How I Protected My Investments When Illness Hit — A Reality Check

What happens to your finances when a sudden illness changes everything? I learned the hard way. One day I was managing my portfolio like usual — the next, I was in a hospital bed, stressed about medical bills and losing control. This isn’t just a health crisis — it’s a financial one. In this article, I’ll walk you through the mindset shifts and practical steps that helped me protect my investments, stay calm, and plan smarter — because your health shouldn’t cost you your financial future.

The Wake-Up Call: When Health Crashes Your Portfolio

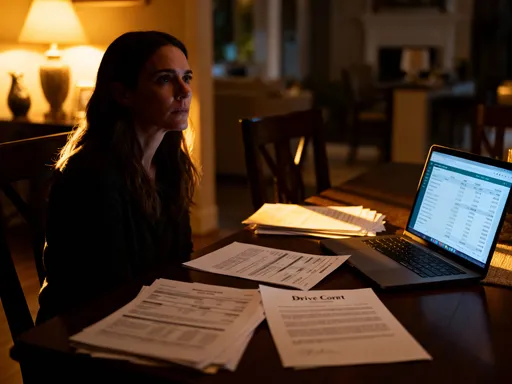

The call came on a Tuesday morning. I had been feeling unwell for weeks, dismissing fatigue as just part of a busy schedule. But the diagnosis was serious — a chronic condition requiring immediate treatment and months of recovery. In the days that followed, medical appointments piled up, prescriptions added to the tally, and work became impossible. What started as a personal health crisis quickly spiraled into a financial emergency. I was no longer earning, but my expenses were multiplying. The most unsettling part? Watching my investment accounts, carefully built over years, begin to erode not from market losses, but from my own decisions under pressure.

I made the mistake many do — I started withdrawing from my brokerage account to cover living costs. At first, it felt manageable. But markets were volatile, and selling during a dip meant locking in losses. I wasn’t managing my portfolio; I was raiding it. The emotional toll worsened the situation. Fear and uncertainty clouded my judgment. I questioned every holding, imagined worst-case scenarios, and considered pulling everything into cash. That moment — sitting in a doctor’s office with a bill in one hand and my investment statement in the other — became my wake-up call. I realized that financial security isn’t just about growing wealth. It’s about protecting it when life doesn’t go according to plan.

For years, I had focused on returns, diversification, and retirement timelines. But I had overlooked a fundamental truth: no investment strategy survives a crisis without contingency planning. Long-term goals mean little if short-term shocks force you to abandon them. My illness exposed a gap in my financial readiness — not in knowledge, but in preparation. I had planned for market downturns, but not for personal ones. And that distinction, I learned, is everything. The real risk to wealth isn’t always the stock market. Sometimes, it’s your own vulnerability.

Why Your Investment Mindset Needs a Safety Net

When illness strikes, the first thing to suffer is often clarity. The mental load of managing a health condition — doctor visits, treatment schedules, emotional stress — leaves little room for rational financial decisions. This is where even experienced investors falter. The human brain, under stress, defaults to survival mode. Short-term threats feel more urgent than long-term consequences. In that state, selling investments to stop the bleeding can seem like the only option, even when it’s the most damaging one. This is not a failure of discipline; it’s a predictable response to crisis. And it’s why your investment mindset must include a psychological safety net.

Emotional resilience is as critical as financial planning. Without it, fear can distort your perception of risk. A temporary market dip may feel like total collapse. A short-term cash crunch may prompt drastic moves that compromise years of progress. The key is to recognize that financial decisions made in moments of high stress are rarely optimal. That’s why building mental armor — a framework for staying grounded — is essential. This doesn’t mean suppressing emotions. It means creating systems that prevent emotion from driving action. One powerful tool is pre-commitment: deciding in advance how you’ll respond to financial stress, so you’re not making choices in the heat of the moment.

For example, establishing rules like “I will not sell investments during medical leave without consulting my financial advisor” can provide structure when judgment is impaired. Another strategy is reframing your identity as an investor. Instead of seeing yourself as someone who must actively manage money every day, view yourself as a steward of long-term wealth. This shift allows you to step back during crises without feeling like you’re abandoning responsibility. It also helps you resist the urge to chase quick fixes or speculative opportunities that promise fast cash but carry high risk. The goal is not perfection, but consistency — staying aligned with your broader financial plan, even when circumstances are far from ideal.

Equally important is recognizing that setbacks don’t erase progress. A pause in contributions or a temporary reallocation isn’t failure. It’s adaptation. By normalizing the idea that financial journeys include detours, you reduce the pressure to maintain an unrealistic pace. This mindset doesn’t eliminate stress, but it creates space for thoughtful action instead of reactive panic. And in times of crisis, that space can be the difference between preserving wealth and losing it.

Emergency Fund: The First Line of Financial Defense

If there’s one lesson my experience taught me, it’s the irreplaceable value of a well-funded emergency reserve. Before my illness, I had some savings, but they were scattered — a little in checking, a little in a money market fund, not enough in one place to cover more than a few weeks of expenses. When income stopped, I had no buffer. That forced me to tap into investment accounts, disrupting my long-term strategy. I now understand that an emergency fund isn’t just a backup; it’s the foundation that protects everything else. It acts as a financial shock absorber, allowing you to weather personal storms without dismantling your investment portfolio.

The purpose of an emergency fund is simple: to cover essential living expenses when income is interrupted. This includes rent or mortgage, utilities, groceries, insurance, and basic medical costs. For someone facing illness, this buffer can mean the difference between stability and financial freefall. The ideal fund provides enough liquidity to last several months — not so large that it sacrifices growth, but sufficient to prevent forced withdrawals from long-term assets. While exact amounts vary by household, the principle remains the same: this money must be accessible, safe, and separate from investments.

Where you keep this fund matters. It should be in a low-risk, liquid account — such as a high-yield savings account or short-term certificate of deposit — where principal is preserved and funds can be accessed quickly. Unlike investment accounts, the goal here is not returns, but reliability. Accepting a modest interest rate is a small price to pay for peace of mind. Equally important is protecting the fund from everyday spending. Many people drain their reserves because they use them as a general savings pool. The solution is discipline: treat this money as untouchable except in true emergencies, and replenish it as soon as possible after use.

Rebuilding an emergency fund after illness can feel daunting, especially with ongoing medical costs. But it’s a priority. One approach is to restart contributions gradually, even if only a small amount each month. Automating transfers ensures consistency. Another strategy is redirecting windfalls — tax refunds, bonuses, or gifts — directly into the fund. Over time, these steps restore financial breathing room. The lesson is clear: no investment strategy is complete without this first line of defense. It’s not glamorous, but it’s what allows you to stay the course when life throws you off track.

Insurance as a Strategic Investment — Not Just a Cost

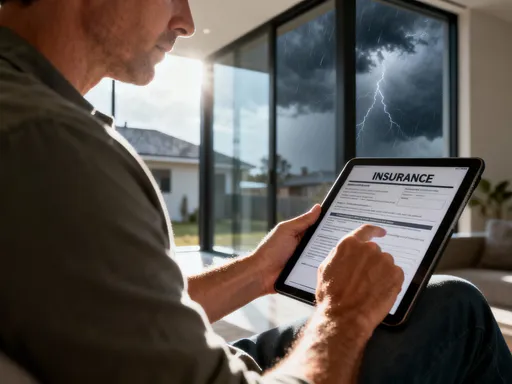

For many, insurance feels like an unavoidable expense — a monthly bill with no immediate return. But my experience revealed its true role: not as a cost, but as a strategic safeguard for wealth. Without adequate health coverage, a single hospital stay can drain savings and force asset liquidation. Disability insurance, often overlooked, is equally vital. It replaces a portion of income when illness or injury prevents work — a critical function when your earning ability is compromised. These policies aren’t luxuries; they’re essential tools that protect the value of everything you’ve built.

I had health insurance, but I later realized I was underinsured. High deductibles and limited coverage for certain treatments meant I still faced significant out-of-pocket costs. This gap turned a manageable health issue into a financial strain. Since then, I’ve reviewed my policies carefully, prioritizing comprehensive coverage over lower premiums. I now understand that skimping on insurance to save money today can cost far more tomorrow. The goal isn’t to eliminate risk — that’s impossible — but to transfer the most catastrophic risks to institutions designed to bear them.

When evaluating insurance, focus on what truly protects your financial stability. For health insurance, consider not just premiums, but deductibles, co-pays, and out-of-pocket maximums. For disability coverage, look at the benefit period, waiting period, and whether it covers partial disabilities. Long-term care insurance may also be worth considering, especially as you age, to avoid depleting assets for assisted living or nursing care. These decisions require careful assessment of your personal situation, but the principle is universal: insurance preserves capital by preventing large, unexpected expenses from becoming personal liabilities.

Viewing insurance as part of your investment strategy changes the conversation. Instead of asking, “How can I reduce this cost?” ask, “What am I protecting by having this coverage?” The answer often reveals its true worth. A policy that prevents a $50,000 medical bill from becoming your responsibility has delivered immense value — even if you never file a claim. In this light, insurance isn’t an expense; it’s a form of risk management that enables long-term investing to continue uninterrupted. It’s one of the most powerful, yet underappreciated, tools in financial planning.

Portfolio Design: Building for Resilience, Not Just Returns

Most investment advice focuses on growth — how to maximize returns, beat the market, or reach retirement goals faster. But my crisis taught me that resilience matters more than return during tough times. A portfolio designed only for performance may collapse under personal stress. The smarter approach is to build for durability: structuring your assets so they can withstand both market volatility and life disruptions. This means balancing growth potential with stability, liquidity, and income generation.

Diversification is often discussed in terms of asset classes — stocks, bonds, real estate — but it should also consider liquidity and risk tolerance. For example, holding some portion of your portfolio in low-volatility assets, such as short-term bonds or dividend-paying stocks, can provide stability when markets decline. These assets may not deliver the highest returns, but they reduce the need to sell during downturns. Similarly, income-producing investments can supplement cash flow during periods of reduced earnings, lessening the pressure to withdraw from principal.

Liquidity is another crucial factor. Not all investments are easy to convert to cash without loss. Real estate, private equity, or concentrated stock positions may be valuable, but they’re not helpful in an emergency. A well-designed portfolio includes enough liquid assets to cover near-term needs without forced sales. This doesn’t mean keeping everything in cash — that sacrifices long-term growth — but ensuring a balanced mix that aligns with your life stage and risk profile.

Avoiding over-leveraging is equally important. Using debt to invest can amplify gains, but it also magnifies losses and increases vulnerability. During illness, debt payments don’t stop, even when income does. High leverage can turn a temporary setback into a financial crisis. A conservative approach to borrowing — using debt only for appreciating assets and maintaining manageable payment levels — adds another layer of protection. Ultimately, portfolio design should reflect not just market conditions, but personal realities. A strategy that works in good times must also hold up in bad ones. That’s the mark of true financial strength.

Decision-Making in Crisis: What to Do (and Not Do)

When you’re unwell, making financial decisions can feel overwhelming. The instinct may be to act quickly — sell investments to cover bills, refinance debt, or chase high-return opportunities to make up for lost income. But these moves, made under pressure, often backfire. The most important step during a crisis is often the hardest: pause. Take time to assess your situation without rushing into irreversible choices. This doesn’t mean ignoring problems — it means addressing them with clarity, not panic.

One of the most damaging behaviors in a crisis is emotional selling — dumping investments at a loss to raise cash or reduce anxiety. While it may provide temporary relief, it locks in losses and undermines long-term growth. Markets recover, but forced sales do lasting harm. Instead, evaluate your cash flow needs and determine whether withdrawals are truly necessary. Could expenses be reduced? Could family assistance or payment plans ease the burden? Exploring alternatives before selling can preserve capital and maintain your investment trajectory.

Consulting a trusted financial advisor is another critical step. When your judgment is clouded by stress or medication, an objective third party can provide guidance and prevent impulsive decisions. A good advisor doesn’t make choices for you — they help you stay aligned with your plan. They can also assist in coordinating with other professionals, such as tax preparers or estate planners, to ensure a holistic approach. If you don’t have an advisor, now is the time to consider one. Their value isn’t in generating returns, but in preventing costly mistakes.

Equally important is delegating financial tasks when you’re unable to manage them. Many people hesitate to involve family or professionals, fearing loss of control. But delegating isn’t surrender — it’s strategy. Assigning someone you trust to handle bill payments, monitor accounts, or communicate with institutions ensures continuity and reduces mental load. Legal tools like power of attorney can formalize this arrangement, providing clarity and protection. The goal is not to do everything alone, but to maintain control through preparation. By setting up systems in advance, you ensure that your finances remain secure, even when you can’t manage them yourself.

Rebuilding and Reframing: Investing with New Wisdom

Recovery is not just physical — it’s financial. As health improves, so must your relationship with money. The process of rebuilding isn’t about returning to where you were, but moving forward with greater wisdom. This means reassessing goals, updating your financial plan, and incorporating lessons learned. It’s an opportunity to strengthen your strategy, not just restore it.

Gradually re-entering the market is often the right approach. After a period of inactivity or withdrawals, rushing back can lead to overcorrection. Instead, resume contributions at a sustainable pace, focusing on consistency over speed. Rebalance your portfolio if allocations have shifted, but avoid drastic changes based on short-term emotions. Remember, markets reward patience. Time in the market still beats timing the market — especially when you’re rebuilding confidence as well as capital.

Updating your financial plan is equally important. Illness may change priorities — perhaps retirement timelines shift, or you place greater value on flexibility and security. These adjustments are not setbacks; they’re refinements. Work with your advisor to realign your strategy with your current reality. This might include increasing insurance coverage, adjusting risk tolerance, or revising estate plans. The goal is a plan that reflects not just your finances, but your life.

Finally, recognize that true financial strength isn’t measured by account balances alone. It’s measured by resilience — the ability to withstand shocks without losing your way. It’s found in preparation, in systems that protect you when you’re vulnerable, and in the peace of mind that comes from knowing you’re ready. My illness was a harsh teacher, but it gave me something invaluable: clarity. I now invest not just for growth, but for stability. Not just for returns, but for peace of mind. And that, more than any number on a statement, is the real measure of success.