How I Protected My Future After Divorce — A Real Talk on Smarter Asset Moves

Going through a divorce was one of the hardest chapters of my life — and financially, I felt completely lost. I didn’t realize how vulnerable I was until I started untangling shared assets. That’s when I learned the hard way: putting everything in one place is a recipe for risk. Slowly, I rebuilt my financial foundation by spreading things out in ways I never thought of before. This isn’t about getting rich quick — it’s about staying safe, staying smart, and taking control when life throws you a curveball. It’s about making choices that protect not just your money, but your peace of mind and independence. The journey wasn’t easy, but it taught me that financial resilience is built not in moments of stability, but in times of upheaval.

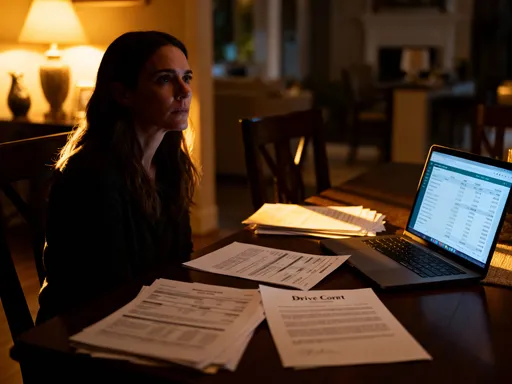

The Emotional and Financial Crossroads of Divorce

Divorce marks more than the end of a marriage — it signals a complete restructuring of personal finances. When two lives separate, so too must their financial identities. What once felt secure as a shared household income, joint savings, or co-owned property suddenly becomes a complex web of decisions that require careful navigation. Emotions run high during this time, and many individuals make financial choices based on sentiment rather than strategy. The impulse to keep the family home “for stability” or to walk away from retirement funds out of guilt can have long-term consequences. These emotional reactions often overlook the reality that financial independence is essential to rebuilding a secure future.

At this crossroads, clarity becomes your greatest ally. The process of dividing assets is not just about fairness — it’s about sustainability. A retirement account may seem less valuable in the moment compared to immediate cash or real estate, but its long-term growth potential should not be underestimated. Similarly, shared debts must be addressed with the same diligence as assets. Transferring responsibility for a mortgage or credit card balance without proper legal documentation can leave you liable for obligations you thought were resolved. The goal is not to win the division but to emerge with a balanced, manageable financial structure that supports your next chapter.

Many women, in particular, face unique challenges during this transition. Years spent out of the workforce to raise children or support a partner’s career can result in limited personal savings or credit history. This imbalance can make the shift to solo finances feel overwhelming. Yet, this moment also presents an opportunity — to redefine your relationship with money, to gain control over your income and spending, and to build a foundation that reflects your values and goals. Seeking support from a financial planner who understands the emotional and logistical complexities of divorce can provide both guidance and confidence during this vulnerable time.

Why Asset Diversification Isn’t Just for Investors

When most people hear “diversification,” they think of stock portfolios and mutual funds — concepts that feel distant from everyday life. But the principle of not putting all your eggs in one basket applies far beyond Wall Street. In the aftermath of divorce, diversification becomes a critical tool for protecting your financial well-being. Relying too heavily on a single asset — such as the marital home, a pension plan, or a joint bank account — creates significant risk. If that one source loses value, becomes inaccessible, or is tied up in legal proceedings, your entire financial security could be compromised.

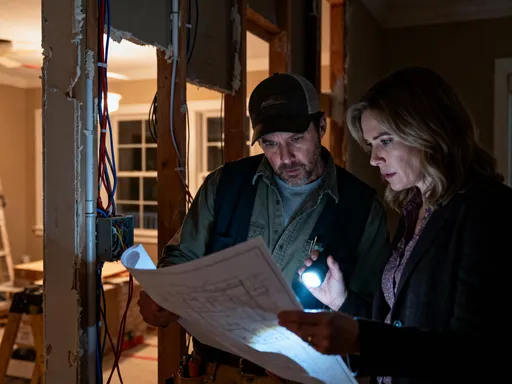

Consider the case of someone who receives the family home as part of the settlement. On the surface, this may seem like a win — a place to stay, a sense of continuity, especially if children are involved. But homes are illiquid assets. They cannot be easily converted into cash, and their value fluctuates with market conditions. Property taxes, maintenance costs, and insurance add ongoing financial pressure. If other sources of income or savings are limited, being “house rich but cash poor” can quickly lead to stress and even foreclosure. Diversification helps avoid this trap by ensuring you have multiple streams of value — some liquid, some growing, some stable — that work together to support your life.

Diversification also extends beyond traditional investments. It includes having access to emergency funds, maintaining a good credit score, and developing skills that can generate income. For example, returning to work or starting a small business may seem daunting, but these efforts contribute to a broader financial ecosystem. Even personal development — such as learning about budgeting, investing, or tax planning — strengthens your ability to manage wealth independently. The goal is not to become a financial expert overnight, but to create layers of protection that reduce reliance on any single source of support.

Identifying What You Actually Own — And What You Can Keep

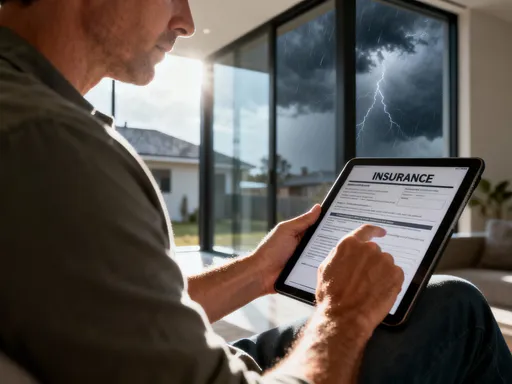

One of the most crucial steps after divorce is gaining a clear picture of what belongs to you. This may sound straightforward, but in practice, ownership can be surprisingly unclear. Joint accounts, shared investments, and mixed assets accumulated over years of marriage require careful examination. The first step is compiling a comprehensive list of all financial holdings: checking and savings accounts, retirement accounts like 401(k)s and IRAs, investment portfolios, real estate titles, insurance policies, vehicles, and even personal property with significant value, such as jewelry or art.

Once the list is complete, the next step is determining which assets are considered marital property versus separate property. Marital property generally includes anything acquired during the marriage, regardless of whose name is on the title. Separate property typically includes assets owned before the marriage, inheritances received individually, or gifts designated solely to one spouse. However, these lines can blur — for instance, if a pre-marital investment account was used to pay household expenses during the marriage, its status may be contested. This is where professional guidance becomes invaluable. Working with a divorce attorney and a certified financial planner ensures that your rights are protected and that decisions are based on accurate legal and financial principles.

Documentation plays a central role in this process. Bank statements, tax returns, property deeds, and account statements provide the evidence needed to support your claims. Without proper records, disputes can arise later, potentially leading to legal challenges or financial loss. Once ownership is established, updating titles, account names, and beneficiary designations is essential. This administrative work may seem tedious, but it formalizes your financial independence and prevents future complications. Knowing exactly what you own gives you the power to make informed decisions about how to use, sell, or invest those assets moving forward.

Building Your Own Financial Ecosystem from Scratch

After the division of assets, the real work begins: building a new financial life tailored to your individual needs. This is more than just opening a new bank account — it’s about creating a complete financial ecosystem that supports your lifestyle, goals, and sense of security. The foundation of this system includes separate banking, updated legal documents, a revised budget, and a clear understanding of your income and expenses. Each component must be designed with intention, reflecting your current reality rather than the habits of a past relationship.

Start with the basics: open individual checking and savings accounts in your name only. Close or retitle joint accounts to prevent unauthorized access and ensure full control over your funds. Update beneficiaries on life insurance policies, retirement accounts, and payable-on-death accounts to reflect your current wishes. These changes may seem minor, but they are essential for protecting your assets and ensuring they go to the people you choose in the event of your passing. Additionally, review and revise your will, power of attorney, and healthcare directives to align with your new circumstances.

Beyond the paperwork, take time to reassess your spending habits. Your household income may have changed, and your expenses likely look different as a single person. Create a realistic budget that accounts for housing, utilities, groceries, transportation, insurance, and personal goals like travel or education. Prioritize needs over wants, but also allow room for self-care and enjoyment. A well-structured budget is not a restriction — it’s a roadmap that helps you live confidently within your means while saving for the future. As you gain stability, consider setting financial goals, such as building an emergency fund, paying off debt, or saving for a new home. Each step reinforces your independence and builds momentum toward long-term security.

Smart Ways to Spread Risk Without Overcomplicating Things

Diversifying your assets doesn’t require advanced financial knowledge or a large portfolio. The key is balance — spreading your resources across different types of assets so that no single event can derail your financial plan. Begin with liquidity: maintain an emergency fund with three to six months’ worth of living expenses in a high-yield savings account. This fund acts as a financial cushion, protecting you from unexpected costs like car repairs, medical bills, or job loss. Without this buffer, you may be forced to take on debt or sell investments at an inopportune time.

Next, consider low-risk investments for stability. Options such as certificates of deposit (CDs), U.S. Treasury bonds, or money market accounts offer modest returns with minimal volatility. These instruments are especially useful for short- to medium-term goals, such as saving for a down payment or funding a child’s education. For long-term growth, index funds or exchange-traded funds (ETFs) provide broad market exposure with low fees. These funds automatically diversify across hundreds or thousands of companies, reducing the impact of any single stock’s performance. Automated investment platforms, often called robo-advisors, can help manage this process with minimal effort, making it accessible even for beginners.

Another important aspect of risk management is income diversification. If your livelihood depends entirely on one job, you’re exposed to the risk of unemployment or industry downturns. Exploring side income opportunities — such as freelance work, consulting, teaching, or selling handmade goods — adds another layer of financial resilience. These streams don’t need to replace your primary income; even small additions can make a meaningful difference during tough times. Over time, some of these efforts may grow into sustainable businesses, further strengthening your financial independence. The goal is not to eliminate risk entirely — that’s impossible — but to reduce your exposure to any single point of failure.

Avoiding Common Pitfalls That Derail Post-Divorce Finances

Even with the best intentions, many people make financial missteps after divorce that compromise their long-term stability. One of the most common is making rushed decisions under emotional stress. In the desire to “move on” or avoid conflict, individuals may agree to unfavorable settlements, such as giving up retirement assets in exchange for the family home. While this may feel like a fair trade in the moment, it can lead to significant shortfalls in later years, especially if the home’s value declines or selling becomes necessary.

Another frequent error is failing to update legal and financial documents. Forgetting to change beneficiaries on retirement accounts or life insurance policies means that an ex-spouse could still inherit those assets, even after the marriage has ended. Similarly, not updating wills or powers of attorney can result in decisions being made by someone who no longer has your best interests at heart. These oversights are preventable but can have serious consequences if left unaddressed.

Tax implications are another area where mistakes occur. Transferring assets like retirement accounts or investment portfolios can trigger tax liabilities if not handled correctly. Qualified Domestic Relations Orders (QDROs) are often required to divide retirement plans without penalty, and failure to use them can result in unexpected taxes and fees. Additionally, selling a home acquired in the divorce may have capital gains tax consequences, depending on ownership duration and profit amount. Consulting a tax professional during the settlement process helps ensure compliance and minimizes financial surprises.

Finally, many people neglect to build an emergency fund or maintain insurance coverage. Without adequate health, auto, or home insurance, a single incident can lead to overwhelming debt. Likewise, lacking accessible cash for emergencies may force reliance on credit cards or loans, increasing financial strain. Avoiding these pitfalls requires discipline, patience, and a willingness to seek expert advice. The choices you make now will shape your financial health for years to come.

Rebuilding Confidence — One Smart Move at a Time

Financial recovery after divorce is not a sprint — it’s a journey of steady, thoughtful progress. There will be moments of doubt, setbacks, and decisions that don’t yield immediate results. But each step you take to understand your finances, protect your assets, and plan for the future builds confidence and resilience. You are not just managing money; you are reclaiming your autonomy and creating a life defined by choice, not circumstance.

Start small. Celebrate the victories — opening your first solo bank account, paying off a credit card, or contributing to a retirement fund. These actions may seem minor in isolation, but together they form the foundation of lasting security. As your knowledge grows, so will your confidence. You’ll begin to see money not as a source of anxiety, but as a tool for building the life you want. Whether that means traveling, supporting your children, pursuing a passion, or simply sleeping easier at night, financial control empowers every aspect of your well-being.

Remember, you are not alone. Millions of women have walked this path and emerged stronger. By focusing on protection, diversification, and long-term planning, you are not just surviving the aftermath of divorce — you are laying the groundwork for a future that is safer, smarter, and more secure. This is not the end of your story; it’s the beginning of one where you hold the pen. With each decision, you write a new chapter — one of resilience, wisdom, and quiet strength.