How I Survived a Job Loss Emergency — My Real Risk-Smart Money Moves

Losing my job hit like a storm I never saw coming. Suddenly, every dollar mattered, and fear crept in fast. But instead of panicking, I took control — not with magic tricks, but with冷静 risk assessment and real, actionable steps. This isn’t theory; it’s what I lived. In this article, I’ll walk you through how I restructured my finances, prioritized survival moves, and protected what I had. It’s about staying smart when stress screams at you to react. I learned that financial resilience isn’t built in the crisis — it’s built before, during, and after. And even in uncertainty, clarity comes from structure, not luck.

The Day Everything Changed: Facing Unemployment Head-On

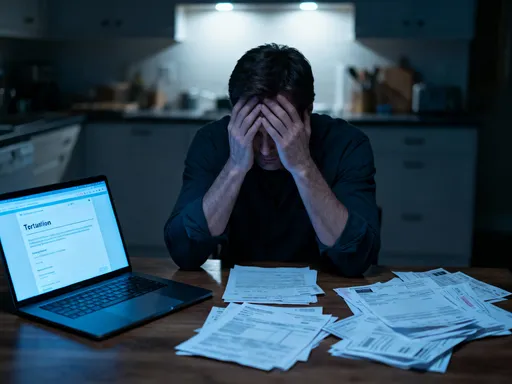

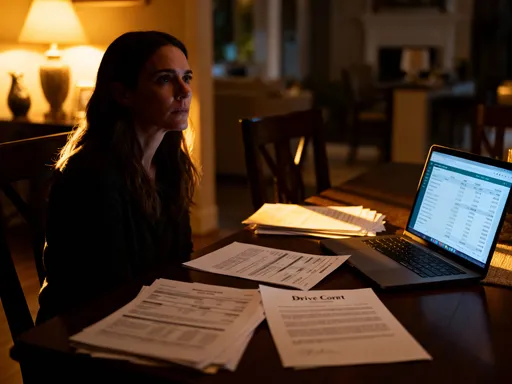

The call came on a Tuesday afternoon. My manager’s voice was steady, but the message was jarring: the department was being restructured, and my position was eliminated. There was no warning, no performance review, no chance to fix something that wasn’t broken. Just silence after the last sentence. I sat at my kitchen table, staring at my laptop, heart pounding. The first wave wasn’t about money — it was about identity. Who was I if not the person who showed up every day, solved problems, and earned a paycheck? But that emotional shock didn’t last long. Reality set in quickly: rent was due in 12 days. My daughter’s school fees were automatic. The car payment would draft in seven. I had savings, yes, but how long would they last?

It was in that moment of overwhelm that I remembered a lesson from a financial workshop I’d attended years before: never make permanent decisions under temporary stress. That phrase became my anchor. I didn’t cancel subscriptions that evening. I didn’t call my retirement account. I didn’t apply for every job within 50 miles. Instead, I did something simple but powerful — I wrote down everything I owed, every source of incoming money, and how long my savings could stretch. That act shifted me from panic to planning. I realized that how I responded in the first 72 hours would shape the next six months, maybe longer.

What I now understand is that job loss is not just an income disruption — it’s a risk event. And like any risk, it can be assessed, managed, and mitigated. The difference between a short-term setback and a long-term financial spiral often comes down to whether someone treats unemployment as an emergency to survive or a crisis to manage. Reacting emotionally might feel necessary, but it rarely leads to optimal outcomes. Calling creditors in anger, maxing out credit cards “just to get by,” or quitting the job search after two rejections — these are reactions that amplify risk. What I chose was different: a deliberate, step-by-step approach grounded in facts, not fear.

This wasn’t about being fearless. I was afraid. But I decided to act as if I had more control than I felt. That mindset shift — from victim to strategist — was the first real move I made. And it changed everything.

What Risk Assessment Really Means in a Crisis

When most people hear “risk assessment,” they think of spreadsheets, stock market volatility, or corporate boardrooms. But in a personal financial crisis, risk assessment is much simpler — and far more urgent. It’s asking honest questions about what could go wrong, how bad it could get, and what you can actually control. It’s not about predicting the future; it’s about preparing for a range of possible outcomes. In the days after my job loss, I stopped thinking in terms of “what if” and started thinking in terms of “what is.” What is my monthly burn rate? What is the minimum I need to survive? What is the worst-case scenario, and do I have a plan for it?

Risk, in this context, isn’t a feeling — it’s a measurable exposure. For example, I had $18,000 in savings. My essential monthly expenses — rent, utilities, groceries, insurance, and minimum debt payments — totaled $3,200. That meant, in theory, I could last just over five months without income. That number became my baseline. But I didn’t stop there. I also assessed non-financial risks: my mental health, my ability to focus on job searching, and the strain on my family. Stress can cloud judgment, and poor decisions under pressure can extend a crisis. So I factored in emotional resilience as part of my overall risk profile.

I also looked at my debt structure. I had a car loan at 4.9% interest, a small personal loan at 7.2%, and a credit card balance I was paying off at 16.9%. The high-interest credit card was a major risk — not because the balance was huge, but because the interest was compounding fast. If I didn’t address it, it could grow even while I was cutting other expenses. That made it a priority, not a footnote. At the same time, I evaluated my access to liquidity. Were my savings in a high-yield account that took days to transfer? No — they were in a standard checking and savings combo with same-day access. That reduced one layer of risk.

Another key part of my risk assessment was understanding time horizons. Was this a three-month gap or a year-long drought? I didn’t know. So I planned for the worst but hoped for the best. I set milestones: if I hadn’t found a job in 60 days, I would take on part-time work. If savings dropped below two months’ worth, I would reach out to family for a short-term loan, not a gift. These weren’t signs of failure — they were pre-determined decision points. By defining my personal risk thresholds in advance, I removed emotion from future choices. That’s what real risk assessment does: it turns uncertainty into structure.

Building Your Financial Triage System

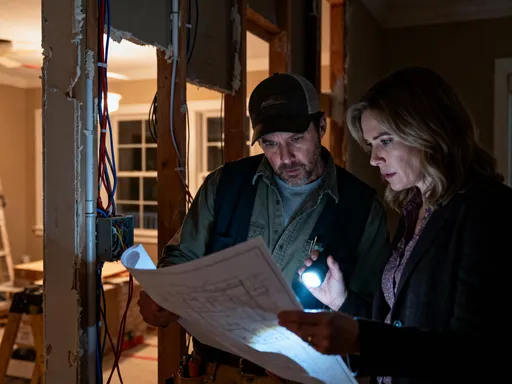

When a hospital receives multiple patients in an emergency, doctors don’t treat everyone the same way. They use triage — a system that sorts patients by urgency and survivability. I applied the same logic to my finances. Not all bills are equally critical. Not all debts carry the same consequence if missed. So I created my own financial triage system, dividing my obligations into three categories: critical, negotiable, and deferrable.

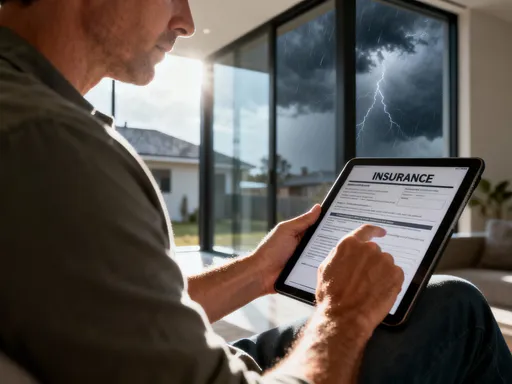

Critical expenses were those that, if not paid, would result in immediate harm or loss. That included rent, health insurance, groceries, and the minimum payment on my credit card to avoid penalties. These were non-negotiable. I protected this category at all costs. Next were negotiable expenses — things like my internet bill, phone plan, and car insurance. These weren’t optional, but their terms could be adjusted. I called my internet provider and switched to a lower-tier plan, saving $35 a month. I downgraded my phone plan temporarily and canceled my premium streaming subscriptions. These weren’t drastic cuts, but they added up. Over three months, I saved nearly $400 without sacrificing basic comfort.

The third category was deferrable expenses — payments that could be postponed without severe consequences. My student loan, for example, offered a deferment option during unemployment. I applied and was approved, freeing up $220 a month. I also reached out to my credit card issuer and requested a hardship plan. To my surprise, they agreed to reduce my interest rate for six months and waive late fees. That single conversation saved me over $150 in interest over the next quarter. I didn’t see these actions as begging — I saw them as strategic negotiation. Companies expect financial hardship. They have programs for it. But you have to ask.

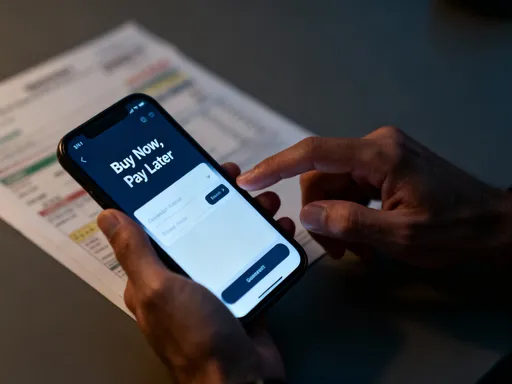

One of the most important lessons I learned was that triage isn’t about deprivation — it’s about protection. I didn’t stop buying groceries. I didn’t let my daughter’s school activities fall through. I protected the core of our life while adjusting the edges. I also made a rule: no new debt unless it was for true emergencies. That meant no “convenience” credit card purchases, no buy-now-pay-later schemes. Every dollar had to be accounted for. I used a simple spreadsheet to track every expense, color-coded by category. Seeing the numbers in front of me kept me honest and focused. Triage isn’t a one-time act — it’s an ongoing process. I reviewed my system every two weeks, adjusting as my situation changed. That flexibility became a source of strength.

Liquidity Over Returns: Why Growth Takes a Back Seat

Before I lost my job, I was focused on growing my money. I had a mix of index funds, a retirement account, and a small side investment in a REIT. I checked my portfolio regularly, proud of the slow but steady gains. But when income stopped, my priorities shifted completely. I no longer cared about returns — I cared about access. That’s when I realized a fundamental truth: in a crisis, liquidity is more valuable than growth.

I had $12,000 in a brokerage account. Selling those investments would have given me cash, but at what cost? Some were down in value. Selling would lock in losses. Plus, there were tax implications. I also had a 401(k) with $45,000. Tapping that early would mean a 10% penalty and income tax — a massive hit. I considered it, but only as a last resort. Instead, I relied on my emergency fund — $18,000 in a high-liquidity savings account. That money was boring. It earned less than 1% interest. But it was there when I needed it, with no penalties, no waiting, no stress.

This experience taught me that financial security isn’t about how much you earn on your investments — it’s about how much you can access when life goes off track. Many people chase high returns without considering liquidity. They put money in CDs, real estate, or long-term bonds that can’t be touched without cost. That’s fine in stable times. But in a crisis, those assets become useless if you can’t convert them to cash quickly. I saw friends dip into retirement accounts early, only to regret it later when penalties and taxes wiped out half the value. Others sold stocks at market lows, locking in losses they never recovered.

My rule became simple: protect principal and access. I didn’t move money into risky assets hoping for a quick gain. I didn’t try to “time the market.” I kept my emergency fund separate, fully liquid, and mentally off-limits for anything but true emergencies. That discipline paid off. When I found a new job after four months, I hadn’t touched my retirement or brokerage accounts. My emergency fund was reduced, but intact. And because I avoided penalties and losses, I didn’t start my next chapter in financial debt. Liquidity isn’t glamorous, but it’s powerful. It gives you time — and time is the most valuable asset in a crisis.

The Hidden Risks of “Quick Fixes”

When money runs low, the temptation to find fast solutions is strong. I had friends who took out payday loans, used cash advance apps, or maxed out credit cards to cover rent. On the surface, these seem like lifelines. But I learned quickly that many “quick fixes” come with hidden costs that can trap you in a cycle of debt. I almost made this mistake myself. One month, after covering essentials, I had only $87 left. My car needed an oil change and new wipers. I was tempted to use a credit card cash advance. The fee was high — 5% plus ATM charges — and the interest rate was 24.99%. But it would solve the immediate problem.

I paused. I asked myself: what is the real cost of this “solution”? That $200 advance would cost me $30 in fees and over $4 in interest the first month alone. If I couldn’t pay it off quickly, the balance would grow. And if I missed a payment, my credit score would drop, making future borrowing harder and more expensive. I realized that short-term relief was not worth long-term damage. Instead, I postponed the oil change by two weeks and bought wipers at a discount store for $12. It wasn’t ideal, but it was sustainable.

This taught me to evaluate every financial decision through the lens of trade-offs. A payday loan might keep the lights on today, but it could cost you three times the amount borrowed in fees and interest. A cash advance app might give you early access to your paycheck, but it often encourages overspending and creates dependency. Even side gigs that promise fast cash — like delivery driving or freelance gigs with unclear terms — can take time away from job searching, the highest-return activity I had.

I did take on a few freelance projects — writing and administrative work — but only those that fit my skills and didn’t drain my energy. I turned down gigs that paid poorly or required long hours. The opportunity cost was too high. Every hour spent on low-value work was an hour not spent on finding a full-time job. I also avoided borrowing from friends or family unless it was structured as a clear, written agreement. Emotions can complicate money, and I didn’t want to risk relationships.

The biggest risk of quick fixes isn’t the money — it’s the mindset. They encourage reactive behavior. They make you feel like you’re solving problems when you’re actually delaying them. True financial resilience comes from facing reality, not avoiding it. I chose to live within my adjusted means, not stretch beyond them. That discipline kept me out of debt and preserved my credit score — a critical asset in any job search.

Reassessing Skills, Not Just Savings

After the first month of unemployment, I realized that focusing only on money wasn’t enough. I had to look at my human capital — my skills, experience, and network. I had been in the same role for nearly seven years. My resume was outdated. My LinkedIn profile hadn’t been updated in years. I didn’t know what skills were in demand. So I did a personal inventory. I listed every skill I had — project management, budgeting, team coordination, software proficiency — and ranked them by market value.

I discovered that some of my most valuable skills weren’t technical — they were organizational and interpersonal. I was good at problem-solving, communication, and managing complex workflows. These are transferable skills. I rewrote my resume to highlight those strengths, using keywords from job descriptions in my target field. I also reached out to former colleagues, not to ask for a job, but to ask for advice. Most were happy to help. One connection led to an introduction. Another shared a job posting before it was public.

I also invested time in upskilling. I took two free online courses — one in data analysis and another in digital project management. They didn’t cost money, but they required focus. I dedicated two hours a day, five days a week. It wasn’t easy, but it kept me sharp and gave me something to show in interviews. I also joined a local professional group, attending virtual meetings and contributing to discussions. This wasn’t just networking — it was rebuilding confidence.

What I learned is that employability is a form of financial protection. The faster you can re-enter the workforce, the less strain on your savings. By treating my job search as a project with goals, timelines, and metrics, I stayed disciplined. I applied to a set number of jobs each week, followed up on applications, and tracked responses. This structured approach made me feel in control. And when I finally got an offer, it wasn’t luck — it was the result of consistent effort. Your skills are an asset, just like savings. And in a crisis, they can be your most powerful tool.

Creating a Dynamic Safety Net for the Future

When I started my new job, I didn’t go back to my old financial habits. I knew that if I did, I’d be just as vulnerable the next time. So I rebuilt my financial plan with risk assessment at the core. First, I increased my emergency fund from three months’ worth of expenses to six. I automated a portion of my paycheck into a dedicated savings account, treating it like a non-negotiable bill. I also diversified my income awareness — I now track not just my salary, but potential side income, skill value, and market demand in my field.

I also implemented regular financial health checks — every quarter, I review my budget, net worth, credit score, and job market position. I ask myself: if I lost my job today, how long could I last? What would I do first? These check-ins keep me prepared. I’ve also built stronger relationships with my lenders and service providers. I know their hardship policies, contact numbers, and negotiation options. I’m not waiting for a crisis to learn how to respond.

Finally, I changed my mindset. I no longer see financial security as a destination — I see it as a practice. It’s not about having a perfect plan. It’s about having a flexible one. It’s about making decisions today that reduce risk tomorrow. I still save, invest, and plan for retirement. But I do it with the awareness that life is unpredictable. And the best protection isn’t wealth — it’s wisdom. The experience of unemployment didn’t break me. It reshaped me. It taught me that resilience isn’t the absence of crisis — it’s the ability to move through it with clarity, courage, and control.