What No One Tells You About Money When Remarrying

Remarrying brings joy, but also financial blind spots no one talks about. I learned this the hard way—merged accounts, unclear inheritances, and overlooked tax traps derailed my fresh start. What felt like love quickly became a money minefield. This isn’t just about budgets; it’s about protecting both your heart and your future. Let’s walk through the real risks—and how to sidestep them—before saying “I do” again.

The Hidden Financial Stakes of Starting Over

Remarrying is often seen as a second chance at happiness, but it also marks a significant financial reset. Unlike a first marriage, where couples may enter with limited assets and few obligations, remarriage typically involves established lives—each partner bringing their own financial history, responsibilities, and long-term goals. The emotional joy of finding love again can easily overshadow the practical realities of merging two independent households. Yet, this union requires more than just combining incomes; it demands a thoughtful reconciliation of spending habits, debt levels, savings patterns, and future expectations. Without open conversations, assumptions can take root—like assuming both partners want to retire at the same age or that shared expenses should be split equally regardless of income differences.

Consider a scenario where one partner owns a home outright while the other rents. When they decide to live together, whose property becomes the primary residence? Does the homeowner refinance in both names, potentially exposing their equity to future claims? What happens if the relationship ends again? These are not signs of distrust—they are prudent considerations. Similarly, one spouse might be debt-free while the other carries student loans or credit card balances. How those debts are managed post-marriage can impact everything from mortgage eligibility to investment capacity. Even seemingly small habits—like one person tracking every expense while the other spends freely—can create tension without clear communication and mutual agreement.

The truth is, remarriage amplifies financial complexity because it often involves children from prior relationships, ongoing alimony or child support, and separate retirement accounts. Each of these elements introduces new layers of responsibility. For example, a parent paying child support may have less disposable income to contribute to joint savings, which could affect how quickly the couple reaches shared goals like travel or home upgrades. At the same time, decisions about inheritance become more sensitive when there are adult children involved. Failing to address these issues upfront doesn’t just risk financial strain—it can erode trust and intimacy over time. Therefore, treating remarriage as both an emotional and financial merger sets the foundation for lasting stability.

Asset Protection: Why Your Past Still Matters

One of the most misunderstood aspects of remarriage is how past assets are treated under the law. Many people assume that everything they owned before getting married remains theirs, but that’s not always true. Depending on state laws—especially in community property states—assets acquired before marriage can sometimes be considered marital property if they’re commingled or used for shared benefit during the marriage. For instance, if one spouse uses savings from before the marriage to pay for a vacation or home renovation, those funds may lose their protected status. This is why understanding the distinction between separate and marital assets is crucial for anyone entering a second marriage.

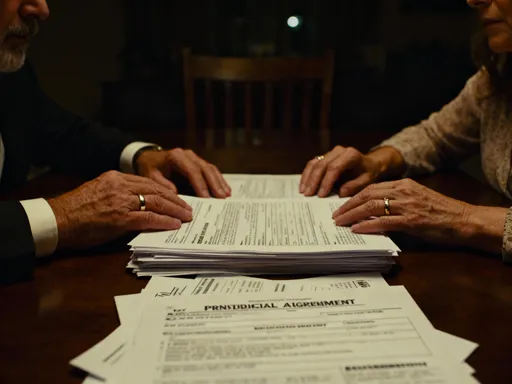

A prenuptial agreement is often viewed as unromantic or even suspicious, but in reality, it serves as a practical tool for clarity and protection. It allows couples to define what stays individual and what becomes shared, including real estate, investment accounts, business interests, and inheritances. A well-drafted prenup can specify how property will be divided in the event of divorce or death, reducing uncertainty and potential conflict. Importantly, it doesn’t imply a lack of faith in the relationship—it reflects responsible planning, much like having insurance doesn’t mean you expect an accident.

Equally important is reviewing property titles and ownership documents. If one partner owns a home before remarriage, keeping it solely in their name—and ensuring mortgage and tax records reflect that—helps preserve its status as separate property. Similarly, inheritance plans should be revisited. Without clear directives, a new spouse could unintentionally displace children from a previous marriage when it comes to receiving assets. For example, if a will isn’t updated after remarriage, state laws may prioritize the current spouse over adult children, leading to family disputes. Trusts can play a vital role here by allowing individuals to designate specific assets to certain heirs while still providing for a surviving spouse.

These protections are not about building walls—they’re about honoring both personal history and present commitments. By acknowledging that financial legacies matter, couples can create a structure that respects individual contributions while building something new together. This balance fosters transparency and reduces the risk of resentment later on, especially when emotions run high due to unforeseen life events.

Debt Isn’t Just Yours—It’s Now “Ours”

When two people marry, their financial lives become intertwined in ways that go far beyond shared expenses. One of the most overlooked dangers in remarriage is the impact of existing debt. While income and assets often get the spotlight, debt—especially when hidden or poorly understood—can quietly undermine a new marriage. In many cases, one partner may enter the relationship with student loans, medical bills, or credit card balances, and unless these are addressed early, they can affect the other spouse’s financial health. This is particularly true when credit is involved, as lenders look at combined financial profiles when approving mortgages, auto loans, or even rental agreements.

Credit scores are a key factor in financial well-being, and one person’s past financial struggles can directly influence the other’s borrowing power. For example, if one spouse has a low credit score due to late payments or high utilization, it could result in higher interest rates on joint loans—or even denial of credit altogether. This doesn’t mean someone with debt should be judged or excluded, but it does mean both partners need full visibility into each other’s financial standing. Transparency is not about blame; it’s about making informed decisions together. A practical first step is reviewing credit reports from all three major bureaus—Equifax, Experian, and TransUnion—to identify any inaccuracies and understand current obligations.

Once the full picture is clear, couples must decide how to manage debt moving forward. Should they consolidate? Should accounts remain separate? There’s no one-size-fits-all answer, but setting boundaries is essential. Some couples choose to keep individual accounts for personal spending while maintaining a joint account only for shared bills. Others may agree to pay down high-interest debt together, viewing it as a shared priority. The key is alignment—both partners should understand the plan and feel comfortable with their roles in it. Additionally, co-signed debts require special attention. If one spouse co-signed a loan for a child or former partner, they remain legally responsible even after remarriage, and that obligation can affect the household’s overall debt-to-income ratio.

Addressing debt openly also builds trust. It shows a willingness to face challenges together rather than hiding behind financial secrecy. By treating debt as a joint concern—even if it originated individually—couples can work toward a stronger, more resilient financial future. The goal isn’t perfection; it’s progress through honesty and cooperation.

Tax Traps That Catch Second-Timers Off Guard

Marriage changes your tax status—and for those remarrying, the consequences can be surprisingly complex. Many people assume that filing jointly will automatically lead to lower taxes, but that’s not always the case. When two incomes are combined, especially if both partners are earning above-average salaries, the household may be pushed into a higher tax bracket. This phenomenon, sometimes called the “marriage penalty,” means the couple pays more in taxes than they would have if filing as single individuals. While some couples benefit from a “marriage bonus,” particularly when one earns significantly less, second marriages often involve dual earners with established careers, increasing the likelihood of facing higher combined liability.

Another overlooked issue is how remarriage affects certain tax deductions and credits. For example, someone who previously claimed the Qualified Widower status may lose eligibility upon remarrying before age 60. Similarly, deductions related to alimony payments changed dramatically after the 2017 Tax Cuts and Jobs Act—now, alimony is no longer deductible for the payer nor taxable to the recipient for agreements executed after 2018. This means that if a person is paying spousal support from a prior marriage, that money comes out of after-tax income, reducing overall cash flow. Failing to account for this shift can create unexpected budget shortfalls.

Retirement account withdrawals also carry tax implications that shift with marital status. Required minimum distributions (RMDs) from traditional IRAs and 401(k)s must be recalculated based on joint life expectancy when taking distributions over time. Additionally, Social Security benefits can be affected. While a new spouse may qualify for spousal benefits based on the other’s work record, this doesn’t eliminate the need to coordinate when each partner claims their own benefits. Claiming too early can reduce lifetime income, especially if one spouse outlives the other by many years.

Given these complexities, consulting a tax advisor before the wedding is one of the smartest financial moves a couple can make. A professional can model different filing scenarios, estimate tax liabilities, and recommend strategies such as income splitting, Roth conversions, or timing large withdrawals to minimize the burden. They can also help update withholding forms to avoid underpayment penalties. By addressing taxes proactively, couples gain clarity and avoid unpleasant surprises come April 15th. Knowledge, in this case, truly is power—and peace of mind.

Estate Planning: More Than Just a Will

Many people believe that having a will is enough to protect their family’s future, but remarriage introduces layers of complexity that a simple will cannot resolve. Without a comprehensive estate plan, assets may not go to the intended beneficiaries, leading to legal disputes and emotional distress. For instance, if a person dies without updating their estate documents after remarrying, state intestacy laws may give priority to the current spouse—even if the deceased intended for children from a previous marriage to inherit certain assets. This can create deep rifts within blended families, especially if one or both partners have adult children who feel excluded.

Beneficiary designations on retirement accounts, life insurance policies, and payable-on-death bank accounts override whatever is written in a will. This means that even if a will states that assets should be divided among all children, a life insurance policy still listing an ex-spouse as the primary beneficiary will transfer the proceeds to that individual. Such oversights are alarmingly common and can completely undo a person’s wishes. Therefore, reviewing and updating all beneficiary forms is one of the most critical steps after remarriage. It ensures that financial protection goes where it’s meant to—whether that’s a new spouse, biological children, stepchildren, or charitable causes.

Trusts offer another powerful tool for managing legacy goals. A revocable living trust, for example, allows individuals to maintain control during their lifetime while specifying how assets should be distributed upon death. It can also include provisions for minor children or dependents with special needs. For blended families, a qualified terminable interest property (QTIP) trust can provide income to a surviving spouse while preserving the principal for children from a prior marriage. These structures require careful drafting with an experienced estate attorney, but they offer peace of mind knowing that intentions will be honored.

Guardianship decisions also deserve attention, especially if either partner has minor children. Naming a guardian in a will ensures that, in the event of both parents’ passing, the children are cared for by someone trusted. However, this decision becomes more nuanced in a blended family—should the step-parent automatically become guardian, or would another relative be better suited? Discussing these questions openly helps prevent confusion and conflict later. Ultimately, estate planning is not just about money—it’s about love, responsibility, and ensuring that one’s values live on.

Retirement Readjustments: Merging Futures Without Losing Ground

Retirement planning takes on new dimensions in a second marriage, especially when partners have different ages, savings levels, and work timelines. One may be ready to retire while the other plans to work for another decade. These disparities require coordination to ensure both individuals can enjoy financial security without sacrificing their independence. Pensions, 401(k)s, IRAs, and Social Security benefits all come with rules that change when marital status changes—and misunderstanding them can lead to missed opportunities or avoidable losses.

For example, spousal benefits on Social Security allow a lower-earning partner to claim up to 50% of the higher earner’s benefit, but only if the primary worker has already filed. Coordinating when each spouse claims their benefit is essential to maximize lifetime income. In some cases, it may make sense for the higher earner to delay filing until age 70 to accrue delayed retirement credits, while the other spouse claims their own reduced benefit early. However, this strategy only works with careful planning and full knowledge of each other’s earnings records.

Pension plans also require attention. Some offer survivor benefits that continue payments to a spouse after death, but electing this option often reduces the monthly amount during the retiree’s lifetime. Couples must weigh the trade-off between current income and future security. Similarly, required minimum distributions (RMDs) from retirement accounts must be recalculated based on the age of the younger spouse when inherited, affecting tax planning and withdrawal strategies. Roth IRAs offer more flexibility since they don’t have RMDs during the owner’s lifetime, making them a valuable tool for leaving tax-free wealth to heirs.

Another consideration is healthcare. Medicare eligibility begins at 65, but if one spouse is younger and not yet eligible, they may need to rely on employer-sponsored insurance or COBRA until they qualify. This can affect budgeting and retirement timing. Additionally, long-term care costs—often overlooked—can deplete savings quickly. Exploring options like long-term care insurance or setting aside a dedicated fund can help protect both partners’ financial well-being. The goal is not to synchronize every detail, but to align major milestones and ensure neither person feels financially stranded.

Building a Shared Future—Without Losing Yourself Financially

A successful remarriage balances togetherness with individual autonomy. While sharing a life should include shared goals, it doesn’t mean erasing personal financial identity. One of the most effective ways to achieve this balance is through a hybrid banking system—maintaining both joint and separate accounts. The joint account covers shared expenses like housing, utilities, groceries, and vacations, funded by agreed-upon contributions based on income. Meanwhile, separate accounts allow each person to manage personal spending—hobbies, clothing, gifts—without needing approval. This structure promotes fairness, reduces friction, and preserves dignity.

Defining spending autonomy is equally important. Couples should discuss thresholds for making purchases without consulting the other—say, $300 or $500. Anything above that amount becomes a joint decision. This prevents surprises and builds mutual respect. Regular financial check-ins—quarterly or semi-annually—help track progress toward shared goals, review budgets, and adjust plans as needed. These meetings aren’t about policing; they’re about partnership and accountability.

True financial security in remarriage comes not from merging everything, but from creating a transparent, respectful framework. It means honoring past commitments while investing in a new future. It means planning for the unexpected—not because you doubt the relationship, but because you value its longevity. With clear communication, professional guidance, and thoughtful structure, remarriage can be not only emotionally fulfilling but financially sound. Love may bring two people together, but wisdom keeps them thriving—for the long run.