy to justify a purchase when you’re tired, stressed, or trying to lift your mood. A new blouse after a tough day. A takeout dinner when the kids are吵闹. These aren’t luxuries in the traditional sense—they’re coping mechanisms. And while they offer short-term comfort, they often come with long-term regret. Recognizing this didn’t make me stop treating myself. It helped me choose when and why I did it—intentionally, not automatically.

Mapping My Spending: The Eye-Opening Truth

The first step in gaining control was simply watching. For one full month, I tracked every single expense—not to judge, not to fix, but to see. I used a simple mobile app that linked to my bank account, but a notebook would have worked just as well. The goal wasn’t perfection; it was honesty. I recorded everything: groceries, gas, coffee, online purchases, even the $2 tip I left at the coffee shop. No exceptions.

At the end of the month, I reviewed the data. What I found wasn’t shocking, but it was revealing. I spent nearly $200 on food delivery and takeout—more than I’d thought. My “miscellaneous” category, which I assumed was small, totaled over $150. It included things like replacement batteries, a new kitchen sponge, and a forgotten donation. Most surprising? I had three active subscriptions I barely used: a meditation app, a meal-planning service, and a cloud storage upgrade. Together, they cost $28 a month—$336 a year—for services I didn’t need.

What this exercise taught me was the gap between perception and reality. I believed I was careful with money, but my spending told a different story. I wasn’t lying to myself—I was just unaware. The act of tracking didn’t change my behavior immediately, but it created awareness. And awareness is the foundation of change. I began to see my spending not as a list of transactions, but as a reflection of my habits, values, and emotional state.

I also realized that traditional budget categories didn’t fit my life. “Entertainment” didn’t capture the cost of birthday gifts or family movie nights. “Personal care” didn’t include pet supplies or household cleaners. So I created my own categories—ones that reflected how I actually spent money. I grouped expenses into broader themes like Home & Family, Everyday Comforts, and Peace of Mind. This made it easier to see patterns and identify areas where I could adjust without feeling deprived.

The 3 Filters That Changed My Spending Decisions

Once I understood my spending, I needed a way to make better choices in the moment. Willpower alone wasn’t enough. I needed a system—something simple I could use before every purchase, big or small. I developed three mental filters, each a question I now ask myself before spending: Do I need it now? Can I wait 24 hours? Does it align with my goals? These questions aren’t about saying no—they’re about creating space between impulse and action.

The first filter—Do I need it now?—helps distinguish urgency from desire. Most purchases aren’t true emergencies. I don’t need a new sweater today. I don’t need to replace my phone charger immediately. Recognizing that most spending is optional removes the pressure to decide right away. This simple pause often reveals that the urge to buy fades quickly once the moment passes.

The second filter—Can I wait 24 hours?—is a powerful tool against impulse buys. I started applying it to everything over $20. If I saw something I liked, I’d add it to a wishlist or take a photo. The next day, I’d ask myself if I still wanted it. More often than not, the answer was no. This didn’t mean I never bought those things—I just bought fewer of them. And when I did, it felt more intentional, less automatic.

The third filter—Does it align with my goals?—connects spending to purpose. My financial goal wasn’t just to save money—it was to feel secure, to have options, to be able to handle surprises without stress. So when I considered a purchase, I asked if it moved me closer to that goal. A new kitchen gadget might make cooking easier, but if it meant dipping into my emergency fund, it wasn’t aligned. A family outing was worth the cost because it supported my value of connection. This filter helped me spend with confidence, knowing my choices reflected what truly mattered.

Automating Discipline Without Feeling Restricted

Willpower is limited. Relying on it for financial control is like trying to stay dry in the rain without an umbrella. I learned that real sustainability comes from systems, not self-control. Automation became my most powerful tool—not to restrict, but to support. By setting up automatic transfers, digital envelopes, and scheduled payments, I removed the daily decision-making that led to slip-ups.

Every payday, I set up an automatic transfer to my savings account—10% of my income, before I even saw it in my main account. This wasn’t a huge amount, but it was consistent. Over time, it grew. More importantly, it taught me to live on what was left, not what I wished I had. I didn’t feel deprived because I never had to decide whether to save—I had already decided, in advance.

I also created digital “envelopes” using separate savings accounts for specific goals: one for vacation, one for holiday gifts, one for car maintenance. Each month, a small amount was automatically moved into each. This made saving for big expenses feel manageable. When the time came to pay, the money was already there—no last-minute scrambling or credit card use.

Bill payments were scheduled, so I never paid late fees. Subscriptions I wanted to keep were reviewed quarterly—if I hadn’t used them, I canceled. This system didn’t eliminate spending; it made it intentional. I still had money for coffee, for small treats, for unexpected joys. But now, those choices came from a place of abundance, not guilt. I wasn’t depriving myself—I was designing a life where saving and spending coexisted peacefully.

The Hidden Triggers That Sabotage Cost Control

Even with systems in place, certain triggers could derail my progress. Stress was the biggest one. When I was overwhelmed, I was more likely to order takeout, skip cooking, or click “buy now” without thinking. Social pressure played a role too—saying yes to outings I couldn’t afford, or buying gifts that stretched my budget because I didn’t want to disappoint.

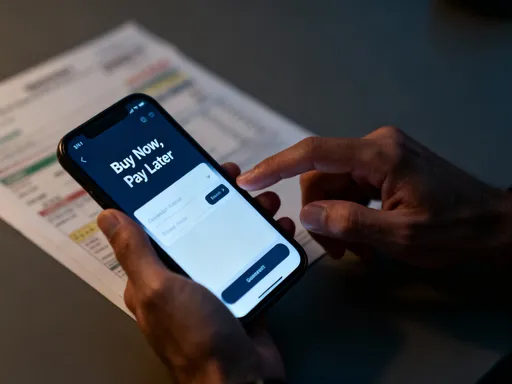

Convenience was another silent saboteur. One-click checkout, saved payment methods, and delivery apps made spending effortless. The easier it was to buy, the less I thought about it. I realized I wasn’t making choices—I was reacting to design. Apps and websites were built to encourage spending, not saving. Notifications, limited-time offers, and personalized recommendations all nudged me toward impulse.

To counter this, I made small environmental changes. I deleted one-click checkout from my browser. I turned off non-essential app notifications. I unsubscribed from marketing emails that made me feel like I was missing out. These weren’t drastic measures, but they reduced temptation. I also started meal planning on Sundays, which cut down on last-minute takeout decisions. When I felt the urge to spend, I asked myself: Am I responding to a real need, or am I being influenced by stress, fatigue, or a clever ad? That question alone often stopped unnecessary purchases.

I also redefined “treats.” Instead of using spending as the default way to feel better, I built low-cost rituals: a walk in the park, a long bath, a phone call with a friend. These didn’t cost money, but they restored my energy. Over time, I began to associate comfort with simplicity, not consumption.

Progress Over Perfection: Building Financial Confidence

Two years into this journey, I can say with confidence that I’ve changed. Not because I’ve eliminated all unnecessary spending—far from it. I still treat myself. I still make mistakes. But the difference is in how I respond. A slip-up no longer feels like failure. It’s feedback. I’ve learned that financial health isn’t about perfection—it’s about consistency, awareness, and course correction.

My savings have grown. My stress has decreased. I no longer dread opening my bank app. More than that, I’ve gained something harder to measure: confidence. I trust myself with money now. I know I can handle surprises. I know I can say no without guilt and yes without fear. That sense of control has spilled over into other areas of my life—better sleep, calmer decisions, stronger boundaries.

Cost control, I’ve learned, isn’t about living with less. It’s about living with purpose. It’s not about denying yourself joy—it’s about choosing joy that lasts. The latte you buy every day might bring a five-minute pleasure, but the peace of knowing you’re prepared for the future brings lasting relief. The goal isn’t to deprive, but to align. To spend in ways that reflect who you are and who you want to become.

If you’re just starting, know this: small steps matter. Track your spending for one week. Try the 24-hour rule on one purchase. Set up one automatic transfer. These aren’t grand gestures, but they’re the foundation of real change. You don’t have to be perfect. You just have to be consistent. And over time, those small choices add up—not just in dollars saved, but in freedom gained. That’s the real reward of cost control: not a bigger bank account, but a quieter mind and a stronger sense of self.